Economic confidence declines in March WSJ/Vistage survey

For the second consecutive month, the economic optimism of small business CEOs has decreased in the Wall Street Journal/Vistage Small Business CEO Survey.

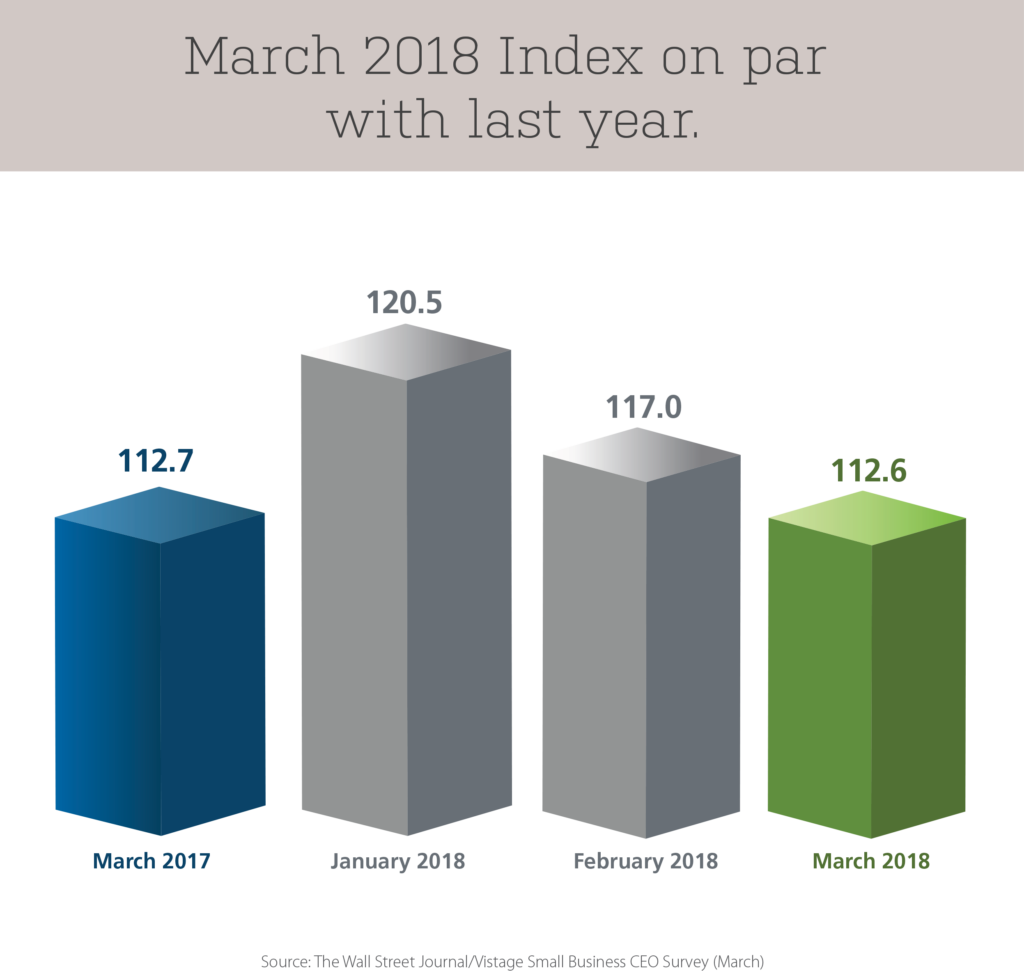

In the March 2018 survey, the Wall Street Journal/Vistage CEO Confidence Index measured 112.7 — a decline of 4.3 points from the February index (117.0) and 7.8 points from the January index (120.5). The current index is nearly equal to that of March 2017, when the index measured 112.6.

In spite of this reduction, however, the index “remains at quite favorable levels,” said Dr. Richard Curtin of the University of Michigan, who analyzed the survey results. “Some of the decline can be attributed to the natural fading of optimism, as greater details about the tax return became known. And, potentially, some of the decline can be attributed to negative reactions to the recent introduction of steel and aluminum tariffs.

The March 2018 survey had 897 respondents. Other highlights from the results include the following.

CEOs believe economy recently improved

CEOs believe economy recently improved

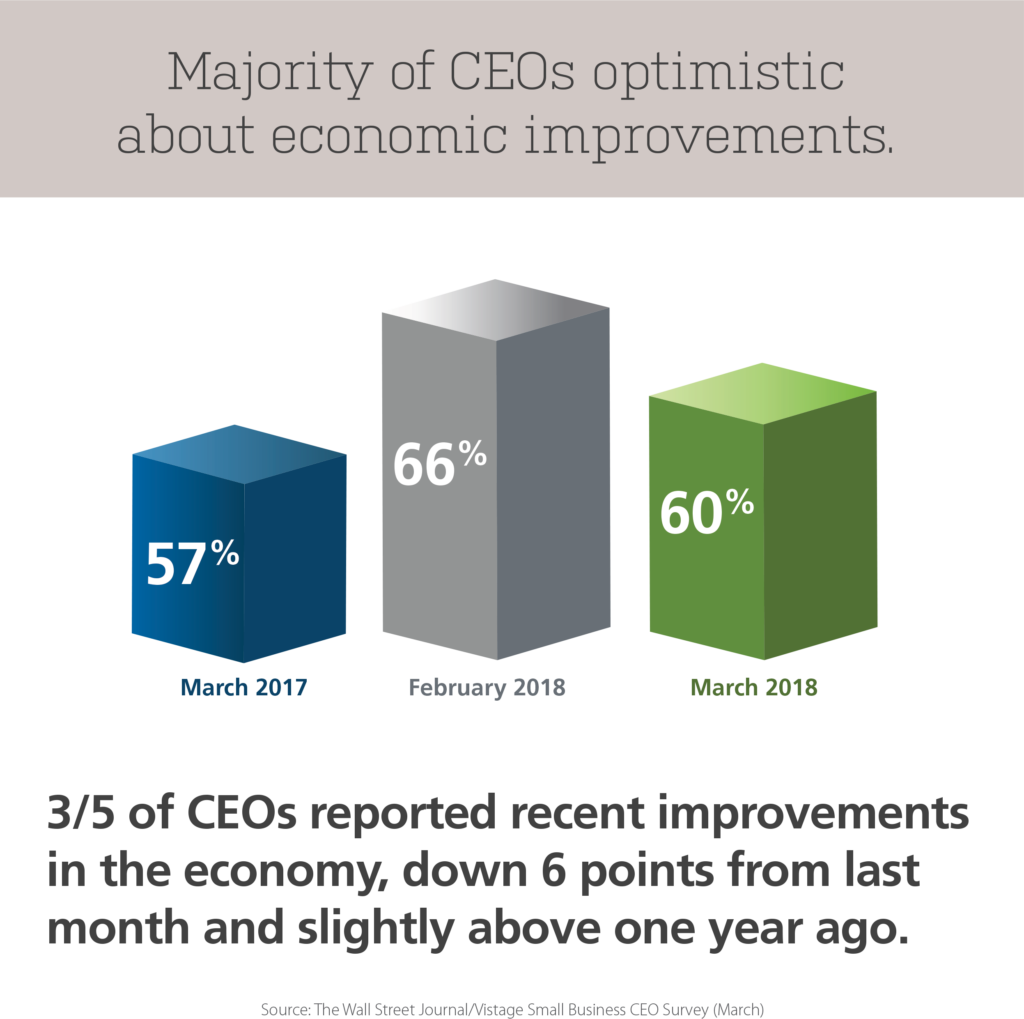

In the March survey, more than half (60%) of small-business CEOs thought that the economy has improved in the last 12 months, compared to the six-year peak of 70% recorded in January. Only 7% of CEOs thought that they had worsened.

Optimism about economic growth in the next 12 months has also declined. In the March survey, only 35% of CEOs said they expected the economy to improve, compared to 45% one month ago and 55% one year ago. However, 47% anticipated that the pace of economic growth would stay consistent. Only 16% said that they expected economic conditions to worsen in the year ahead.

Positive financial prospects for small businesses

Positive financial prospects for small businesses

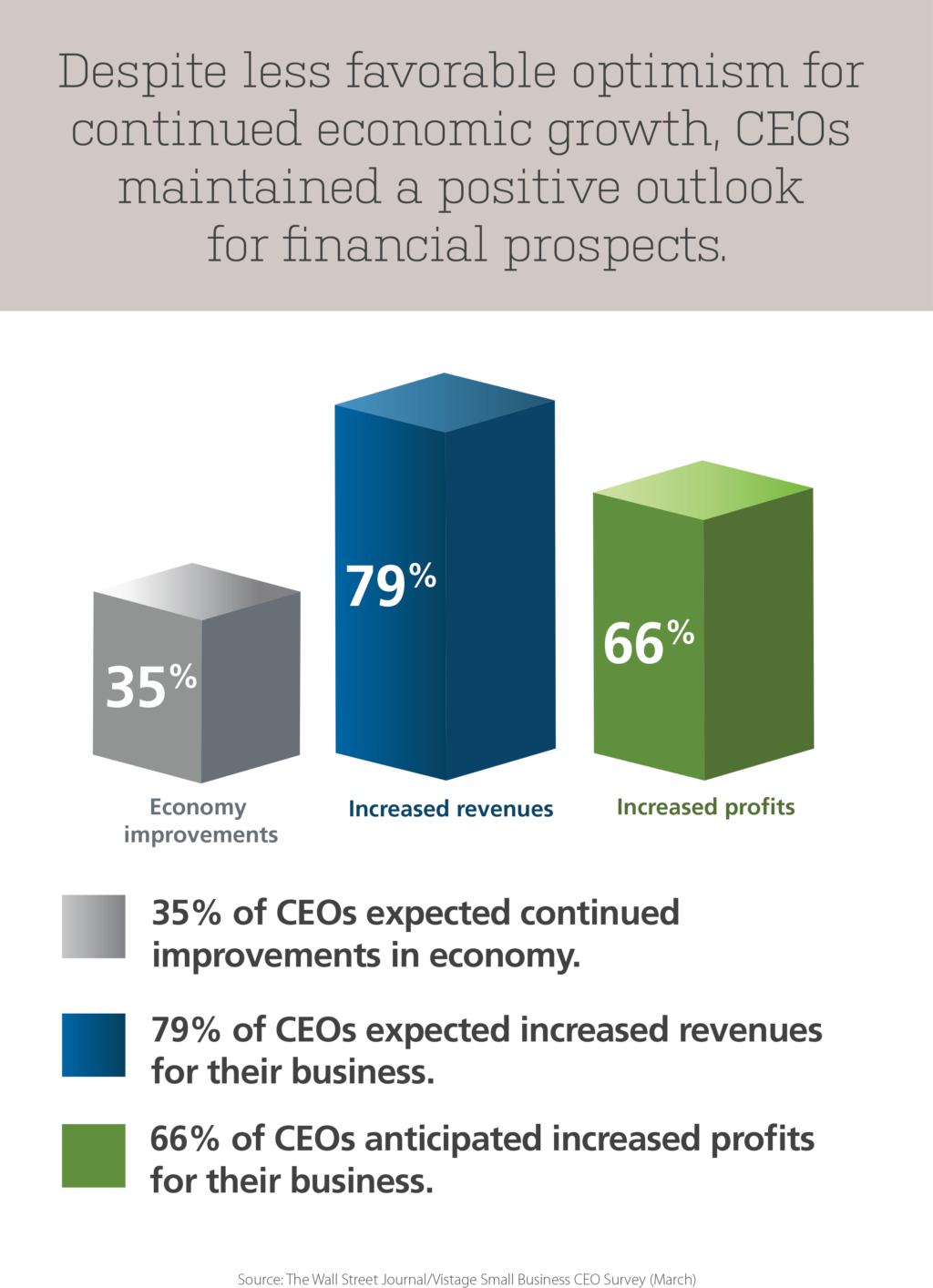

Small-business CEOs remain optimistic about the outlook of their own company’s revenues and profits, although the ratio has declined slightly in the last two months.

The majority of CEOs (79%) said that they expect their revenues to increase in the next 12 months. This is slightly less than the six-year peak of 83% recorded in January but greater than the 75% recorded one year ago. Revenue declines were anticipated by only 5% of CEOs.

Similarly, 66% of CEOs expect higher profits in the year ahead. This is marginally below the 69% peak recorded in January and slightly above last March’s 63%.

CEOs intend to increase workforce

CEOs intend to increase workforce

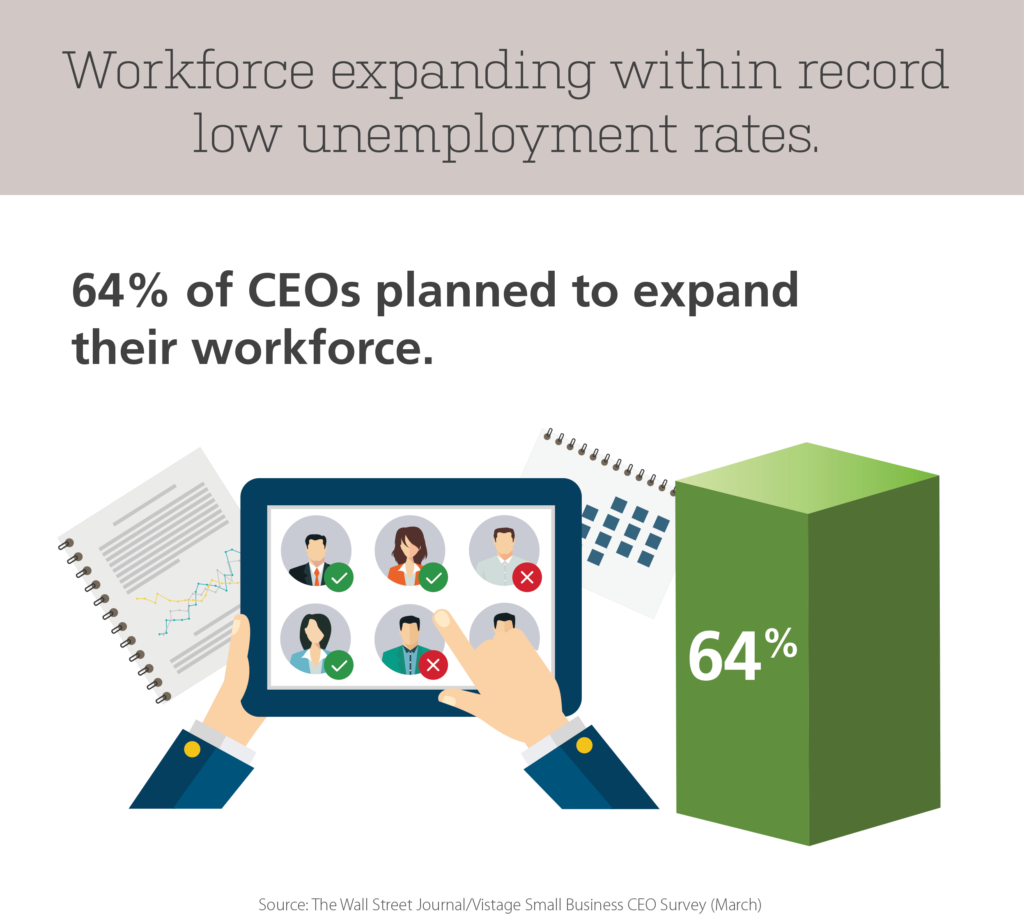

More than half of small-business CEOs (64%) plan to expand their workforce in the year ahead. By comparison, this figure was 72% three months ago — a record peak — and 59% one year ago. Very few CEOs (3%) plan to reduce the number of their employees this year.

“The data indicate that job growth in the nation, as a whole, will remain strong in the year,” said Curtin. “Small businesses are still struggling to hire and retain enough employees to keep up with today’s robust demand and tomorrow’s increases in sales.”

Most CEOs expect to increase investments

Most CEOs expect to increase investments

More than half of small-business CEOs (51%) plan to expand their investment expenditures in the year ahead. This is largely consistent with the 52% recorded in the past three months.

In addition, for the sixth consecutive month, only 6% of CEOs reported that they planned to reduce their investment expenditures in the next 12 months.

Tax reform impacts business expenses

Tax reform impacts business expenses

About half (45%) of CEOs said that the tax reform would impact their business expenses for entertainment, meals and transportation. In particular, CEOs reported that they would change their policies in order to reduce or shift the treatment of employer-paid expenses.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey