How to Convert Data into Cash

Since 1990, big data has been on the main stage, acting as the engine that drives digital transformation, with tremendous amounts of data being produced every day. This big data phenomenon is shifting the global economy towards profitable complex data analysis and management. Entrepreneurs and huge companies alike are looking into this fact and are finding ways to make such data profitable. It’s certainly creating not only business opportunities, but job opportunities as well.

Research from McKinsey&Company says benefits vary across business sectors. Those poised to gain substantially from this are “the computer and electronic products and information sectors, as well as finance and insurance, and government.” Other businesses, such as retail, online and offline, can still benefit from it when used effectively.

While the value of big data is a foregone conclusion, how to turn data into cash is a topic of conversation across virtually all peer advisory groups. This article discusses how businesses nowadays efficiently and profitably utilize big data in management, customer/service specialization, product/service innovation, operations, and in creating new business models. It poses some of the implications of this growing industry to the business sector, job-creating opportunities, and policy-making, including the internet sales tax.

- What Is Data Monetization?

- What Are the Benefits of Data Monetization?

- How Can You Convert Data to Cash?

- What to Consider When Converting Data to Cash

- Key Takeaways: How to Convert Data to Cash

What Is Data Monetization?

No matter your industry, data is everywhere. It’s generated and collected from various sources, including individuals, social media, sensors, and more. Data monetization is turning this plentiful data into revenue, business value, or economic gains. The two overarching data monetization strategies are:

- Direct data monetization

- Indirect data monetization

Direct Data Monetization

External or direct data monetization involves selling data directly to independent third parties or through a broker. When monetizing data, it can be packaged with insights and analysis (Insights-as-a-Service) or sold as raw data (Data-as-a-Service):

- Data-as-a-Service is when you offer data as a one-time product or a continually updated subscription service. For instance, companies like Zoom Info offer data to organizations to help drive more efficient sales and growth.

- Insights-as-a-Service offers expertise and analytics associated with the data that can also be sold as a subscription-based service or as a one-time product. For example, Meta for Business sells valuable insights into how customers engage with advertisements on their platform.

Internal or Indirect Data Monetization

Another process of monetizing data is indirectly. Internal or indirect data monetization evolves data into valuable business insights that fuel better decision-making skills and improved organizational performance. Indirect data monetization can help you better understand customer behavior and drive a more efficient sales process. Examples of internal data monetization include:

- Strategic cross-selling and upselling opportunities through targeted marketing

- Hiring and retaining employees based on analytics and data

- Gathering and reporting supply chain KPIs to bolster transportation and inventory management

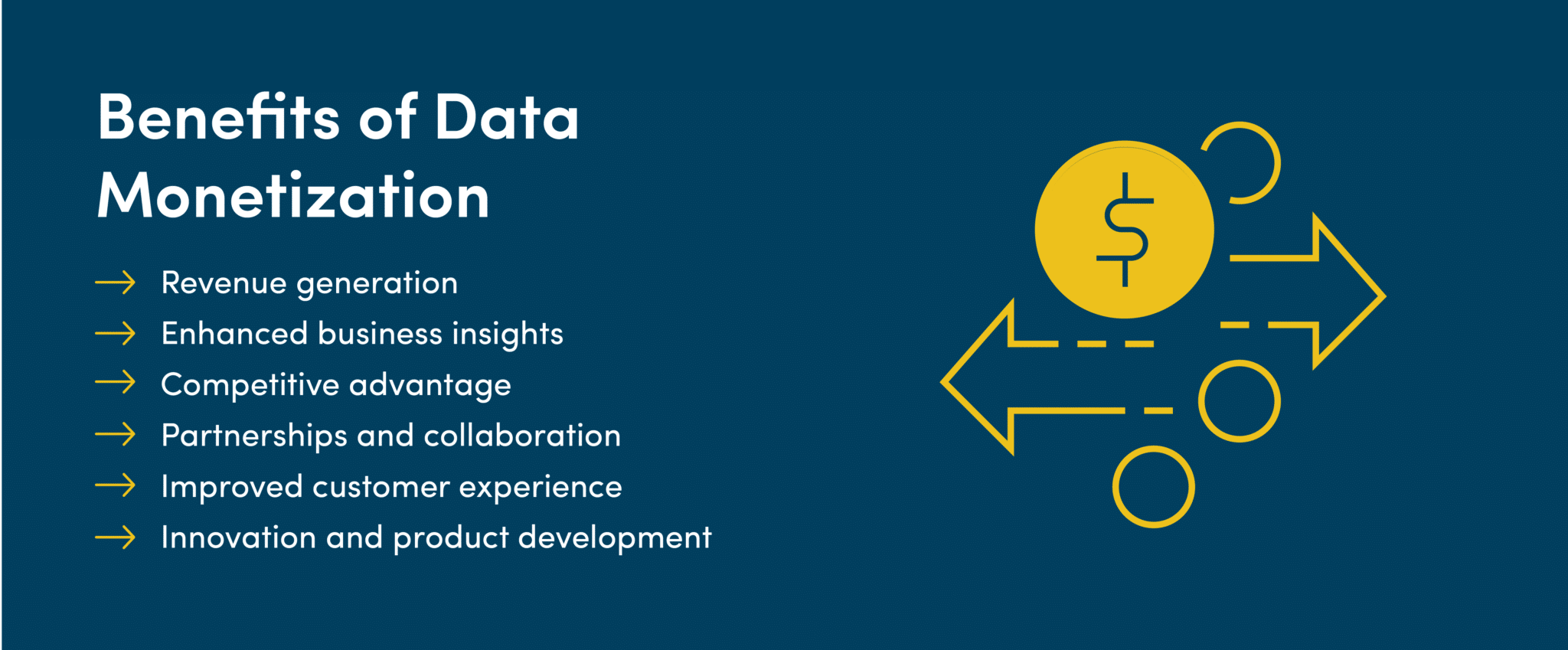

What Are the Benefits of Data Monetization?

Virtually every business is sitting on volumes of data. Data monetization is the process of treating the data like the valuable asset it is and demonstrating a commitment to maximizing it. When you do, you can unlock the following benefits of data monetization.

- Revenue generation: One of the most prevalent benefits of data monetization is the ability to convert data to cash. Monetizing data can represent a new and substantial revenue stream to complement your existing business models.

- Enhanced business insights: Data has embedded insights, trends, and patterns that might not be apparent. Through data monetization and analysis, you can uncover tremendous hidden value, empowering you to make better and more timely decisions at all levels of the organization. It can help resource allocation, cash flow forecasting, operational efficiency, and your business strategy.

- Competitive advantage: Monetizing data can produce prized insights, revenue streams, predictive modeling, and even data-driven solutions. These benefits can help you attract and retain customers more efficiently, creating a unique competitive advantage.

- Partnerships and collaboration: Data monetization strategies can open the door to opportunities that are hidden in plain sight. Your data can be the key that unlocks collaborations and partnerships with other organizations seeking insights. It can create new business opportunities and develop mutually beneficial relationships.

- Improved customer experience: All customers want to be understood and presented with personalized solutions. In today’s hyper-competitive business world, your ability to predict and anticipate needs can be the difference between success and failure. Data monetization strategies can help you deliver unique customer experiences, increasing satisfaction and loyalty by offering the right solutions at the right time.

- Innovation and product development: Developing and evolving your product and service offering is vital to the sustainability of your business. Yet, managing the timing and variables of service and product enhancements can be challenging. Fortunately, the insights gained from analyzing and monetizing data can create a proven roadmap to success. It can provide data and insights that help streamline the development of services and products.

How Can You Convert Data to Cash?

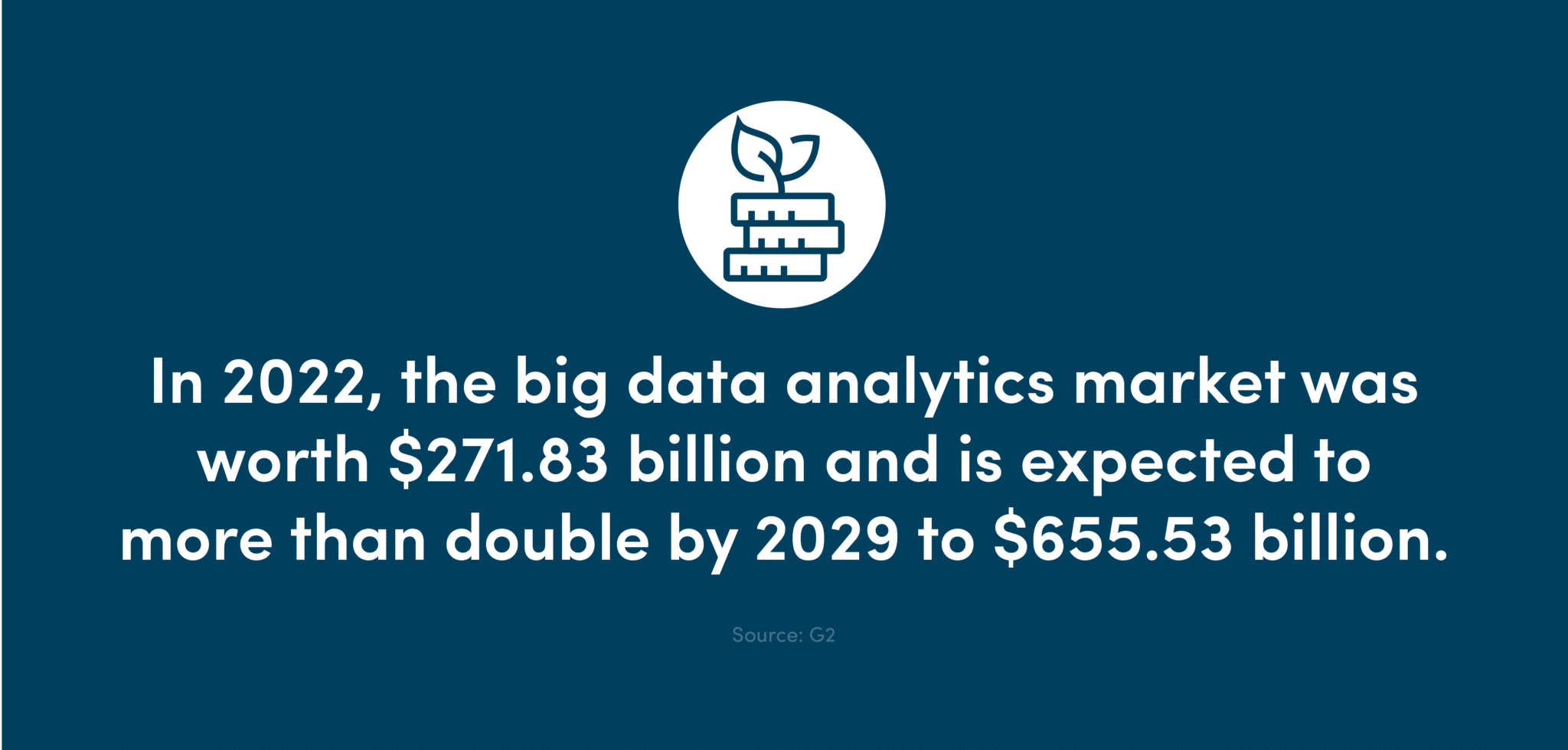

In 2022, the big data analytics market was worth $271.83 billion and is expected to more than double by 2029 to $655.53 billion. If you want to capitalize on the most valuable resource your business has, you must know how to convert data to cash.

- Management

Through automated algorithms, managers can make better decisions through a more precise analysis of data. Rather than anticipatory analysis, they generate predictive analysis through hypothesis-testing via controlled experimentation. With this, they can test which works best with what strategy with minimal to no risks at all.

- Customer or Service Specialization

Companies can better reach their target consumers through segmentation. This way, they see which products and/or services are appropriate with which consumer segment. Facebook, for instance, matches users with features and ads. By combining data from various applications, they create behavioral patterns and therefore, make appropriate suggestions. Meanwhile, Amazon offers various content and dynamic pricing, using real-time analysis, to different sets of users and makes adjustments as they go.

- Product or Service Innovation

Crowdsourcing is made more effective through social media. Consumer insights can be acquired from various tweets (converted to usable data) which companies use for product/service development and innovation. Also, data is becoming a standalone product as analytics utilize them to provide companies with rich insights to improve operations, thereby creating new revenue streams.

- Operations

Rather than learning in retrospect, preventive measures could now be taken through predictive analysis. GE, for instance, can help their customer airlines monitor GE jet engine performance, therefore, anticipating maintenance needs.

By analyzing and comparing data among store branches, a certain retail company can appropriate store performance and consumer behavior with product distribution—limiting overstocking.

- New Business Models

Big data opens new business ventures. For example, real-time location data is booming with more people using smartphones for navigation and by businesses for mobile advertising. Even insurance companies can now price risks based on a person’s driving behavior rather than his age via mobile apps.

- Implications

Organizations and business leaders will have to inventory their data assets in order to identify potential value-creating opportunities. The gap between supply and demand for human capital (i.e., data scientists) is projected to reach 140-190,000 people by 2018. While this creates job opportunities, it also demands equipping people.

Technology development is integral since only a few can handle a tremendous amount of data, not to mention, can effectively manipulate, aggregate, and analyze such data.

Privacy and security are still an issue for the IT and business industry. Policy-makers have yet to address legal concerns, establish intellectual property framework, and create policies that balance privacy concerns with capturing value.

When utilized to their advantage, businesses can profit greatly. Small businesses could even offset losses posed by the internet sales tax. If sales boom through effective real-time analysis, they won’t be hurt as much. Then again, the big data industry still has a long way to go as far as policies are concerned.

What to Consider When Converting Data to Cash

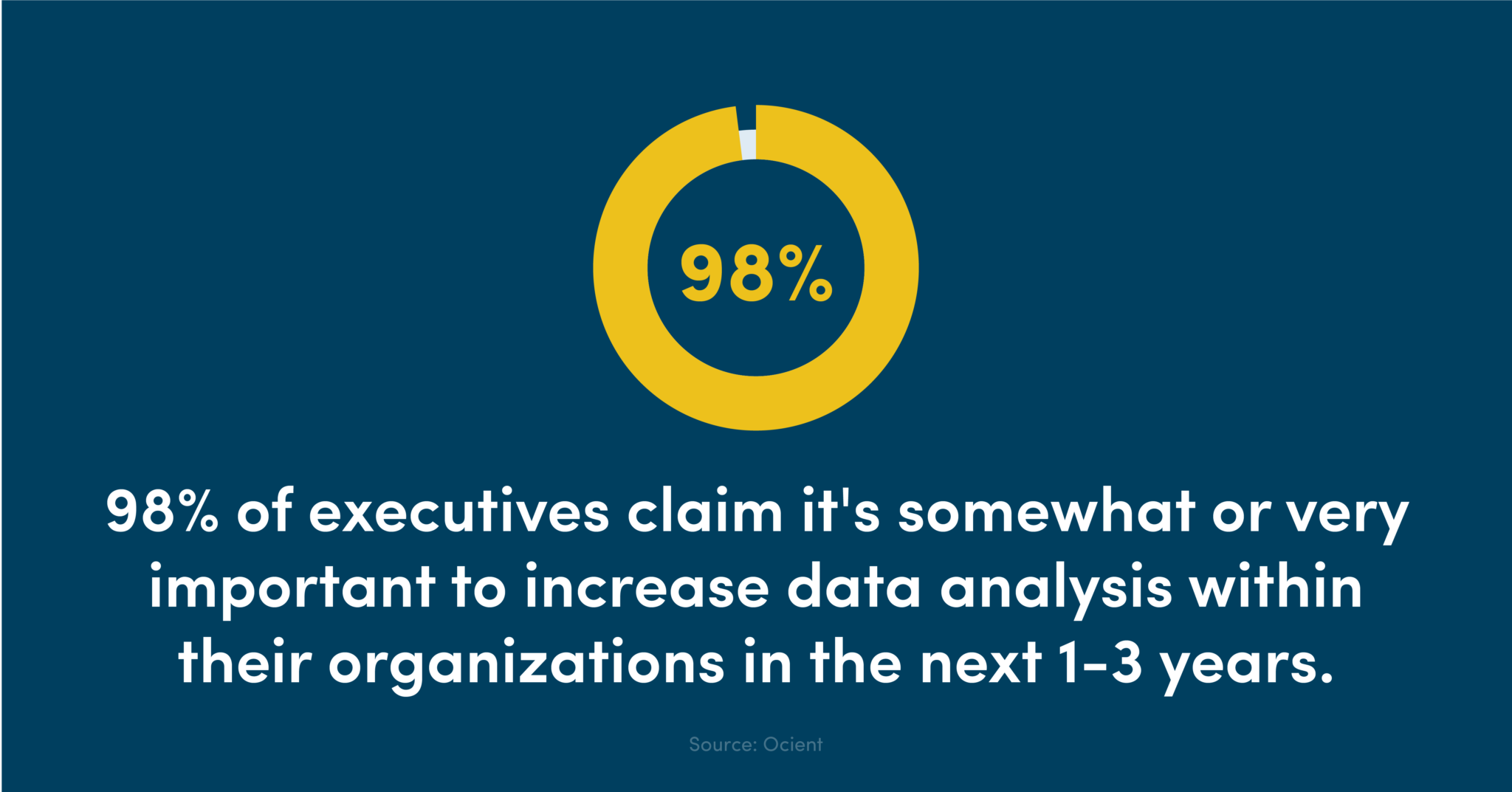

According to Ocient research, 98% of executives claim it’s somewhat or very important to increase data analysis within their organizations in the next 1-3 years. Nevertheless, the demand for data is on the rise. However, before you define your external data monetization strategies, you should consider a few attributes.

Target audience

After you’ve packaged, analyzed, and collected your data, it’s time to define the internal and external users who would find it valuable. Ensure you consider businesses, non-profits, government entities, business users, data analysts, frontline workers, and customers. In doing so, you can build personas to help articulate:

- How they use the data

- Levels of data literacy

- Pain points, needs, and wants

- Existing tools in use

Compliance and governance

The proliferation of big data has ushered in a new and evolving regulatory environment governing privacy, how data is shared, and other parameters. If you’re interested in monetizing data, you must ensure you’re up-to-date on governance and compliant regulations, such as the General Data Protection Regulation (GDPR) in Europe. Failure to do so can lead to hefty fines and potential legal ramifications.

Security

A strong security and data governance framework must be a part of your organizational culture. It’s essential to keep your data safe and organized. More so, when you have proper data security protocols, you can further ensure data customers on the integrity of the product.

Business intelligence platform

The Business Intelligence (BI) platform is essential to your data monetization strategy. For starters, the BI platform must meet your specific needs, which often requires customization. The platform should be engineered to optimize processes and reduce development time. Most importantly, your BI platform must have the scope and flexibility to handle your current and future data needs.

This is vital because the rate of data generation is an exponentially expanding affair. Simultaneously, your BI platform must be user-friendly and built with the end user in mind. The most valuable data will be underutilized— at best—if the BI platform is cumbersome, difficult to access, and not user-friendly. It can devalue your data monetization efforts.

Key Takeaways: How to Convert Data to Cash

Data monetization can be complex, but it’s more than worth the effort. It can help your organization generate additional revenue streams, gain enhanced business insights, develop partnerships, improve the customer experience, streamline innovation and product development, and create a unique competitive advantage. Whether you use internal data monetization strategies or direct, it represents a tremendous opportunity to grow your business from the inside out.

Category : Financials

Informative Post with Big data, we can say Big data has a lot of capacity to profit organizations in any kind of industry, ubiquitously in world. it is a useful to decision-making and helpful to improve the financial position of any organization.