The business baseline of COVID-19

In early March, COVID-19 set a series of shocks into motion: The stock market crashed. Borders closed. The economy plunged. Communities descended into quarantine.

One month later, a new business baseline has emerged. Across the country and around the world, total business activity is sitting at ground level, waiting to rise up.

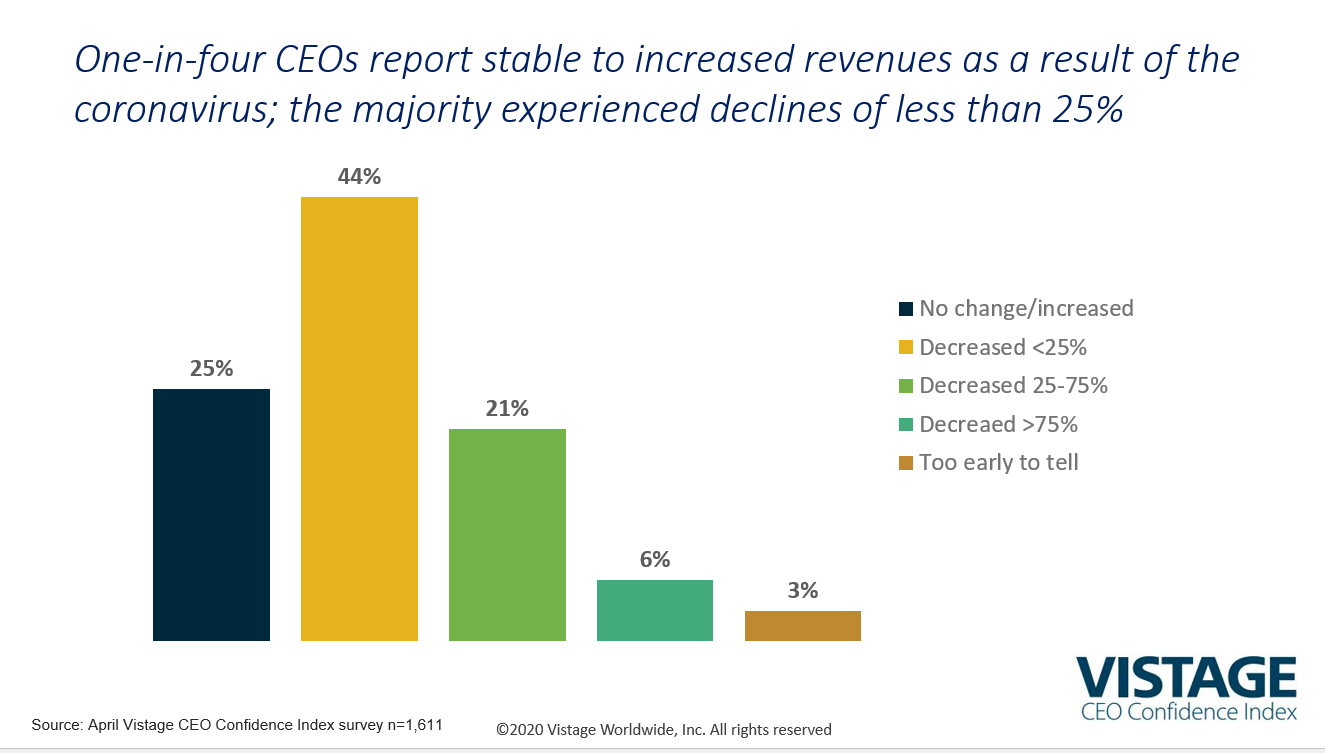

While the COVID-19 crisis has devastated some industries, other industries have experienced a surge in business. In fact, our April survey* of 1,611 CEOs indicates that some, but not all, of small and midsize businesses are struggling:

- One-quarter (25%) of CEOs reported no change or even improved revenues.

- A large group (44%) said revenues are down as much as 25%, but noted their businesses are still functioning. These leaders will need to make hard decisions regarding their workforce, the long-term impact on customers and their ability to survive more than a few months at this level of activity.

- Of greater concern are the 21% of CEOs that have seen business revenues decline between 25% and 75%. These leaders will be forced to make very difficult and painful choices very soon.

- Even more devastating, 6% of CEOs have seen revenues collapse by 75% or greater.

Now, cash is more than king

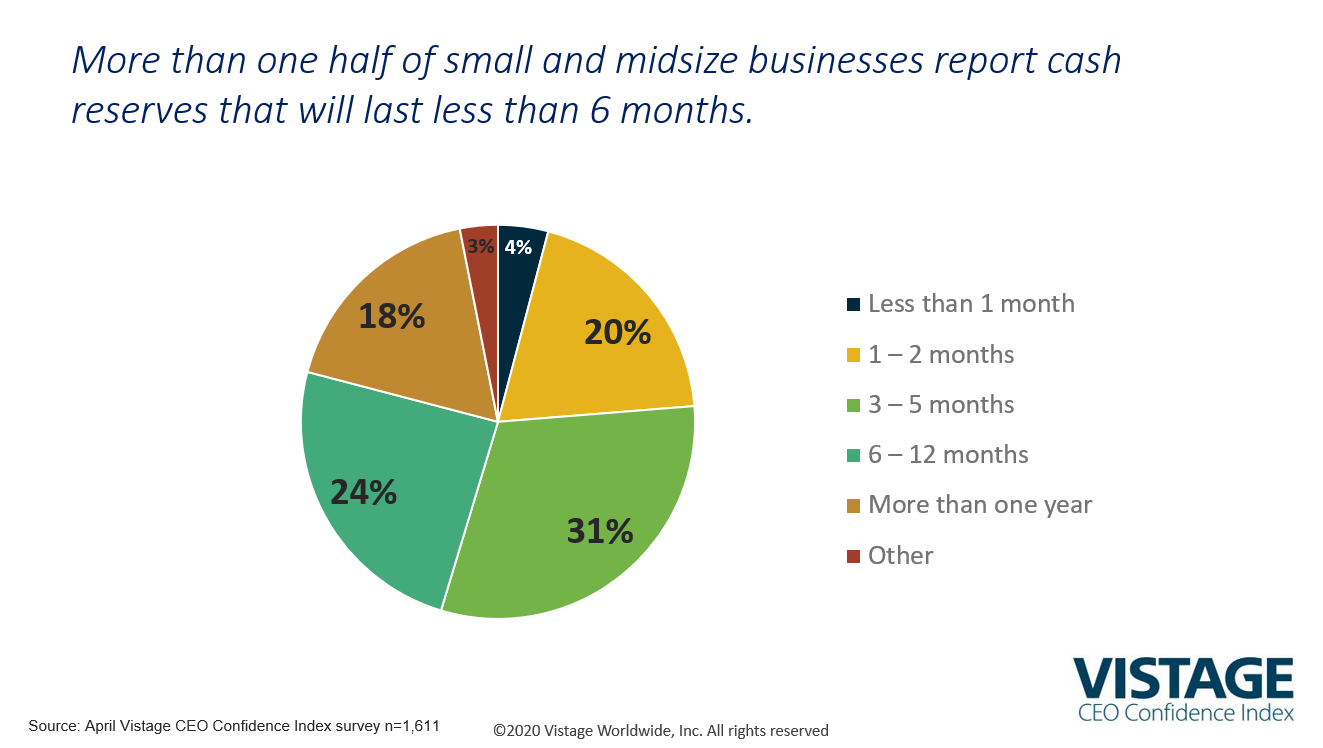

Falling revenue is just one side of the financial story. In today’s world, cash is more than king; it’s like a ventilator. During a crisis, it can mean the difference between a company’s survival and its failure.

In our survey, 42% of CEOs reported having more than six months of cash on hand, which includes the 18% that have reserves for more than a year. That means the majority of CEOs have less than six months’ worth of cash reserves, which is a very short runway for some companies.

Current economic forecasts from ITR Economics suggest a gradual return of business activity starting in Q3 and, with it, increasing revenues into Q4 and beyond. However, there is a chance that a second wave of the virus could extend the crisis, extracting a deeper toll for many businesses already on the brink of collapse.

Sources of relief

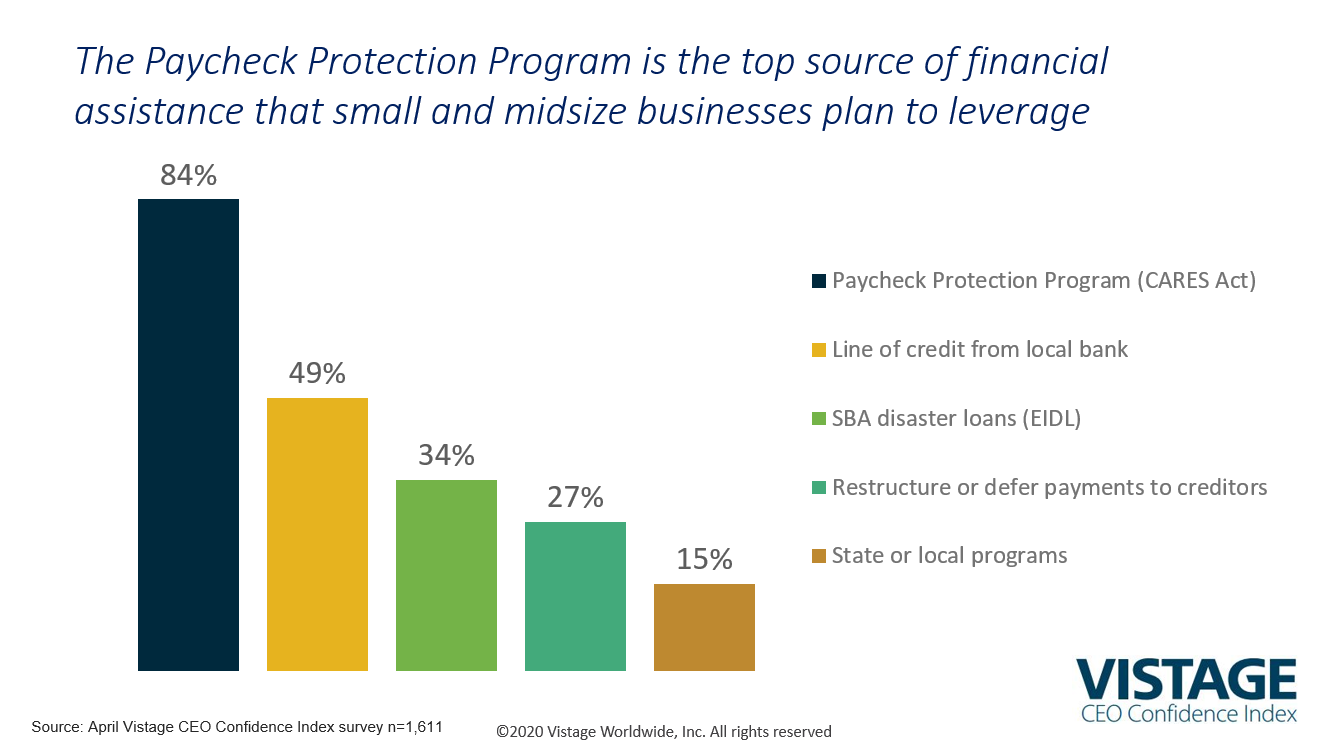

Fortunately, small and midsize businesses can now access a variety of financial assistance options from both the government and financial institutions. Combined with sound financial planning and good decision-making, these resources can give businesses more flexibility and extend their financial runways.

For leaders, the first line of defense comes from leveraging local banking relationships and exercising an existing line of credit. Indeed, CEOs who have followed this strategy have already been rewarded with additional flexibility and financial options. For example, many have gained faster access to the Paycheck Protection Program (PPP) due to longstanding relationships with Small Business Administration (SBA) certified lenders. In fact, 84% of the CEOs we surveyed plan on taking advantage of the PPP.

At the same time, some leaders have encountered difficulties in accessing SBA loans. In hindsight, it was unrealistic to expect the federal government to quickly pivot, scale and distribute funds to small businesses. But, after much initial confusion, money is beginning to flow.

Predictions for economic recovery

Unlike prior recoveries, which had a V-shape or U-shape, this recovery will be more like a check mark: It will have a sharp, downward slash to the left, with a slow but steady rise to the right.

As the health crisis subsides, CEOs will begin to bring their employees back to work as their customers begin to buy again. The question is: How long will we be at this new base level of business activity before we can hit the reset button — and begin the slow ascent to the new reality that exists on the other side of the crisis?

*About the survey: Our April Vistage CEO Confidence Index survey data includes responses from 1,611 SMB CEOs and key executives collected April 1–8, 2020. Daily responses did not vary over time during the survey period, suggesting that this data captured the new baseline of business activity until quarantine levels change. The demographics of our survey include a variety of industries, including nearly three-quarters of respondents representing manufacturing, construction, finance/accounting, consulting services, wholesale trade, healthcare, business services and computer systems. Some of the harder-hit verticals, like hospitality, entertainment and travel, are not fully represented in this survey.

Category : Economic / Future Trends

Tags: CEO Confidence Index