2021 M&A trends: Reshuffling the deck

Economists have taught us that recessions and recoveries represent a rebalancing of markets.

As our economy rebounds, we will see an unprecedented redistribution of markets, risk, wealth and volume. Some of us will sell our crypto and buy cruise line stock. Others will wonder whether it’s time to sell their company.

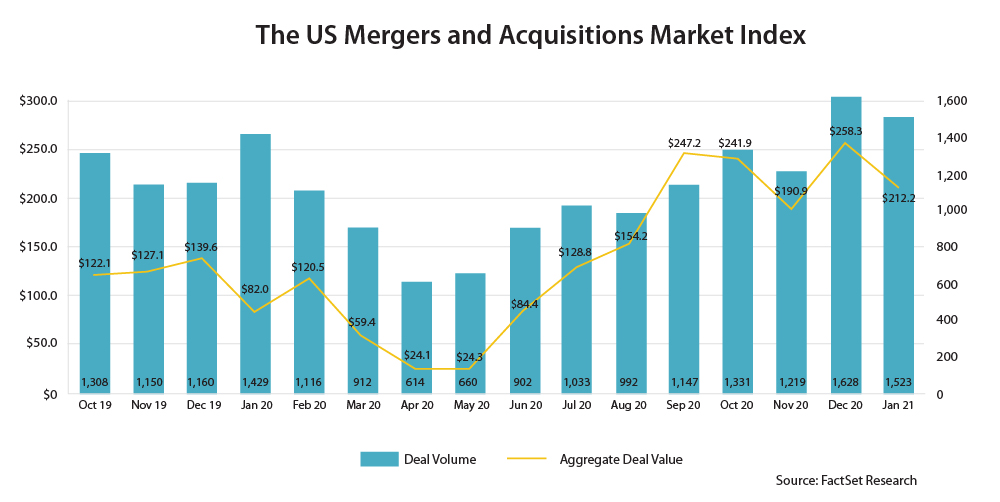

Rebalancing is also represented by pent up demand for mergers and acquisitions. The last few months have offered a sharp uptick in acquisition activity. As business strategists, we have borne witness to clients who sold too early and others who sold too late. Like an investment advisor once told me, it’s hard to catch a falling dagger. Thus, timing the market is difficult.

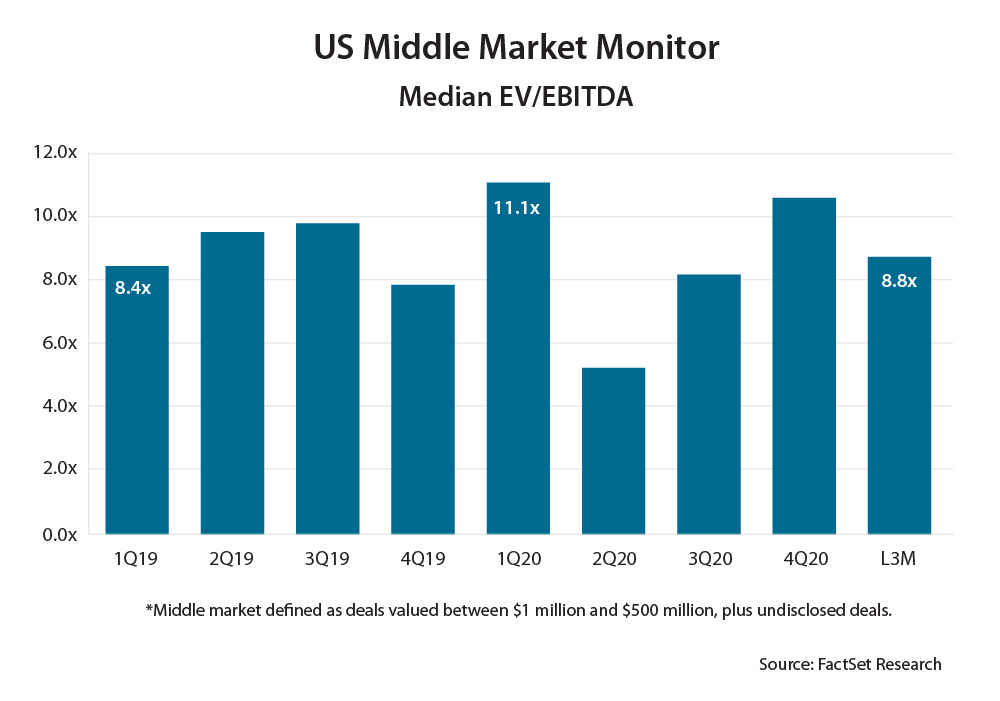

There are multiple methods for valuing companies. In some industries such as fintech, it’s more likely for a company to be valued based on a multiple of revenue. But most mid-market companies pay more attention to EBITDA multiples.

The size premium is alive and well in US markets. The S&P 500 price/earnings ratio (PE) as of this writing is a staggering 40 times, up from 25 times in January 2020. Public company PE’s are not an exact corollary to private company EBITDA multiples, but it does provide a relative benchmark. In relative terms, the size premium is dramatically higher than a year ago. Put another way, size matters more than it ever has.

The average US private company—between $1 and $500 million in revenue—sold for 8.8 times its EBITDA (cash flow) over the last three months. The size premium is magnified at the bottom of the scale. A $5 million revenue company may only be worth 4-5 times its EBITDA.

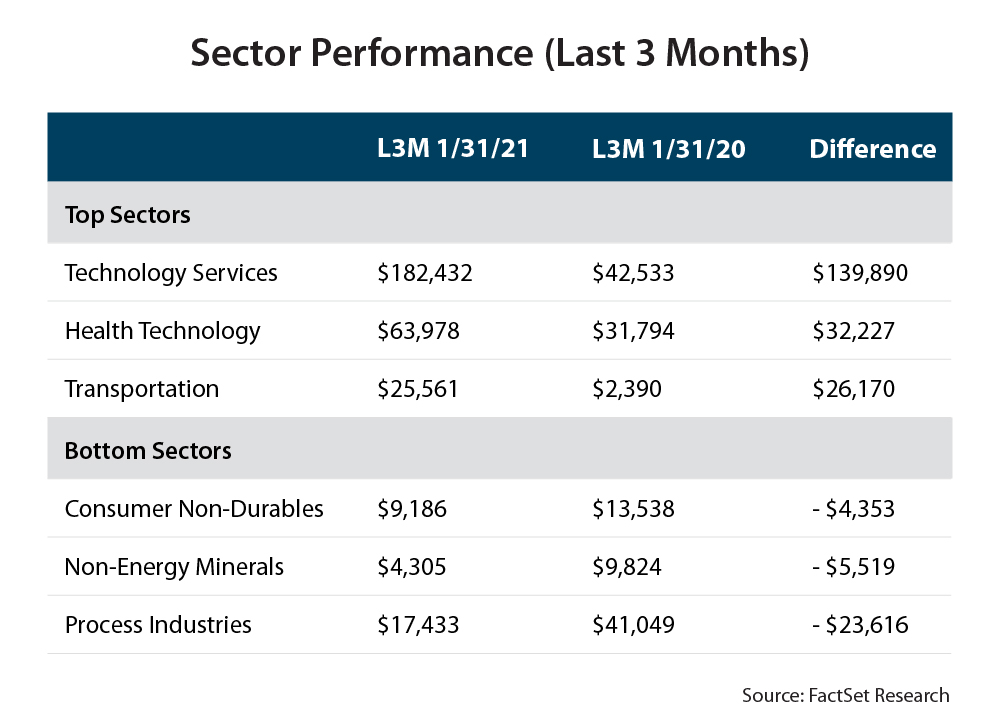

We are at a unique intersection where the impacts of the pandemic are blended with more fundamental market dynamics. Short-term cycles may be impacting industries like minerals. The pandemic almost certainly accelerated trends already underway, such as the adoption of healthcare technology. In 2020, we saw entire sectors including surgery robotics achieve significantly faster adoption.

The ambition of private equity firms to push in dry powder (non-invested capital) is the wild card of valuations. Private equity firms are impatient because their partners aren’t being paid when their capital is not deployed. There were 173 private equity deals of mid-market private companies in January, up from a low of 53 in April and 69 in May.

The number of public transactions completed in 2020 was consistent with prior years, but the value of those deals was much lower—perhaps also reflecting fewer mega-deals than normalized years. According to Deloitte, deal count goes down 12% on average during downturns, while deal value goes down 47%.

Yet, the IPO market is once again in a frenzy. With new listing options such as SPAC’s (special purpose acquisition companies) driving volume, it has been routine for company values to double on the first day of trading, with many sliding thereafter.

The global nature of M&A also shines a light on regional economies. While China should realize a somewhat tepid growth rate in 2021, Europe’s economies are very weak. There could be lighter deal flow in industries with traditional European buyers and sellers such as food processing equipment. Geopolitical uncertainty may prompt buyers to stay closer to home.

Here are some key M&A considerations for 2021 and beyond.

Understand the underlying consolidation in your industry.

Pre-pandemic, US deal flow focused on vertical integrations. It’s important to understand how various business combinations will reframe your industry. For example, various technologies such as blockchain and payment methods will cut out intermediaries, such as banks.

Companies are utilizing more alliances in order to offer solutions to customers without the need to deploy capital. For example, all airlines now offer complex carrier networks so any passenger can travel almost anywhere in the world within their ecosystem.

Use acquisitions to reposition in markets.

One way buyers are using acquisitions is to reframe their offer and outmaneuver uncertainty. For example, our construction clients who have focused on commercial building are using acquisition and development opportunities to shift to residential. Acquisitions are a way to reduce consolidation risk in customers or sectors.

Surround yourself with professionals.

Whether you are a buyer or a seller, it’s critical to hire the right investment banker and transactional attorneys. Pay the price; the right advisors are worth their weight in gold.

Be opportunistic, but also smart.

There will be weakened competitors who were unable to stem the tide. Many companies were propped up artificially by government assistance in the form of SBA loans such as PPP and EIDL. Once they burn through this cash, they may or may not have the chops to rebound. Those buyers who act quickly are likely to be rewarded.

Warren Buffet once said that “you are better off buying a wonderful company at a fair price than a fair company at a wonderful price.” Don’t be pound foolish.

Think about what you are buying.

While there will be revenue-building opportunities in this environment, many acquirers today are buying companies for other reasons such as entry into new markets, expansion of capabilities or acquiring talent. We mustn’t forget that we were in a talent war a year ago, and accessing talent will emerge again as a key driver to M&A activity.

Consider deals within the new reality.

It’s hard to compare company valuations based on a shifting landscape. Yet acquisition may be the fastest way to scale in a market where organic growth has been hard to come by. It’s important to look beyond the horizon and think about how our world will be different in the future. For example, many companies are shifting their thinking about remote work and the implications of geography. In the past, it was important to have headquarters in a major city close to an airport. In the future, entire industries — such as call centers — will shift towards more virtual or hybrid environments.

2021 is shaping up to be an unusual year for M&A. Make sure you are prepared to take advantage of the opportunities that lie ahead.

Related content

- What to spend on marketing in 2021: A story of a digital revolution

- Trends report: 6 strategy considerations for a new world

- Trends facing business in 2021 and beyond

- 9 key ways to gather and report useful KPIs

- The Future of Work in America [report]

Category : Economic / Future Trends