A hard view of the long climb to recovery

At the economic bottom of the COVID-19 crisis, the global economy had paused as shelter-in-place orders sidelined consumers, workers and everyone else. The quarantine effectively “flattened the curve,” protecting the healthcare system from being overwhelmed.

Now, with the quarantine gradually relaxing across the globe, it’s encouraging to see more people interacting with each other; more consumers venturing back to the marketplace and more businesses returning to the workplace. As businesses slowly re-engage their flywheels, they are resetting their strategies and determining how to rebuild their businesses to thrive in the new reality of the post-COVID world.

Revenue expectations settle on the bottom

The initial economic carnage occurred in March as the collapse of business activity forced CEOs to quickly make many difficult decisions. Through April, as businesses found the bottom, they adjusted to quarantine life and the economic perils it presented for their businesses and employees. In May, CEOs of small and midsize businesses (SMBs) faced the brutal facts about the state of their businesses and began to think about the path forward.

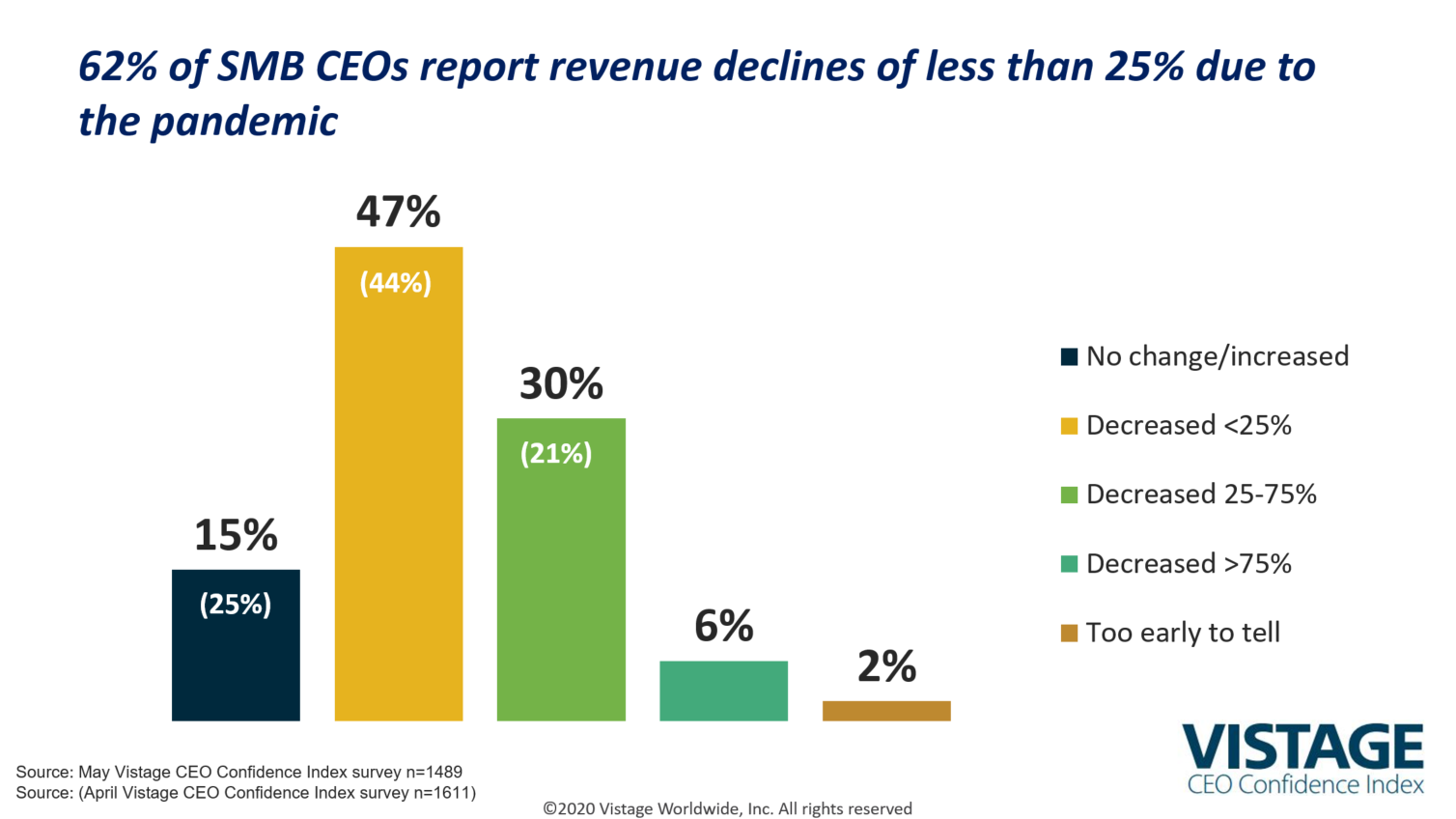

Our analysis of the May Vistage CEO Confidence Index survey, which captured responses from 1,489 CEOs of SMBs, found that revenue expectations declined slightly from April but showed signs of stabilizing; an indication that we were at the economic bottom of the pandemic. Other trends in CEO sentiment about revenue expectations in the May survey include:

- 15% of CEOs reported stable to increasing revenues, down 10 points from April.

- 47% of CEOs reported revenues declines of less than 25%, up slightly from 44% in April. This suggests some pain, but clearly survivable with the assumption that the virus is passing.

- The discouraging data point is the increase of CEOs reporting losses of 25-75% of revenue. 30% of CEOs reported losses ranging between 25-75%; an 8 point increase from 21% in April.

- There is no good news in the fact that 6% of SMBs continue to report revenues declining 75% or more.

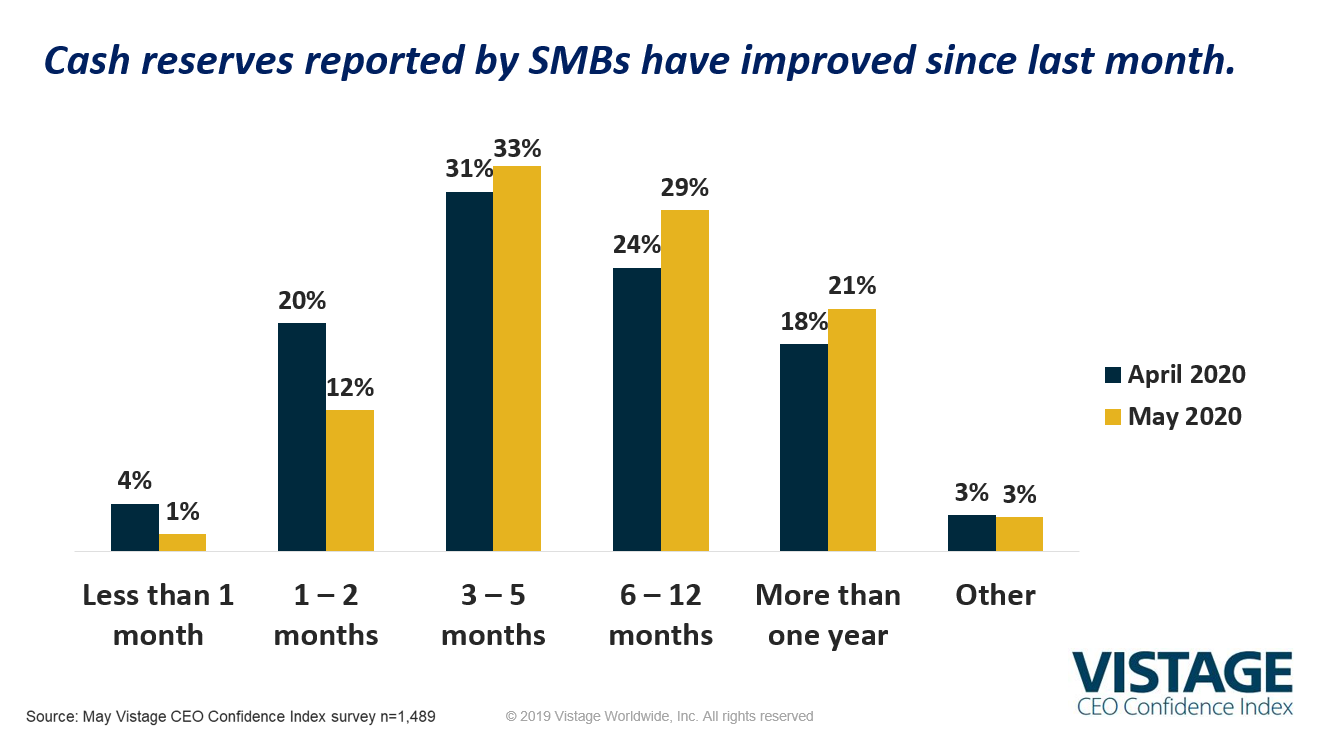

PPP power: Infusing cash flow

With revenue down and expense cuts in place, cash has become more than king—it is the oxygen that businesses need to survive. Our data showed a positive shift in the cash reserves reported by SMBs; in May just 13% of CEOs reported having two months or less of cash reserves compared to 24% in April. And 50% reported cash reserves of greater than six months, up from 42% in April. This indicates a longer runway for businesses to survive through the pandemic. Much of that runway is based on government relief, and specifically the Paycheck Protection Program (PPP).

Created in late March as part of the CARES Act, the PPP was designed to help small businesses by infusing cash to subsidize payrolls and minimize layoffs. The forgiveness provision of PPP made this program massively popular and the volume of applicants, combined with the uncertainty around guidelines, led to many challenges for SMBs. Varying response times from banks, different tranches of funding and constantly changing guidelines have only added to the anxiety felt by leaders looking for financial relief—and loan forgiveness—needed to survive the pandemic.

Cash flow improved significantly with PPP loans and the remarkable ability of the Small Business Administration and the banking system to execute the program. Eighty-two percent of Vistage CEOs surveyed reported plans to leverage the PPP. Of the small businesses that applied, 98% were funded or approved for funding at the time of the survey, which was conducted the week of May 4 – 11. Based on the timing of the survey, these statistics encompass SMBs that applied for both the first and second tranche of funding for the PPP.

A hard view…

Finding the road to recovery from today’s bottom to the post-pandemic new reality will challenge CEOs to rebuild their businesses to accommodate the changes already sweeping business, commerce and life in general. The unpredictability and unknown science of COVID-19 makes any economic predication less than certain.

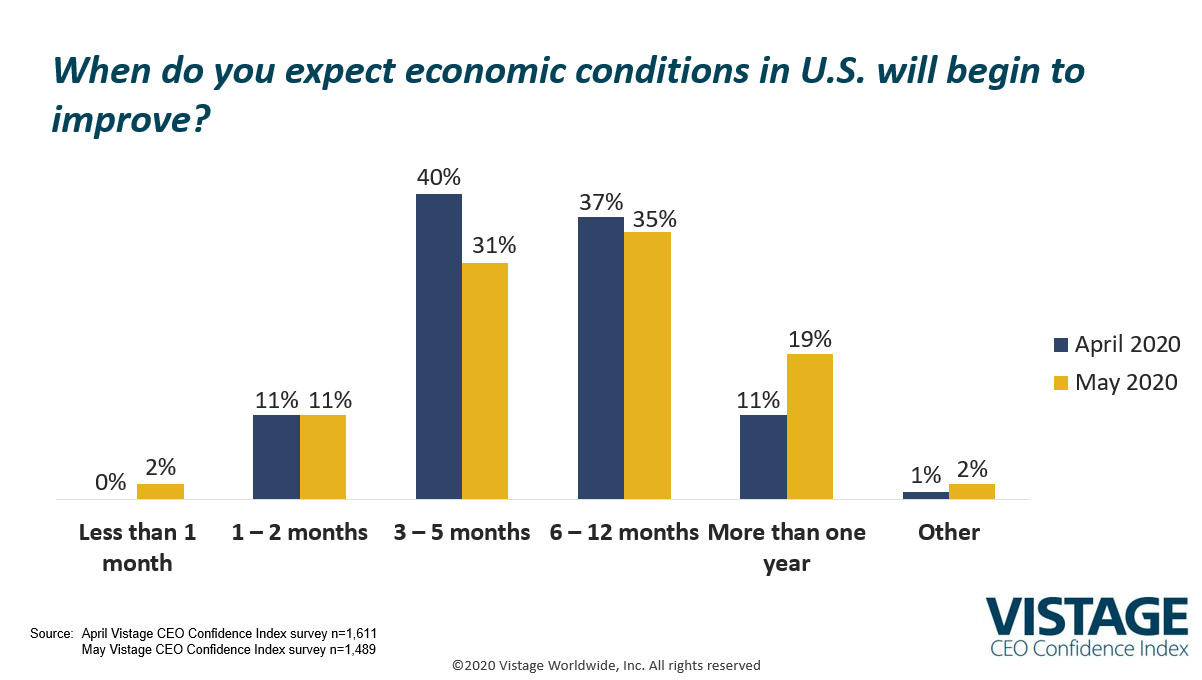

Yet, CEOs need to reset their strategic plans based on assumptions and be prepared to adapt again in the event of a second wave. CEO sentiment about the length of the recovery changed from April to May; when asked when the economic conditions will improve 9% fewer CEOs thought conditions would improve in the next three to five months while those that thought it would be 12 months or more increased by 8%.

…of a long climb

Combined with stabilizing revenue and cash flow, expectations for improved economic conditions set the foundation for the long climb to the new reality. Of course, the recovery won’t be fast or easy. The initial burst of growth will be followed by plateaus, setbacks and even slower growth. The second half of the recovery will be twice as hard. Many jobs and businesses will never return while many more will reinvent themselves out of necessity.

While it’s important to accept the brutal business facts and gain a clear perspective on the future of the economy, the reality of the situation doesn’t have suppress optimism.

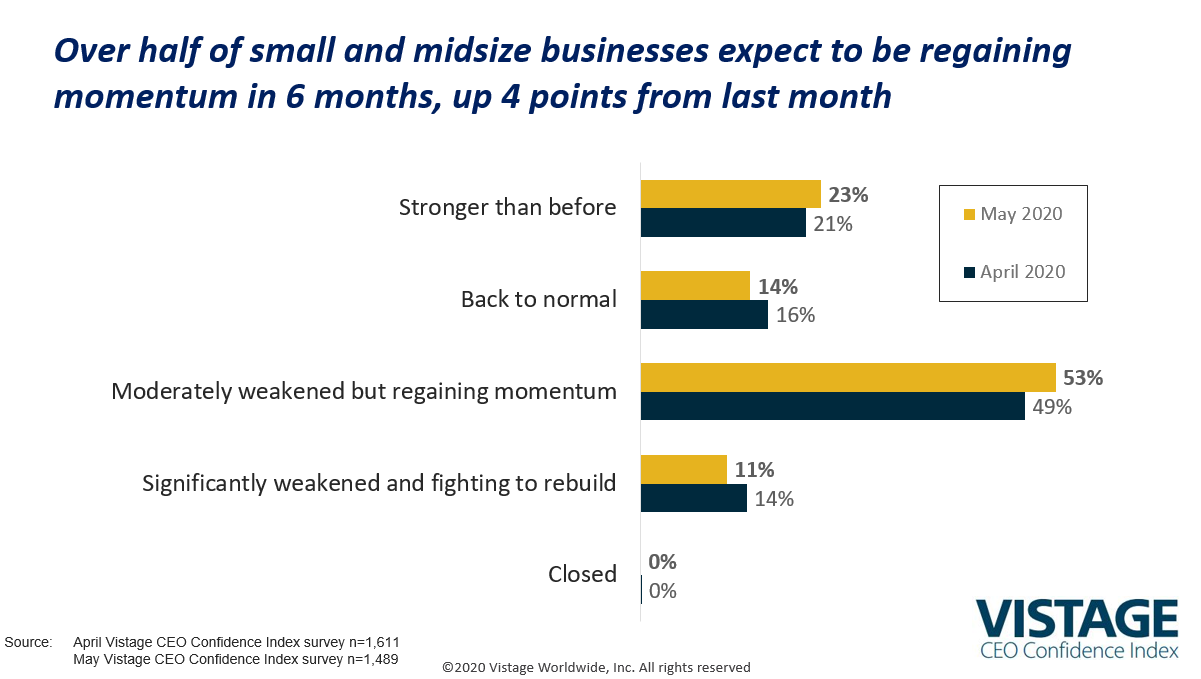

SMBs thrive because of the entrepreneurial instincts and innovation mindset of their leaders. While only 15% have revenue equal to or greater than pre-COVID levels, 36% expect that in six months they will bounce back to a place equal to or stronger than before the pandemic. Fifty-three percent of businesses report they will be weakened but regaining momentum in six months, and 10% report they will be significantly weakened but fighting back in six months. None of the CEOs surveyed believe they will be closed and out of business (0%).

Prosperity exists at the end of the hard climb

The path forward is yet to be built. We do know it will be long and hard. Even once we have a vaccine and health concerns are relieved, business will not return to where it was, it will relentlessly move towards the new reality forced by the COVID-crisis. Leaders need to stay focused on regaining the momentum needed to rebuild, leveraging learnings from other crises including the Great Recession and 9/11. With commitment to their company culture and employees, digitally transforming their business, and adapting to meet customers changing needs, CEOs can lead the way back to prosperity again.

Download all A Hard View of the Long Climb to Recovery graphics

Category : Economic / Future Trends