COVID-19 trends report: Strategy considerations for a new world

Entering the new year, our collective curiosity centered on whether there would be a recession in late 2020 or 2021. Recessions are an economy’s way of rebalancing capacity. COVID-19 served as an accelerant for structural shifts in our economy that were already underway.

Today we consider 12 trends already in evidence. These trends are taking on a level of permanence we are only beginning to understand. We offer this as a preview of factors driving change in the months and years ahead, as CEOs begin to evaluate scenarios and where they go from here.

This post does not cover the health crisis, vaccines, return-to-work scenarios and other factors that are already well-represented in the news.

1. Unemployment and demographics

Economists’ predictions vary widely on where and when unemployment will normalize, with the Congressional Budget Office predicting 16% unemployment in Q3, 12% in Q4, and stabilizing at 11% in 2021. During times of economic prosperity, employment growth tends to cap at around 1.5% per year.

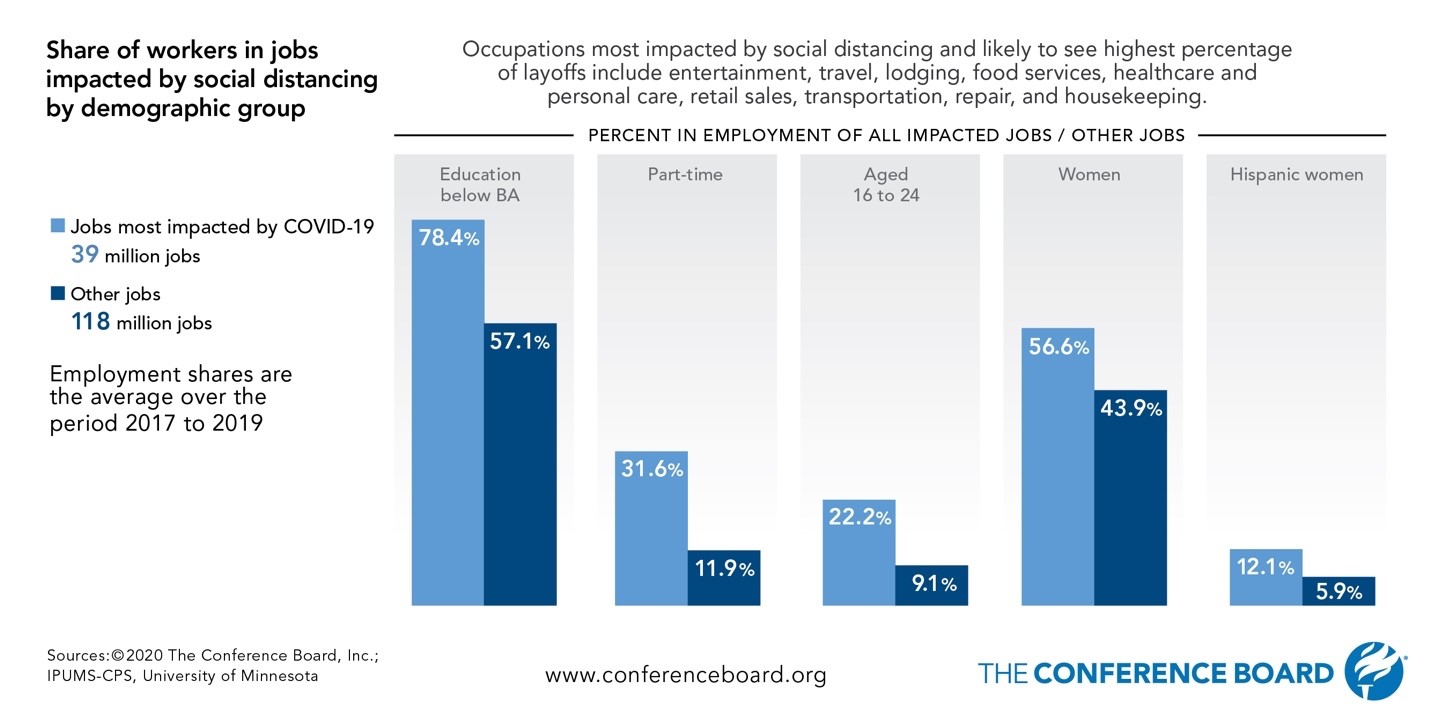

While the April jobs report reflected another 20 million lost jobs, 18 million are expected to be temporary losses. Job losses resulting from social distancing and stay-at-home orders were not proportionate. In the March jobs report, 60% of job loss came from the restaurant sector. Women suffered more than men, and the more educated the worker, the more likely they were to sustain employment.

Source: The Conference Board

Unemployment is an imperfect measure of employment as it does not account for the underemployed. March saw a 36% decline in demand for gig economy jobs like housesitting, babysitting and cleaning. Sixty-eight percent of gig workers have no income and 89% are looking for a new source of income.1 This will provide opportunities for companies to shift spending from W-2 to abundantly available freelance workers.

COVID-19 will deeply disrupt demographic trends from home buying to migration. The “gray tsunami” has been put on hold, as retirees have suffered losses in their retirement accounts and will participate in the workforce longer.

Home affordability is not improving. In April the inventory of homes for sale declined by 15.3% as new listings declined by 44.1%. Sellers have taken on a posture of waiting things out.2 On average it takes 62 days to sell a home, with the average home price roughly the same as last year ($320k nationally).

2. Consumer spending

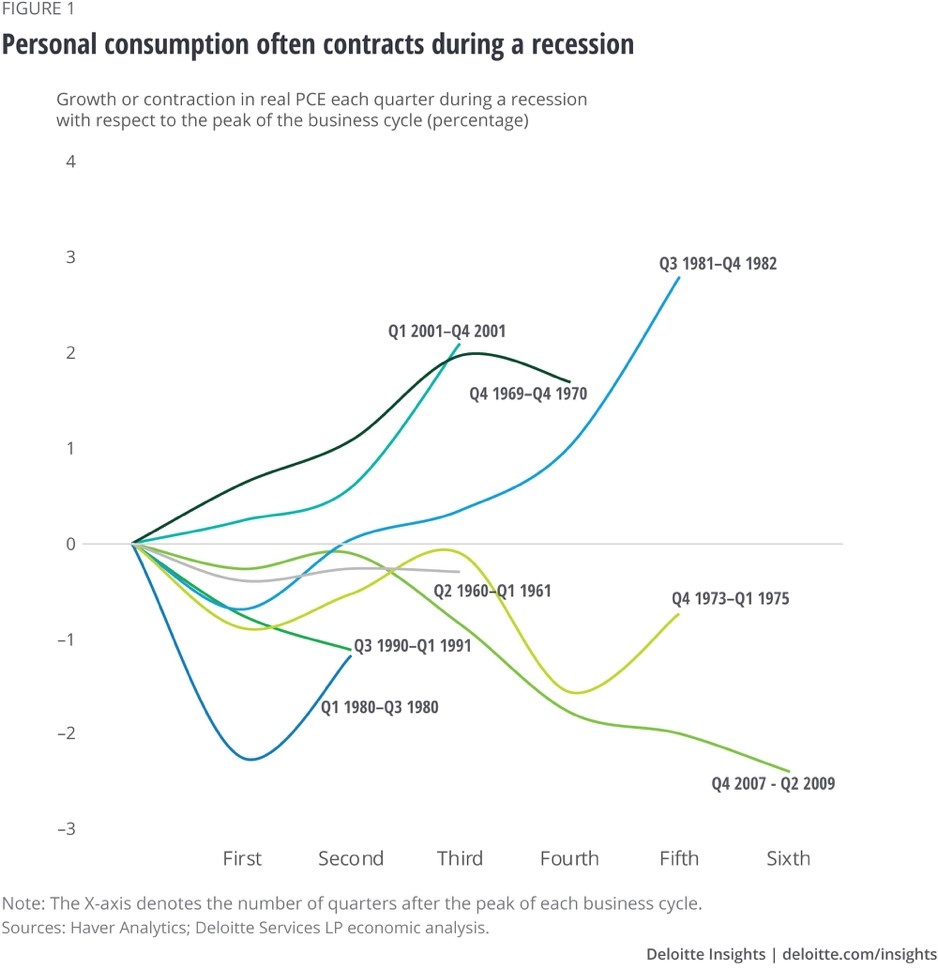

Consumerism fuels the U.S. economy, with consumer spending exceeding 70% of GDP. Deloitte projects a 21% decline in durable goods spending in 2020, coupled with a 2.7% decline in nondurable goods spending. Services will grow 1.3% in 2020, (the growth rate slowing from last year) but illustrating our movement from buying tangible goods in stores to services that we consume at home. Consumers are pausing on discretionary purchases. Our economy cannot return to sustainable levels of growth if the unemployed cannot spend.

Source: Deloitte

3. Ramifications of U.S. debt

While we were all focused on stimulus and what to do with our PPP checks, that sneaky Federal Reserve was locking in U.S. debt for the next 10 years at 0.6%. In a market where there is no yield and investors flocked to safety, the Fed created stimulus funding in the form of cheap U.S. bonds.

The U.S. government has two choices in paying off debt. They can either raise taxes or capitalize on the “debt overhang,” a strategy where an economy produces growth and inflation higher than the borrowing rate. While the nomination of Biden over Sanders may cool calls for taxing the rich, U.S. debt (as a percent of GDP) will swell by 22% this year, well over 100% of GDP. Higher tax rates for high wage earners seem inevitable, a movement that could only be accelerated if economic conditions worsen.

4. Oil, deflation and other shocks

Among the most serious threats facing us today is another unexpected economic shock at a time when the U.S. government may not have ammunition to respond. The stimulus exceeded spending on WWII and the wars in Korea, Vietnam, Iraq and Afghanistan combined.

Large economies such as Japan, Italy and UK (post-Brexit) are under significant strain. Many of the current indicators, including lower oil prices, declines in demand, fiscal austerity and declining confidence could promote deflation in the U.S. or in Europe.

While the Fed maintains a 2% inflation target, the short-term contraction is deflationary. Retail stores are closed, which will depress commercial real estate, and dine-in meals are not available at any price.3

Prolonged deflation would bring tremendous harm to the U.S. economy. Companies with slumping sales would reduce labor, and the greatest pain would be felt by an hourly population living paycheck to paycheck. Deflation would impact U.S. bond yields and force the government into deeper deficit spending. The stock market would tank.

Lower commodity prices, notably oil, will depress the oil belt and other state economies. A similar price shock in 2015-16 had a major impact on downstream manufacturing, and 2020-21 will be an ugly time for capital intensive industries.

5. The new face of retail

Consumerism has sparked a new world order in which people expect unlimited variety at low prices, immediately. Retailers will have no choice but to act like showrooms and design centers, acknowledging that the last mile of distribution may no longer shield them from the Amazon effect. There is an underlying concern that stores may open, but shoppers may not return.

Pre-COVID-19, retail space was contracting and malls were becoming more experiential in an omnichannel world. The mall of tomorrow will include automated building functions and voice technologies in addition to livestreamed personal shoppers with AV/AR technologies. There will also be more mobile commerce (non-card) solutions such as Apple Pay, PayPal and even bitcoin accepted in retail stores.

Amazon Prime now has a membership estimated at over 150 million, up sharply this year.4 Bots will fulfill many human interactions, and large fulfillment centers will offer next- or same-day delivery, as a standard. E-commerce providers already feel pressure to have multiple hubs throughout their delivery area.

6. Radical changes to the healthcare system

In advance of the 2020 presidential election, the healthcare debate will take a drastic turn. There will be more momentum for universal healthcare, but perhaps with a private pay option. Regardless of the system we adopt, the cost of healthcare will go up dramatically.

2021 Federal Employees Health Benefit premiums are expected to increase 40% in 2021. Private health insurance costs in 2021 will be drastically higher, and healthcare as a percentage of revenue will be materially higher for private companies.

While city hospitals have been overrun by COVID-19 cases, many community hospitals have had layoffs as a result of fewer elective surgeries and the public steering clear of hospitals.

The Federal Communications Commission is racing to administer $200 million for an emergency telehealth program funded by the COVID-19 stimulus package. We can expect relaxed compliance on telemedicine as a new norm, used to mitigate costs spiraling out of control.

Medicare provided a temporary waiver for telemedicine across state lines, enabling rural communities to leverage telemedicine as a viable alternative. Forty-six percent of Americans say the coronavirus has had an impact on their mental health.5 Mental health hotlines have reported a significant surge in call volume.6

Current utilization of AI by Google and Apple to combat the pandemic is a sign of things to come in biotech, medical devices and healthcare service solutions. A government desperate to fight such health events will try to better lever data-rich cloud solutions.

7. Airline consolidation

While airlines received $50 billion in federal stimulus, they also built a business model based on reducing social distancing, and then built capacity right before demand collapsed.

Current plans include wiping out half of their first-class cabins, which comprise about 5% of the seats and about a third of the profit. There will be massive consolidation among airlines—those with the weakest balance sheets folding into those who can control the right routes in the right airports. Pre-COVID-19, the gates in major airports were oversold. It’s not hard to understand why Warren Buffet sold all his airline stocks.

8. Food that feels good

During the pandemic, sales of Chef Boyardee increased by 146%. While we could do better on our pasta choice, for many, the canned variety brought us back to childhood. While we seek comfort food, we are also supporting our local restaurants, another market with overcapacity ripe for a correction. Like airlines, it’s hard to imagine many independents surviving distancing guidelines that only allow 25% or 50% of capacity utilization.

In China, regions that recovered from the outbreak reported a surge in online food ordering, even after consumers returned to work. Through March, food deliveries in the U.S. were up 22% from a year ago.7 Fast-casual, more suited to take-out will continue to gain momentum.

9. The U.S. vs. China

After two years of saber-rattling, the president announced a phase 2 agreement with China in January, viewed as a sign of trade war de-escalation. China agreed to increase purchases of U.S. agricultural products, tighter intellectual property oversight, and scrutiny over currency movements.8 Since then, voices have grown louder that the U.S. should pull back on economic integration with Asia. In March, Republicans introduced legislation aimed at reducing U.S. dependence on Chinese pharmaceuticals.

Many believe China was not forthcoming with critical information about COVID-19 contagion and scale, only to later be accused of hogging PPE.9 This frames a new narrative that Xi Jinping represents a rising threat as an antagonist to the U.S.

Biden has said, “I’ve spent more time in private meetings with Xi Jinping than any world leader.” A Biden election would soften the saber-rattling; however, our souring relationship with China feels eerily similar to our relationship with the Soviets during the Cold War as we battle over manufacturing supremacy, computer chips, 5G and strategic positions such as the South China Sea.

10. Manufacturing

Given the strain with China, global commerce could split into two distinct markets—those who transact (buy and sell) in the East, and those who transact in the West. Manufacturers are coming to grips with geographic concentration risk—understanding that they must maintain velocity in their supply chain and go deeper in continuity plans with vendors. During the SARS epidemic, one Tier-3 spring supplier held up the computer industry for months.

Samsung pulled much of its China production and moved it to India and Vietnam. U.S. producers who tried to move production during the early days of the trade war had trouble finding needed infrastructure in other countries, even if they could find a supplier. Countries like Vietnam do not have the trade routes required to transport goods to the U.S. with the same frequency.

Many are taking this pause as an opportunity to further automate their plants in a period of lower labor investment.

11. Shifts in technology

Many companies were flat-footed without well-thought-out business continuity plans, leaving IT departments scrambling. Many had to integrate collaboration software while beefing up security software and VPNs. Hardware companies may see major demand coming from enterprises, who are placing large orders for laptops and mobility devices to support employees now working from home.

Microsoft has been a darling of Wall Street, leading in cloud and with a more integrated suite including Teams and Skype with Power BI. Zoom adoption was sudden, and the company has had difficulty managing volume. In the long run, the market will favor integrated solutions.

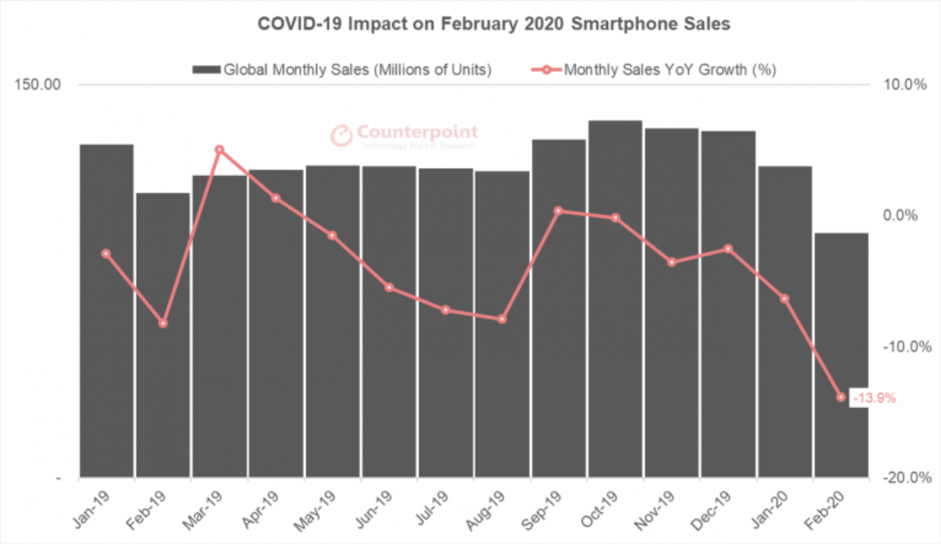

Smartphone sales will be down dramatically this year (iPhone sales declined 38% in February) with manufacturing shifting to lower price models. While factories in Asia are reopening, companies are experiencing challenges getting production fully running.

Source: Counterpoint

There is renewed demand in network equipment and communications, including speeding up 5G network deployments which have fallen behind in local communities. There are many potential choke points in the electronics supply chain. Raw materials such as aluminum and copper are difficult to replenish quickly.

Other technology developments will be amplified as a result of COVID-19. Contact-free facial and iris detection will be popular in retail stores and restaurants. Google, Microsoft, Amazon and Apple will be in a race to create both reading devices and consumer products to enable touch-free detection.

12. Impact on government

A late March poll of registered voters found healthcare would be their number-one issue in selecting a candidate for president. Sixty-three percent deemed healthcare as “very important” followed by the economy at 60% and foreign policy at 54%. On balance, the longer COVID-19 impacts the economy, the greater the chance that Biden wins the election.

Following stimulus, it is likely that Congress will pass infrastructure legislation, which has bipartisan support as a jobs bill. Given the weakening of the federal balance sheet, final legalization might need to be at a lower cost (the initial bill included a price tag of up to $2 trillion). Any infrastructure bill is sure to include 5G funding and expansive broadband coverage throughout the U.S.

Some state and local governments will be insolvent. Virtualization of government has not been a smooth transition. Regulators struggled to transition to an agile, digital world, as evidenced by the botched implementation of the PPP program.

What to do with this information

At a time when markets are chaotic, both management and employees are nervous about uncertainty. Leaders must stay a step ahead of their followers, and as businesses stabilize, they will begin to think long-term again.

To inspire confidence, CEOs will need to recalibrate their strategic plans, consider scenarios and create specific contingency plans so their teams can see a path forward. The time to lead with vision is now.

References

1AppJobs

2Realtor.com

3Squawk Box CNBC

4Business Insider

5KFF Health Tracking Poll, March 25-30

6In an era of quarantine, crisis hotlines face growing and urgent demand – Washington Post

7Which company is winning the food delivery war? by Kathryn Rieck – Second Measure

8It’s official: Trump signs China trade deal, says tariffs could be lifted in phase 2 – Market Insider

9How China Lost Biden –and America – Bloomberg Businessweek, April 27

Category : Economic / Future Trends