Investment and hiring plans diverge, according to Oct. 2019 WSJ/Vistage survey

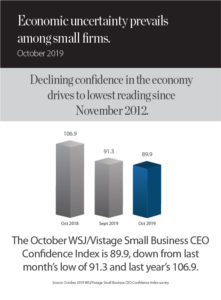

Declining economic confidence among small firms is impacting planned investments more than workforce expansion plans according to the latest survey conducted by Vistage and the Wall Street Journal. The survey, conducted October 7 – 13, captured input from 678 CEOs and other leaders of small businesses across the United States. The data was used to calculate the WSJ/Vistage Small Business CEO Confidence Index, which was 89.9 in October – down from last month’s 91.3 and last year’s 106.9.

According to Dr. Richard Curtin, an economist from the University of Michigan who analyzed the data, “The difference between plans to increase investments compared to plans to expand the workforce indicates that small firms are concerned about the longer term future.” The data confirms this; just 11% of small-firm CEOs said they expect the economy to improve in the year ahead, the lowest level recorded since the survey started in 2016.

According to Dr. Richard Curtin, an economist from the University of Michigan who analyzed the data, “The difference between plans to increase investments compared to plans to expand the workforce indicates that small firms are concerned about the longer term future.” The data confirms this; just 11% of small-firm CEOs said they expect the economy to improve in the year ahead, the lowest level recorded since the survey started in 2016.

When looking at the impact on expansion plans, Curtin notes that “Just 35% of small-firm CEOs indicated plans to increase fixed investments, which indicate longer term bets on economic growth. This is the lowest level since the fiscal cliff episode during the three month span from November 2012 to January 2013.”

Compare this to more than half (55%) of small-firm CEOs that reported plans to increase personnel in the year ahead, and it’s clear that while hiring will support short revenue growth expectations, CEOs remain cautious about longer term investments.

Download the October 2019 report for more perspectives from small-firm CEOs, including:

- Sentiments on the recent and future performance of the U.S. economy

- Revenue and profitability expectations

- Expansion plans for hiring and investments

Related links

About the WSJ/Vistage Small Business CEO Survey

Interactive data

View infographic