CEO confidence rises to the valley of the 2010s growth cycle [Q1 Vistage CEO Index]

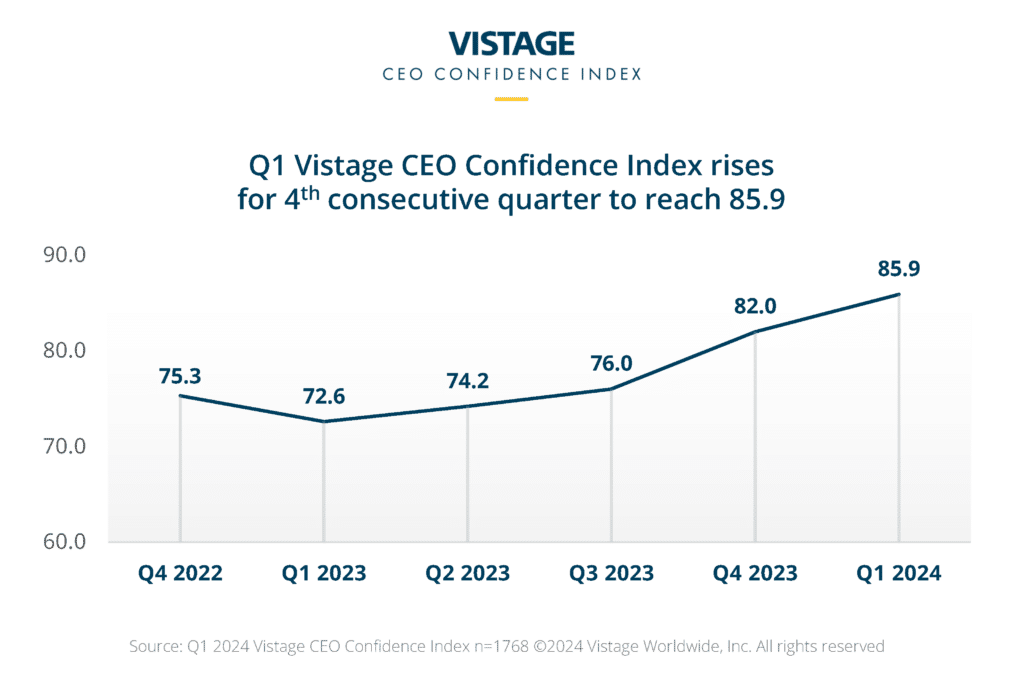

Athletes recovering from serious injuries go through rigorous rehab just to get back to minimum performance levels. From there, it’s a long path to becoming competitive again. As the economy continues its recovery from the injuries inflicted by the pandemic, the sentiment captured from 1,768 CEOs who responded to the latest Vistage CEO Confidence Index survey is increasingly positive. The Q1 2024 Vistage CEO Confidence index rose for the 4th consecutive quarter to reach 85.9.

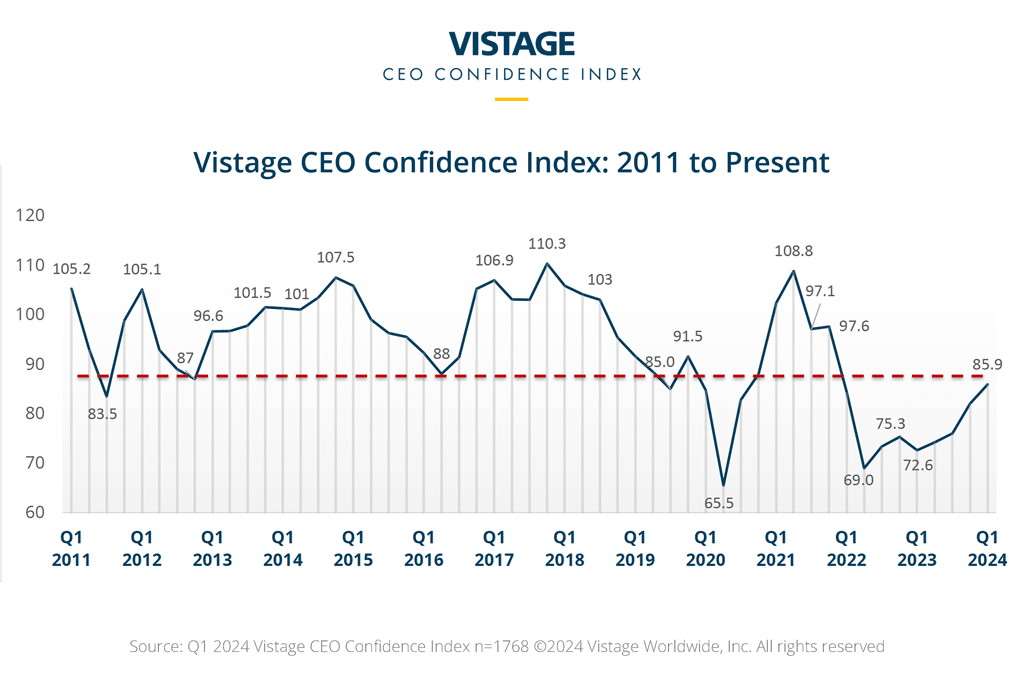

While the continued rise of the Index demonstrates growing confidence, especially when compared to the recent low of 69.0 from Q2 2022, a longer view shows that this current rise brings today’s Index in line with the historical bottom of the rising tide decade of 2010. So while there is great momentum, we are simply returning to the bottom of the playing field of the growth decade, and CEOs need to invest in their business so they’re prepared to take full advantage of this rising trend.

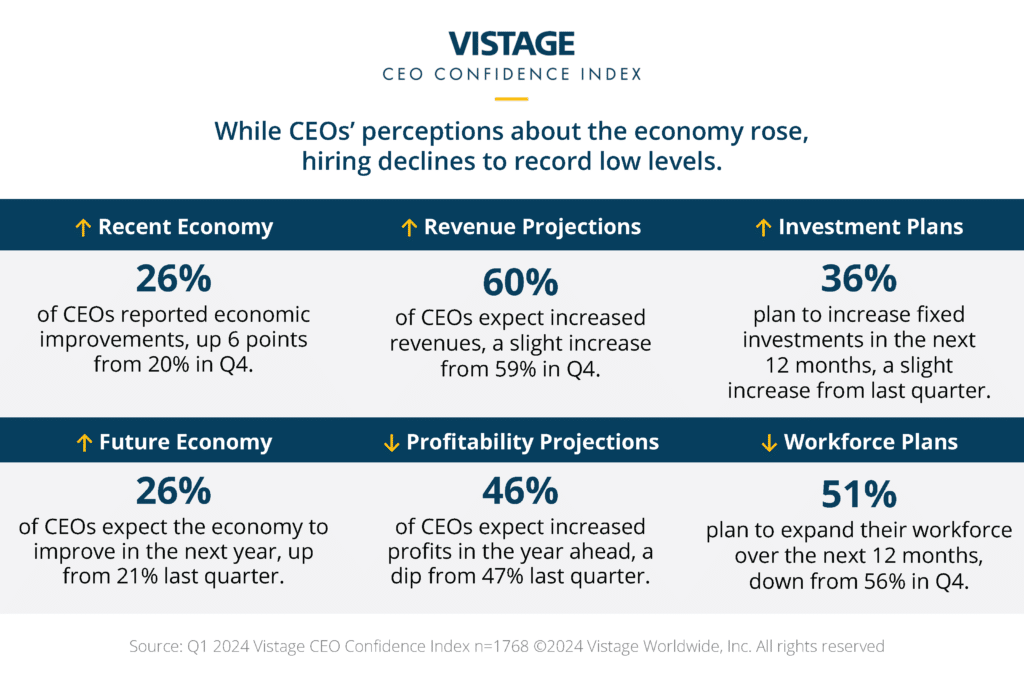

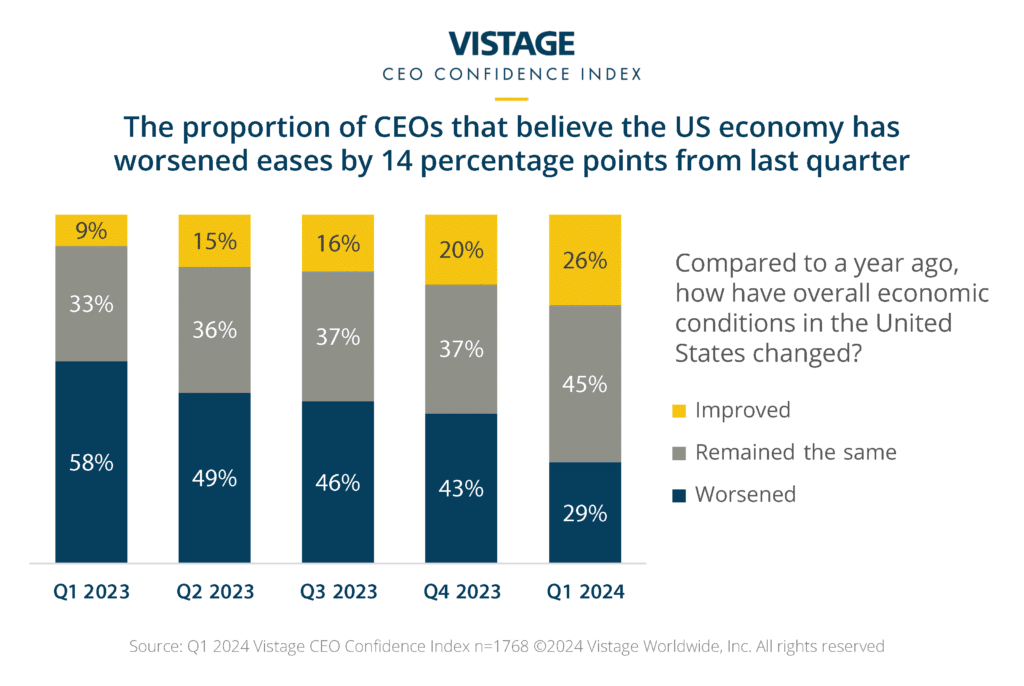

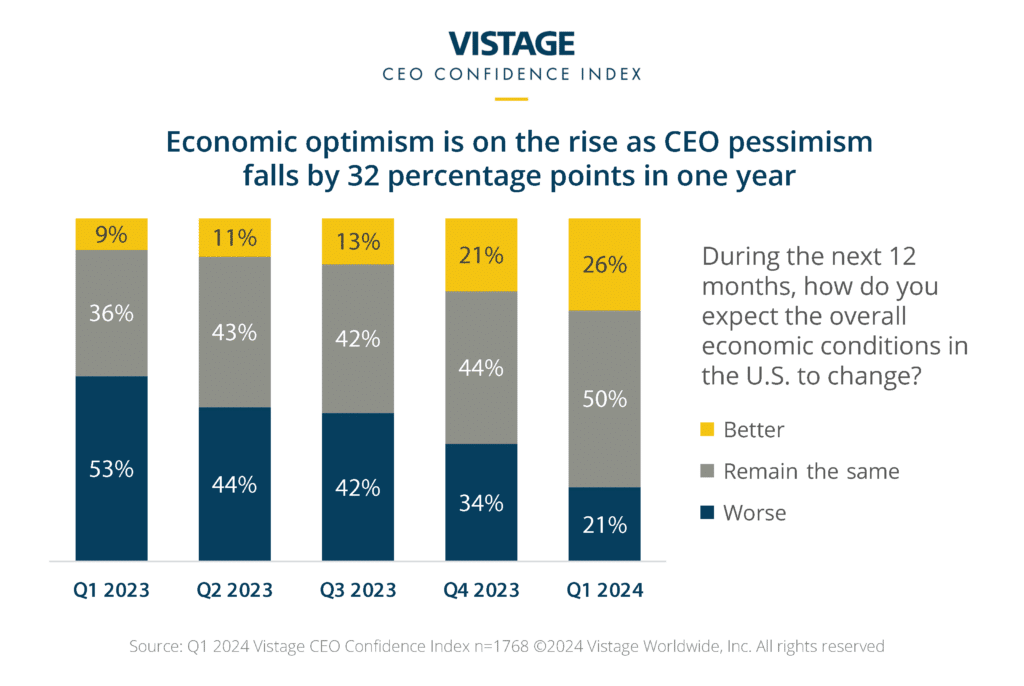

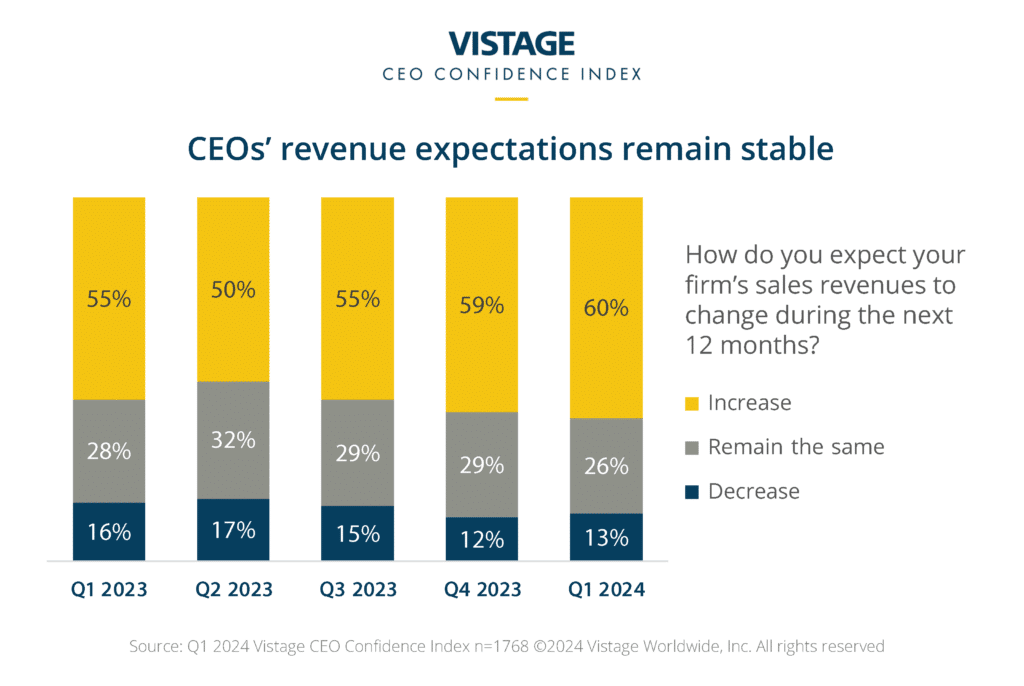

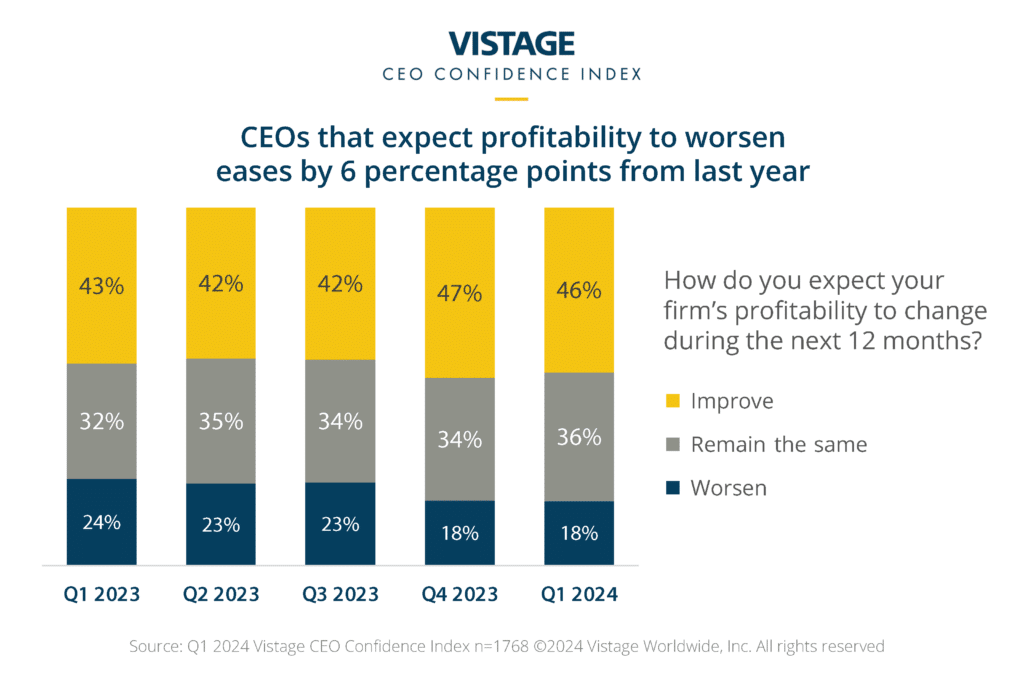

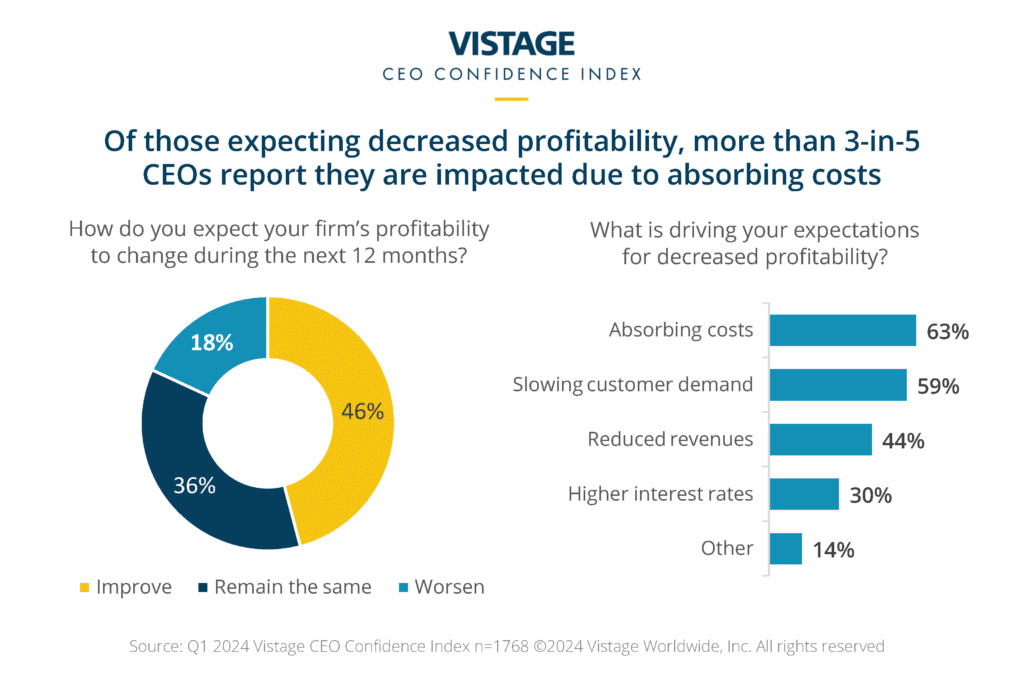

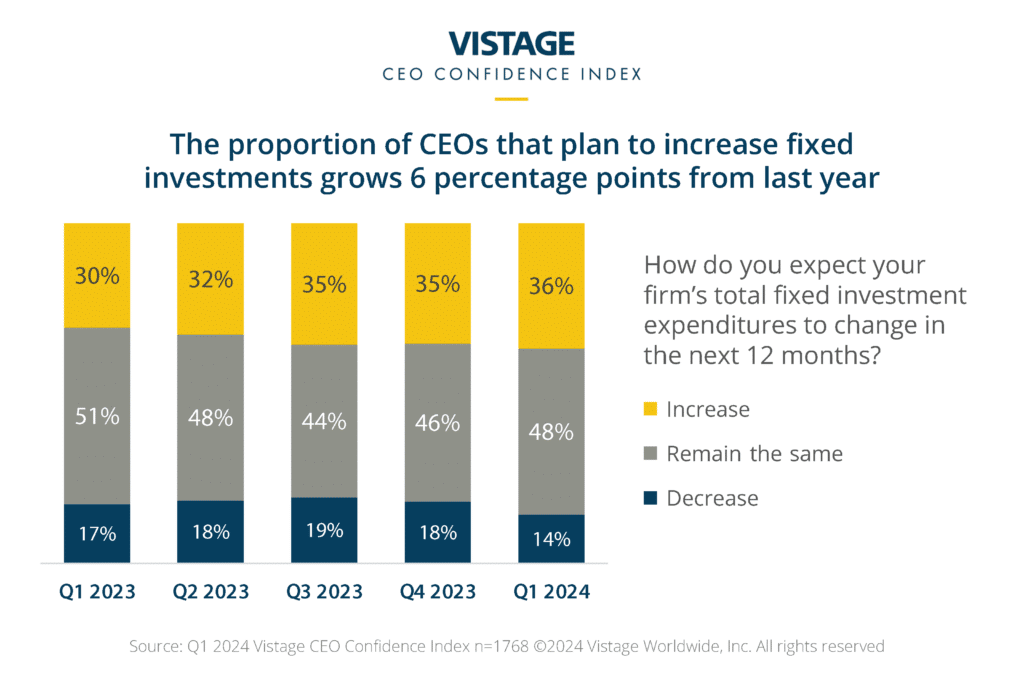

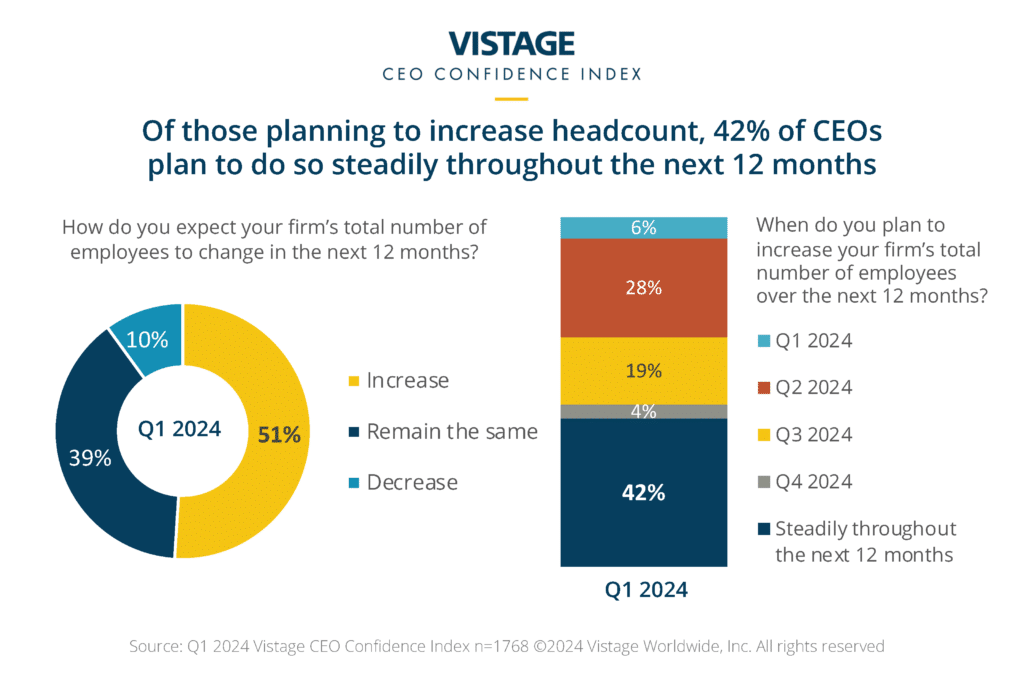

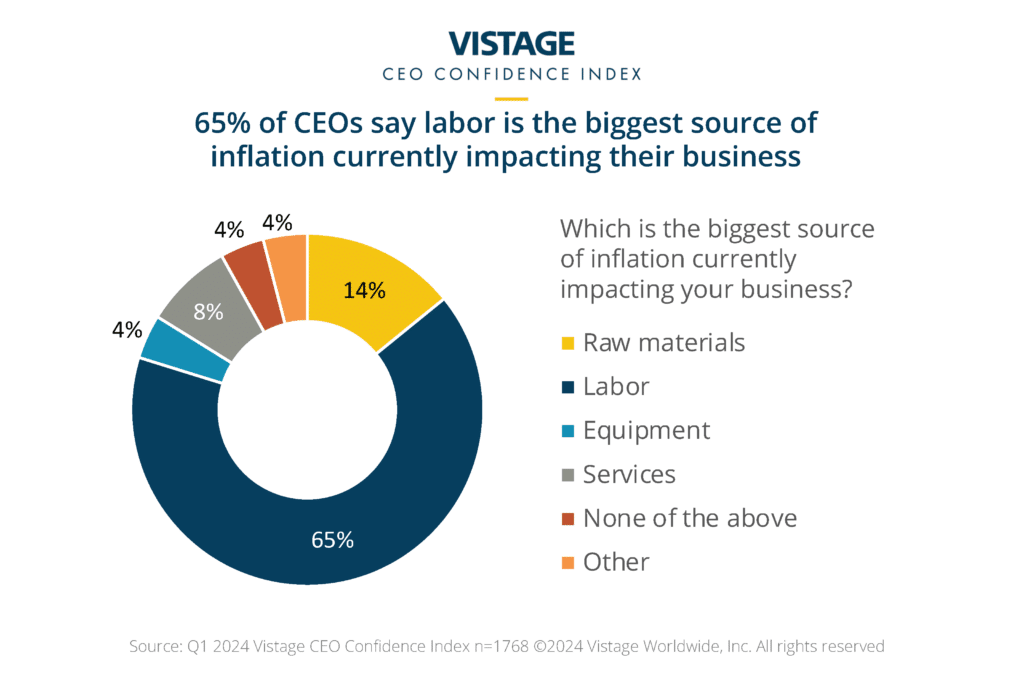

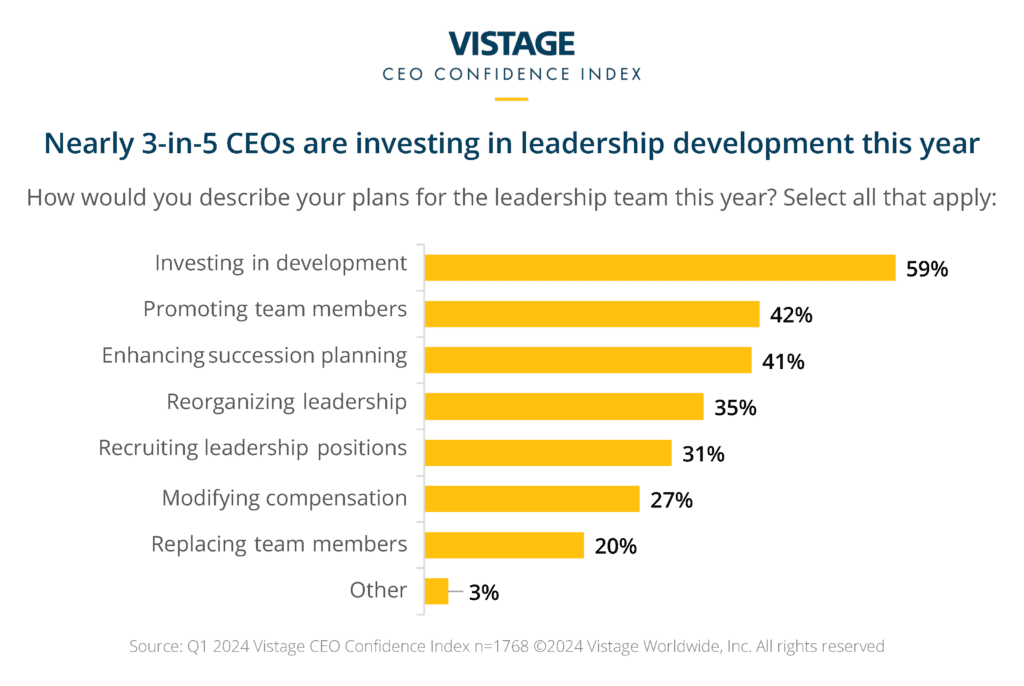

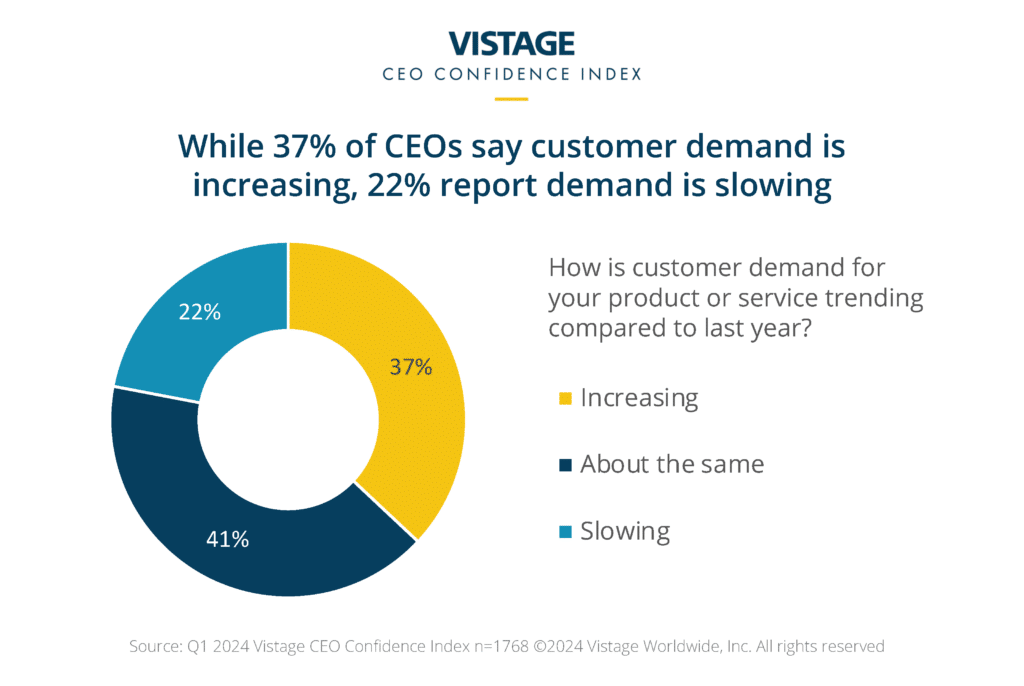

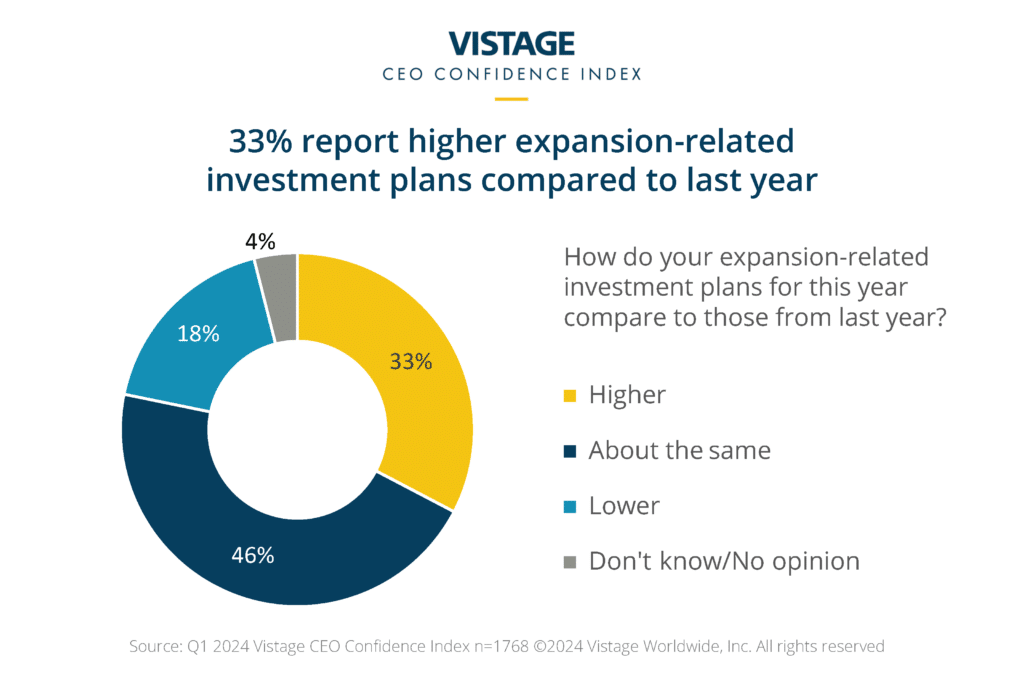

Economic sentiment continued to improve and was the primary driver for the increase in the Vistage CEO Index. Expectations for revenue and profits were flat compared to the prior quarter. And in the area of expansion plans, the minor uptick in those increasing investment plans was offset by a drop in planned increases in hiring. While the labor market has cooled — causing a reduction in workforce velocity while bringing stability to the organization — wages continue to put pressure on small and mid-sized businesses. Over one-quarter of CEOs (26%) plan on increasing salaries in 2024 with 47% holding salaries steady. When asked to identify the biggest source of inflation currently impacting their business, 65% of CEOs identified labor as the main cause. Today’s cool workforce market will quickly overheat again when the projected 2025 growth cycle begins.

Inflationary pressures continue in a tight labor market while customers are cutting back due to increased costs. Also, health insurance premiums are through the roof!”

Scott Hobbs, President, Hobbs, Inc., New Canaan, Connecticut

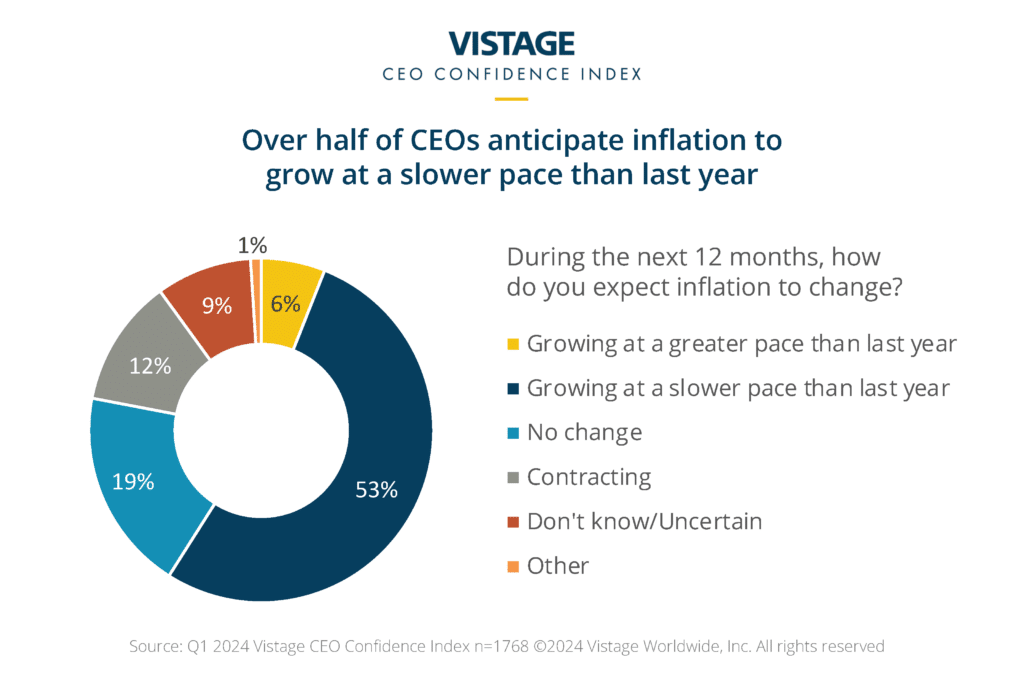

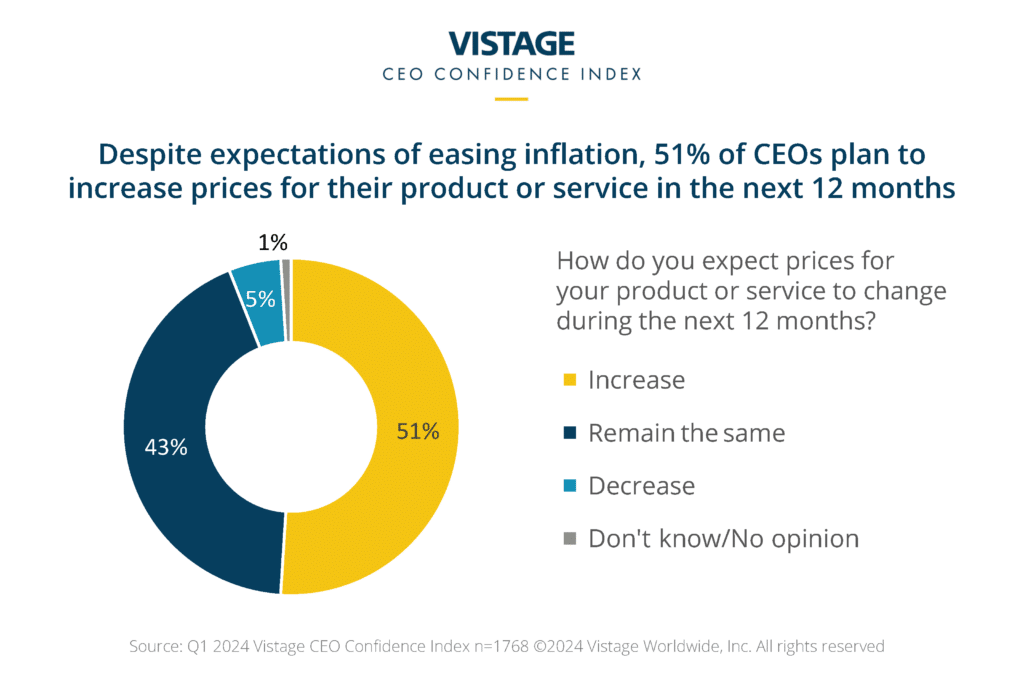

The slowing economy is expected to finally heal completely in 2024 and be ready to compete for growth later this year. Meanwhile, interest rates have peaked and are predicted to decline later this year. Over half (53%) of CEOs believe the inflation rate will slow to lower the growth rate in the year ahead while 12% of CEOs think it will contract. However, costs continue to rise. Pricing remains a sensitive topic as increased costs for materials, equipment, services and the aforementioned labor costs force CEOs to consider passing on yet another round of price increases to their customers. Even so, the 51% of CEOs who plan to increase prices in the year ahead is down from Q4 2023’s 54% and well below the peak reached in Q3 2022 when over two-thirds (67%) of CEOs planned to raise prices.

CEOs will have the unique opportunity to take advantage of a slowing demand this year to invest in their team and prepare for the forecasted growth cycle in 2025.

Download the Q1 Vistage CEO Confidence Index report to learn more about current CEO sentiment

Expert Perspective: ITR Economics

Based on the connection of the Vistage CEO Confidence Index to future changes in the U.S. Industrial Production Index, one might expect that the accelerated upward rates-of-change of the Vistage CEO Index signal a potential recovery and growth in U.S. Industrial Production. Jackie Green, VP of Economics for ITR, notes that it is important to exhibit caution while interpreting the Vistage CEO Confidence Index’s upward trend as an outright positive sign for the overall economy, reminding us this rise comes from the extreme lows that are part of the overall economic landscape.

Watch the conversation to learn more about how the Vistage CEO Confidence Index aligns with ITR Economics’ forecasts.

Here are key takeaways from ITR’s analysis of the Q1 data:

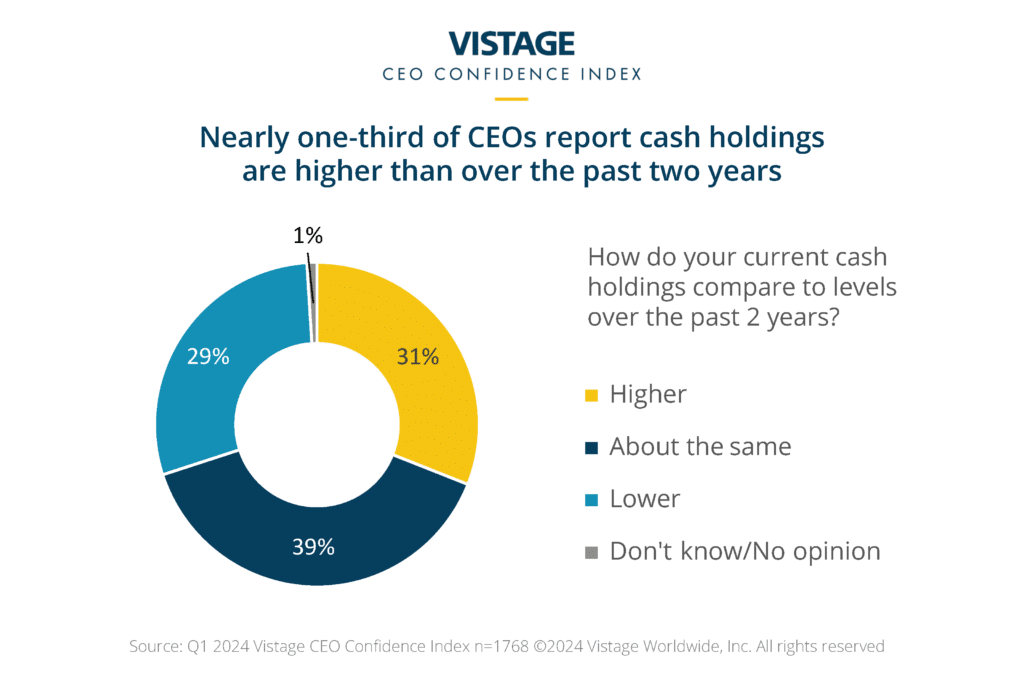

- Investment Strategies: Nearly one-third (31%) of CEOs report holding more cash than usual, indicating a cautious approach to investing due to high interest rates. Greene recommends using spreadsheet models to evaluate the opportunity costs of waiting for lower rates versus investing now, and to consider focusing on recession-resistant areas as a strategic move.

- Inflation Outlook: Inflation is expected to ease through the remainder of 2024, settling into a low rate by year-end. However, a rebound is anticipated in 2025, with rates climbing back into the 3% range. Take advantage of the decline and be prepared for rates to rise again.

- Labor Market Dynamics: Business owners have more hiring leverage in 2024 compared to 2023, but the job market remains competitive. A shift has occurred, taking the job-opening to job-seekers ratio from 2-to-1 to 3-to-2. Other factors include ongoing skills gaps and regional variances in available talent, which suggests CEOs can expect continued wage pressure and a tight labor market for the foreseeable future.

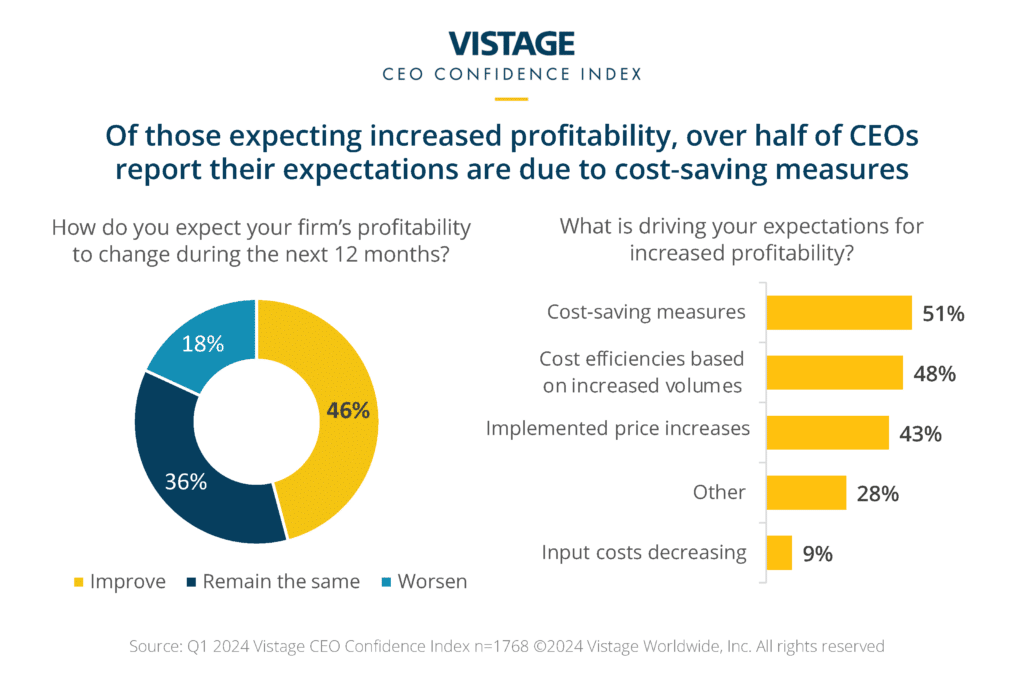

- Profitability and Expense Management: Survey data indicates that small and midsize businesses experiencing higher profitability have achieved this by cutting expenses, while those facing reduced profitability are absorbing costs rather than passing them on. CEOs are advised to assess their current profitability status and strategize for improvement, considering both immediate and long-term perspectives.

We are leveraging more technology, including AI, in an effort to increase output without needing to hire as quickly.”

Justin Seibert, President, Direct Online Marketing, Wheeling, West Virginia

‘Now’ normal settles in for workforce planning

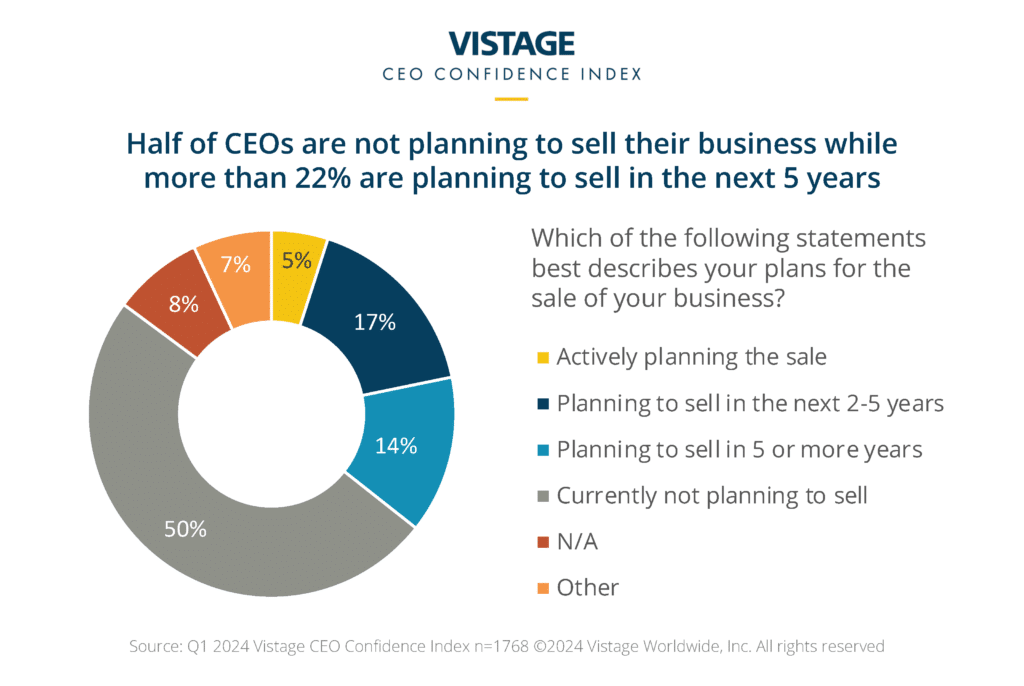

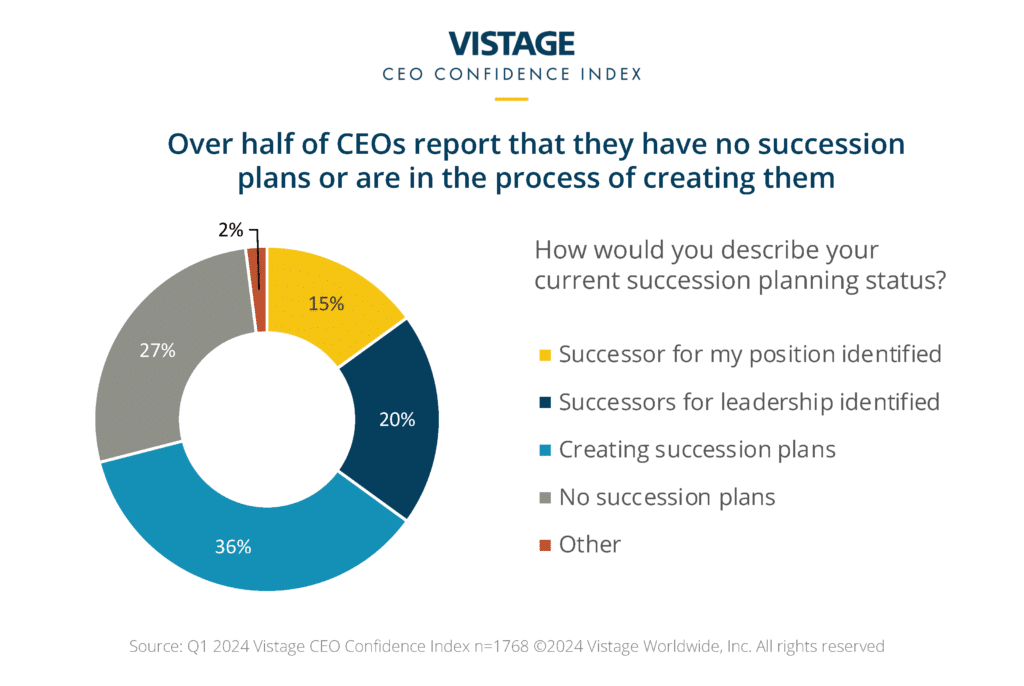

The relative calm of a still slowing economy creates a false sense of security as we settle into the “now” normal. Not too long ago, CEOs faced a frenzy of hiring and retention challenges as the economy surged and the workforce evolved. But now hiring has slowed, retention has improved and quit rates have lowered. Unfortunately, the status quo won’t last forever, and by 2025, a new growth cycle will begin. “Now” is the optimal time to consider — or reconsider — your succession plans.

With executives in key positions retiring in 5-7 years, we are restructuring and hiring intentionally for capabilities required to succeed in those leadership roles. For those identified as potential successors, we are also investing in development and providing exposure to drivers of our business model.

Kelly Wehner, President, Case Systems Inc, Midland, Michigan

Succession planning brings with it new energy and urgency as 4 factors blur and challenge the status quo. These factors include:

- A pending growth cycle that will demand more workers

- Increased opportunities fueling workforce velocity

- The generational shift of Boomers leaving the workforce combined with the rise of Millennials into leadership roles

- The predicted 2030 global depression

Read the complete analysis in our Q1 2024 Vistage CEO Confidence Index report and examine trends in our new data center over time.

For 20 years, the Vistage CEO Confidence Index has been the definitive voice of high-performing, high-integrity small and midsize business leaders. It’s provided the world-class insights that chief decision-makers need in service to our vision of being the most trusted resource to SMBs.

The Q2 2024 Vistage CEO Confidence Index survey will be in the field June 3-17, 2024, to capture CEOs’ sentiment at the mid-point of the year and any shifts in strategies based on current challenges.