Economy reaches the first plateau of recovery

The promise of a sharp, V-shaped economic recovery feels like a distant dream, and the U.S. is awakening to the grim reality that COVID-19 is still here and is not going to just go away.

The resurgence of cases, positivity rates, hospitalizations and deaths in many parts of the US not initially affected in March and April is evidence that the first wave is still washing over us. In some parts of the country, that means a return to lockdown or a retreat to a stricter level of quarantine. In either case, it represents a misstep as we reach the first plateau.

The July Vistage CEO Confidence Index survey — which captured feedback from of 1,334 CEOs of small and midsize businesses (SMBs) — showed that CEO optimism continued to improve from April lows, but with decreased momentum. The inconsistent re-openings in different parts of the country and lack of a national strategy to manage COVID-19 adds more uncertainty to the equation. With big company layoffs yet to begin, the next round of economic stimulus uncertain and few positive health trend lines to be seen, we may sit on this plateau for some time.

And yet, there is growing optimism amongst leaders of small and midsize businesses that there is a better future ahead.

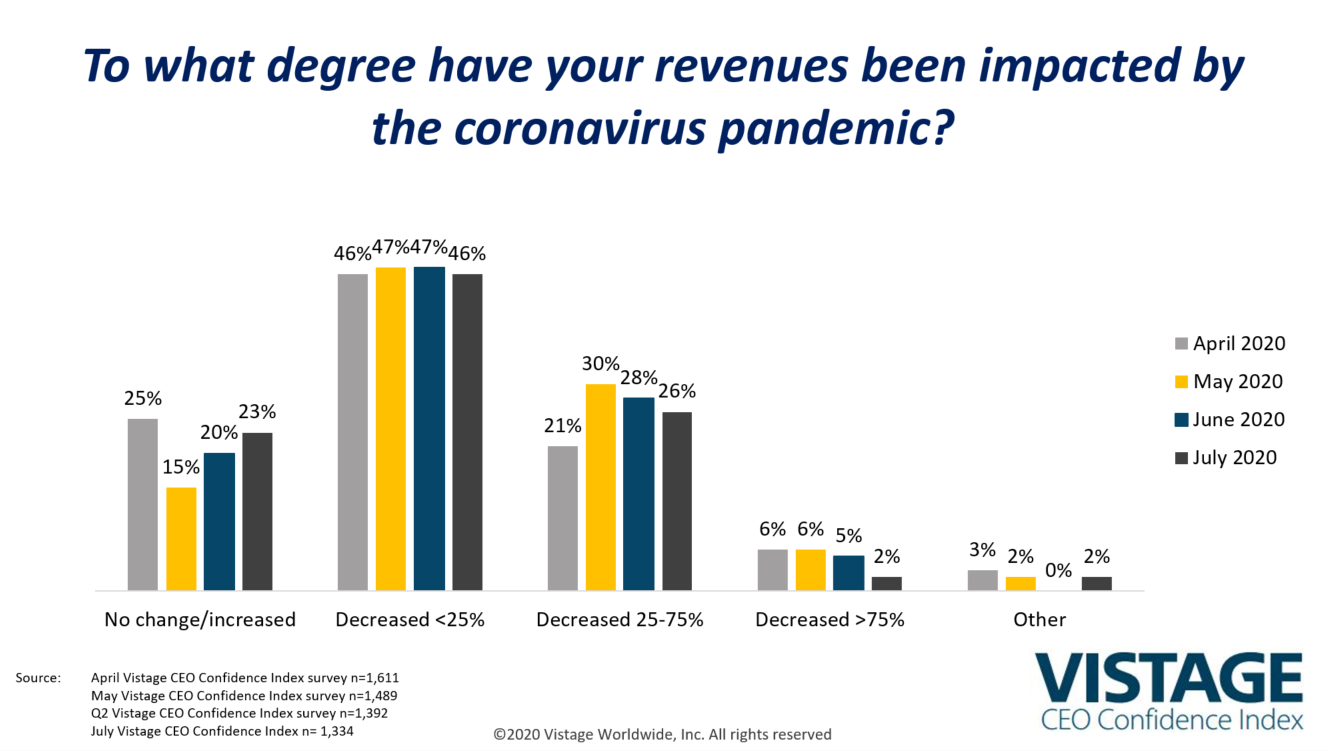

Revenue impacts stabilize as cash flow improves

The revenue impact of COVID-19 improved again in July, but only slightly.

In monitoring trends over time, there was a small increase in the number of CEOs who reported revenue equal to or greater than before the pandemic, and a slight decrease in those reporting losses of more than 75%. This illustrates the stalled recovery.

However, optimism for the future continues to grow. Over half (51%) of CEOs expect increased revenues in the year ahead, up from just 21% in April. While still far below December’s survey when 67% of CEOs reported expectations for increased revenues, this gain shows a growing sense of confidence in a solid recovery.

Profit expectations follow a similar pattern: 46% of CEOs expect increased profits over the next 12 months, a significant jump from 19% in April and just 11 points short of December’s 57%.

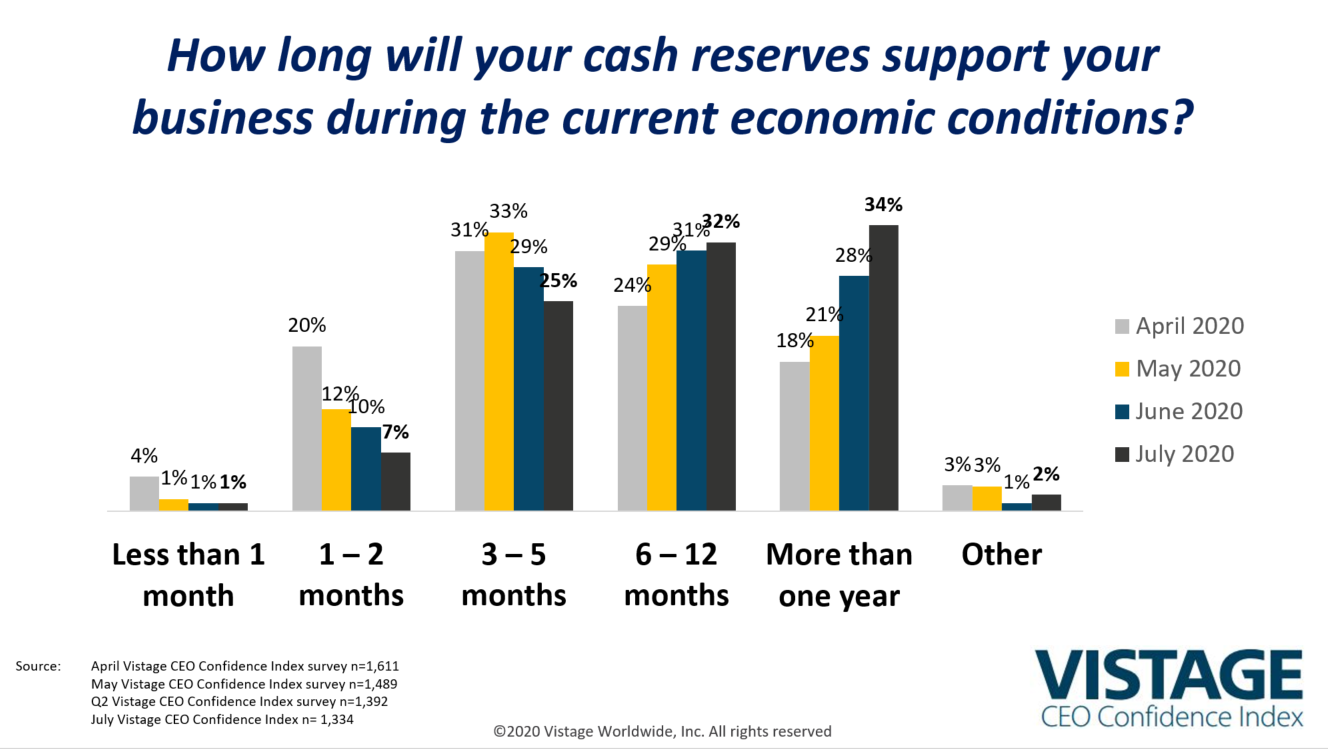

In our analysis of cash reserves, the picture continues to improve. Just 7% of small and midsize businesses surveyed have less than two months of cash on hand, 25% report three to five months of cash reserves, and 31% have six to 12 months of runway — all small gains from prior months.

At the top of the scale, over one-third (34%) of CEOs report their cash reserves would support their businesses for more than one year, up from 28% in June. This trend of improved cash flow is driven by the impact of federal stimulus programs along with the rigorous cost-cutting implemented by small and midsize businesses.

Timeline for economic improvement lengthens

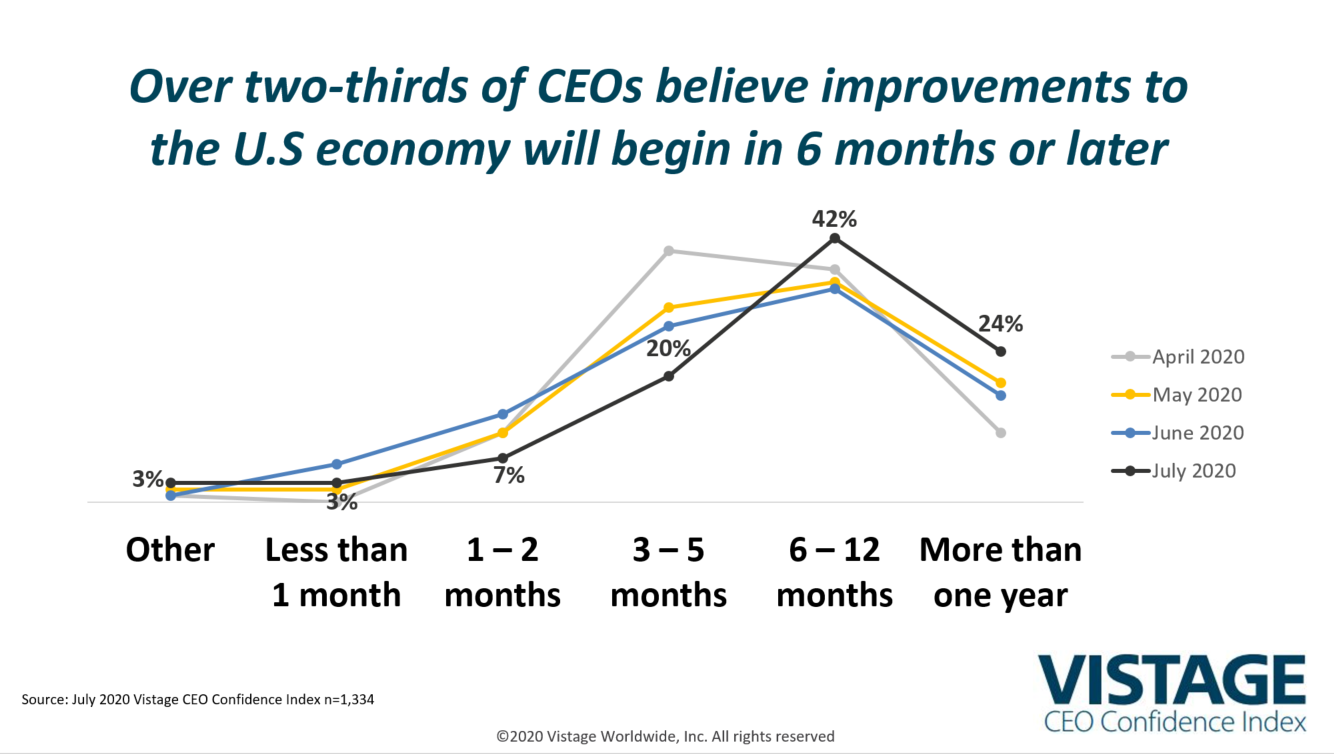

Looking forward, CEOs continue to push out their expectations for when the economy will improve.

Those with optimistic short-term views of recovery taking two months or less fell by half from June (14%) to July (7%). Additionally, those expecting improvements in the three to five month horizon fell by almost a third; from 28% in June to 20% in July.

The proportion of CEOs expecting recovery to be longer-term increased:

- 42% of CEOs expect conditions will begin to improve in 6 – 12 months, up from 34% in June

- 24% expect recovery will take more than one year, up from 17% in June

CEO sentiment suggests that it will be a longer and more difficult climb out of the “corona-ditch.”

When asked about the timeframe for their businesses to recover from the crisis, CEO expectations aligned with their sentiment about economic recovery and revenue impact.

Of the 22% of SMBs that were not impacted or have already recovered, more than three-quarters (76%) report revenues are equal to or greater than before the crisis.

Caution with confidence

The unsteady and inconsistent reopening of some parts of the country combined with the disturbing spike in COVID-19 cases is putting a damper on the V-shaped recovery everyone had hoped for.

While CEOs expressed increased optimism for their individual businesses over the 12-month horizon, they expect the economic recovery will take longer. A full recovery is dependent on either achieving the now doubtful “herd immunity” or the development of a vaccine. While encouraging progress is being made, completion of vaccine trials could take at least six to nine months from now, at best.

Finding the right balance of business activity and human interactions will be the key to making the phased recovery successful. Until we collectively accept the necessity of following CDC recommended guidelines, the recovery will continue to false-start; the revenue that results from re-opening will only stall when we are required to return to a tighter level of quarantine. Getting to the first plateau of recovery has brought millions of workers back to the workplace and made life seem a little more normal. Achieving the next level of business recovery will require community discipline, something we’ve yet to display. The alternative is a long wait for a vaccine. 2021 is not guaranteed.

Category : Economic / Future Trends

Tags: CEO Confidence Index