WSJ/Vistage May 2020: Free-fall in small business confidence ends

Highlights:

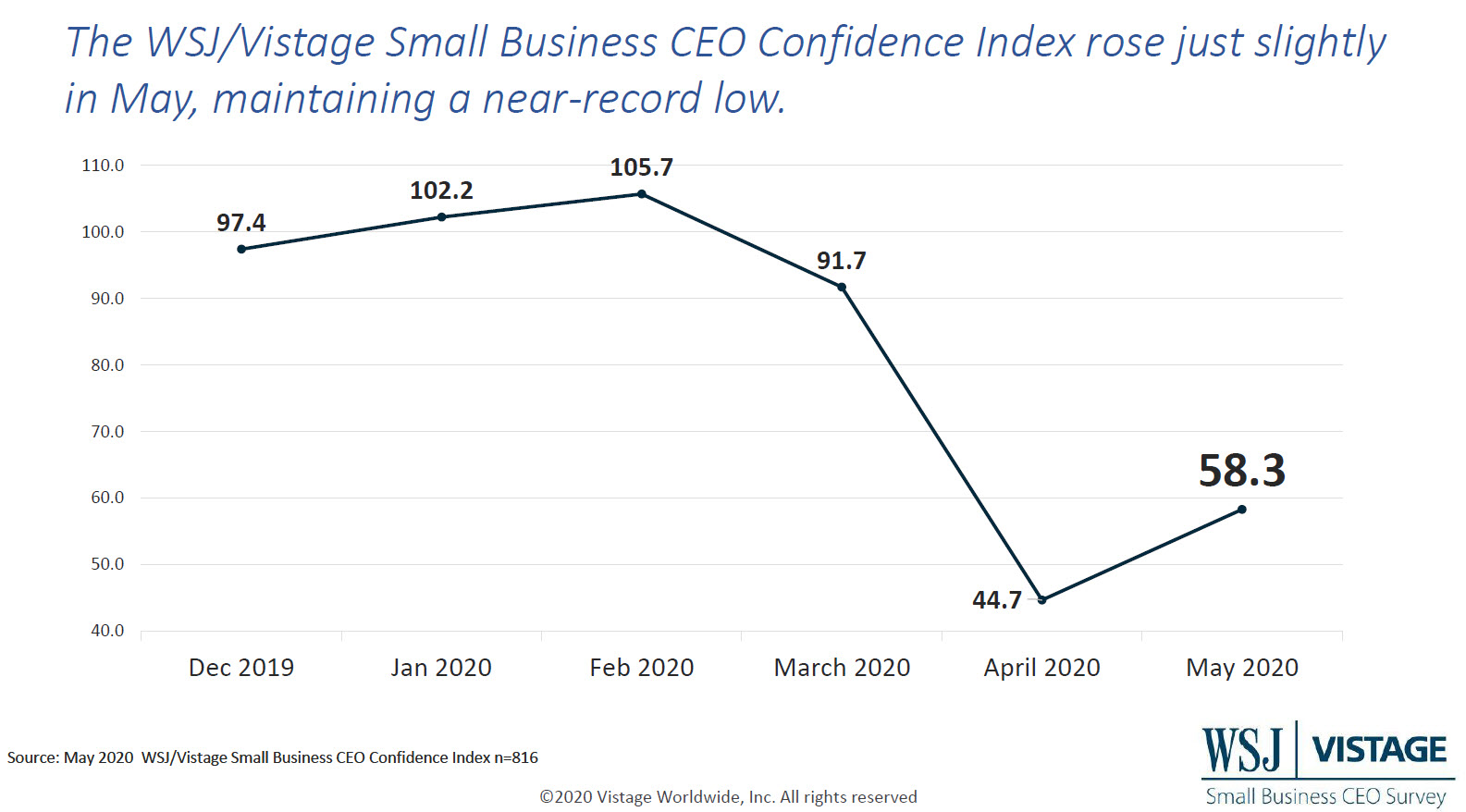

- The WSJ/Vistage Small Business CEO Confidence Index increased slightly to 58.3 in May

- Optimism in the U.S. economy is on the rise; 41% of small business CEOs believe the economy will improve in the year ahead, up from 33% last month and 19% two months ago

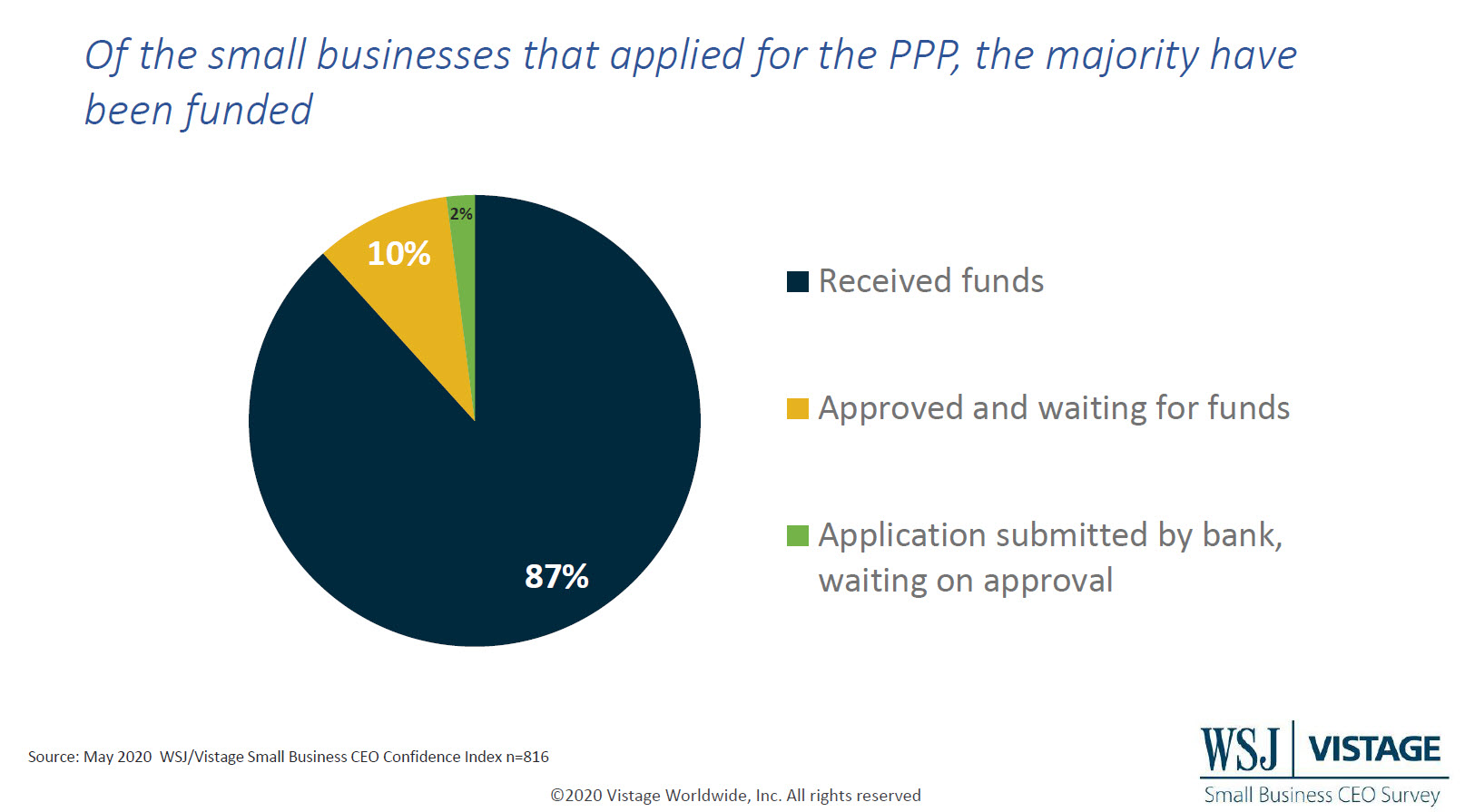

- Nine-in-ten respondents reported applying for the PPP; of those 97% were funded or approved for funding

Confidence among small businesses improved slightly in May, largely driven by increasing expectations for economic improvement. This is according to the most recent survey conducted of small business CEOs by Vistage in partnership with the Wall Street Journal.

The WSJ/Vistage Small Business CEO Confidence Index rose to 58.3 in May, still far below October’s peak of 105.7. This small gain is driven by the economic engines that are beginning to turn as many states begin to relax restrictions in the first phase of the recovery. And while small business CEOs expect improvement to the economy in the next 12 months, the reality is that the pandemic will impact the pace of growth over time.

While there were small gains in CEOs’ expectations for revenues, profits, employment or investments, the sentiment of small business leaders remains near the record lows set last month. According to Dr. Richard Curtin, a researcher at the University of Michigan who analyzed the results, “given the horrendous economic damage due to the coronavirus pandemic, small business leaders have adjusted their actions and future plans to revitalize their companies.”

Financial assistance leveraged by the majority of small businesses

Small businesses are especially challenged in a recession due to their limited resources in terms of both cash and manpower. Dr. Curtin notes that “these small businesses are critically dependent on the knowledge and skills of their employees, but often do not have the financial resources to maintain payrolls when their businesses are shuttered.”

This is evidenced by over half of small business CEOs (55%) reporting that they have less than six months of cash reserves. To provide much-needed cash flow, government relief programs—including those offered in the CARES Act, through the Small Business Administration and the Federal Reserve—are critical to offering small businesses the support they need to survive. But the Paycheck Protection Program (PPP) is by far the most popular; 90% of respondents to the May survey applied for the PPP; of those that applied, 87% received funds and 10% were approved and waiting for funds.

“These programs help to forestall further damage to their companies and employees, but most programs provide aid only on a one-time basis,” says Dr. Curtin. To balance the short-term support offered by the PPP and other CARES Act provisions, other sources can provide a cash parachute; 42% of small business CEOs reported plans to seek lines of credit from a local bank.

Adjustments to workforce minimized

While unemployment in the U.S. has reached record levels, the majority of small businesses surveyed have been able to maintain their workforces. Just 39% of small business CEOs reported that the size of their workforces declined during the pandemic; 61% reported their workforces remained stable (53%) or increased (8%). Dr. Curtin notes that “While the workforce declines reported by 39% was a significant loss, it would have presumably been higher without the assistance programs.”

Another factor in maintaining employees is the opportunity to implement remote working. Work-from-home continues to be a viable—and sometimes necessary—option for small businesses. The April survey found that 89% of small businesses had implemented remote working, a trend that continued in May; 92% of small business CEOs reported that remote working had been implemented or was implemented and will be extended. As states enter the first phase of recovery, small businesses may be able to follow the likes of Facebook and Shopify and make working from home a long-term option or even a requirement.

New products may offset revenue declines

Nearly half (48%) of small businesses changed the products or services they offer as a result of the pandemic. Of those that made changes, the majority of small business CEOs (52%) report they have added products or services that would increase their long-term growth potential; 27% have temporarily pivoted to offer items in high demand.

These new products may help offset the declining revenues small businesses are reporting. While 15% of small business CEOs report stable to increasing revenues, and 17% report declines of less than 10%, half report revenue declines between 10 – 50%.

The road to recovery varies for small businesses

Small business CEOs believe the recovery will take place over a long time, and their individual views are very much based on where they are located, their industry, their customer base as well as whether they are deemed an essential business. When asked when economic improvement would begin in the U.S., just 14% of small business CEOs expect improvement within two months, 30% expect it to begin in three to five months, 33% expect it to begin in six to 12 months, and 20% expect it to take more than one year. Dr. Curtin shares that “these projections reflect the fact that the recovery is dependent on a resolution to the coronavirus as well as reversing the extraordinary economic losses.”

The May WSJ/Vistage Small Business CEO survey was conducted May 4 – 11, 2020 and gathered 816 responses from CEOs and other leaders of small businesses. Our June survey, in the field June 1 – 8, will reveal how the PPP impacted how small businesses manage their workforces.

Download the May 2020 report for the complete analysis.

Related links

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey