Economic trends facing business in 2021 and beyond

Editor’s note: This article is part of a series on external trends impacting small and midsize businesses. In Part 4, we study economic trends facing businesses in 2021 and beyond.

To explore the most recent economic trends, check out our article: Economic Trends Facing Business in 2022 and Beyond.

As the history of 2020 is written, it will be the year of COVID-19 and the biggest freefall of the U.S. economy since the Great Depression. How and when this story will end are uncertain.

While there seems to be a singular focus on the timing and efficacy of a vaccine, there are deeper fundamentals at play in the U.S. economy. The recovery has been artificially supported by government stimulus. Classical economic theory would suggest that rapid increases in deficit spending would be followed by inflation and currency devaluation. At some point, borrowing costs will have to go up.

As we enter 2021, America is in the midst of a highly uneven recovery. Some economists believe 2021 will result in the highest GNP growth in the last twenty years, at a time when nearly 15 million Americans can’t pay their rent. Here are economic trends to consider in the year ahead:

Sources: The Conference Board and Kiplinger

U.S. GDP is expected to grow 3.4% in 2021. The momentum of the recovery is widely believed to come down to two highly reported variables: the timing of a vaccine (which we will not cover here) and the likelihood of further stimulus.

Other 2021 trends

Part 1: Ecological trends facing business in 2021 and beyond

Part 2: Social trends facing business in 2021 and beyond

Part 3: Technology trends facing business in 2021 and beyond

Bidenomics, stimulus and the stock market

The Biden administration, diluted by the likelihood of a Republican-controlled Senate will have to confront the pandemic and a fragile economy.

Animal spirits—the emotions that govern our investment decisions—are still prevailing on Wall Street. On November 24, the Dow Jones Industrial average closed above 30,000 for the first time, on news of a vaccine and the naming of Janet Yellen as incoming Treasury Secretary. Yellen is a labor economist who is said to have the steady hand and temperament that can find common ground with Congress. Yellen said that “the recovery will be uneven and lackluster if Congress doesn’t spend more to fight unemployment and keep small businesses afloat.”

There is renewed effort for Democrats and Republicans to agree on a stimulus before President Elect Biden takes office. A bipartisan effort to extend relief has focused on more money for education, help for small business and extension of job benefits. The Republican proposal cut out relief for airlines, rental assistance and state/local governments who face a $400 billion shortfall.

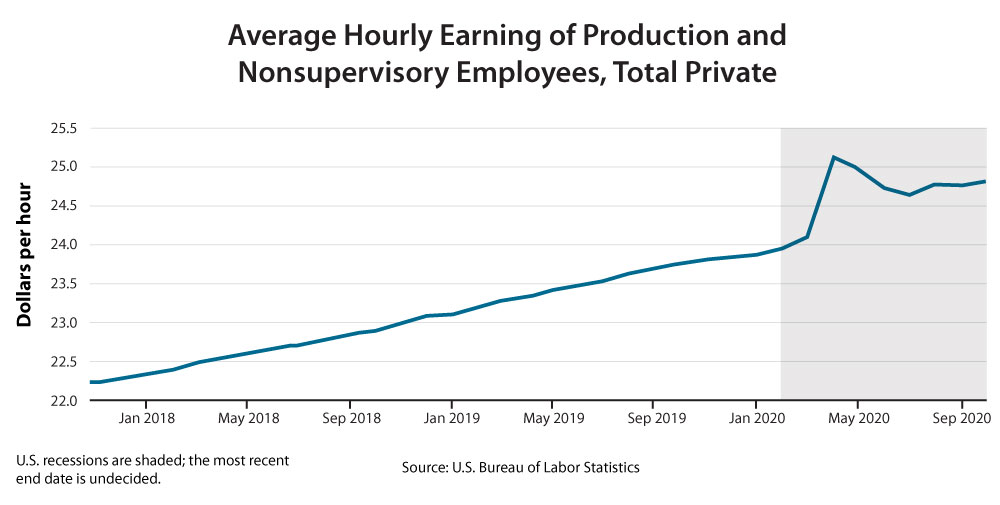

Extension of the Paycheck Protection Program (PPP) seems likely. PPP appears to have achieved its objectives given the spike in wages after the legislation was passed in April.

U.S. public markets remain one of the few bastions of safety throughout the world and have outperformed foreign markets. As of Thanksgiving, the S&P Index was up 13% for the year. Big stocks and big tech have driven the rally. Since their March lows, Apple is up 105%, Amazon 64% and Tesla 538%. Of late, small-cap stocks have spiked, with the Russell 2000 up 19% in November—its best month ever. While Vistage companies have performed well, the average “small company” in the U.S. took a 20% revenue hit.1

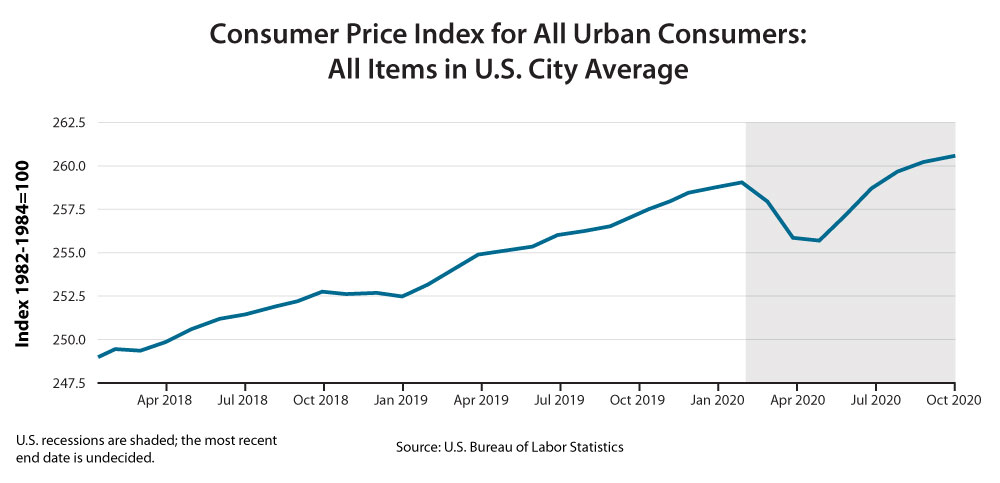

As consumer spending comprises roughly 70% of GDP, consumer spending is still the bellwether for U.S. economic activity. Experts have their eye on prices, as any protracted level of inflation would hurt the people who can afford it the least:

During the pandemic, the federal government flooded the system with so much cash that corporations couldn’t borrow it all, prompting Treasury Secretary Steve Mnuchin to ask Congress to reappropriate $455 billion in COVID relief. While the backstop of the U.S. government is comforting, it is also unsustainable. Biden takes over when public debt is 106% of GDP, the highest in history.2

Will Biden reverse U.S. protectionist trade policy? Biden’s rhetoric suggests a hard line in protecting U.S. interests with China. Yet, whether tariffs will remain the long-term trade policy of the United States is unclear. Ironically, a weaker dollar would boost U.S. manufacturing exports. Under Trump, the U.S. dollar has on average been 18% stronger than under Obama.3

Construction and housing

U.S. home sales reached a 14-year high in October amid low interest rates and fundamental shifts in housing preferences. This degree of housing growth is somewhat unprecedented in a period of high unemployment and soaring prices. With interest rates at their lowest since the government started measuring in 1971, buyers are splurging on single-family homes with more space. The S&P Homebuilders Select Industry Index is up 24% this year, as big builders such as Lennar and D.R. Horton can’t keep up with demand for new housing. In October, existing home sales were up 27% from the prior year. Prices are also higher, up 16% from the prior year, with the average home price at $313,000 (the highest on record).4

Evictions will spike after the first of the year when such protections expire. According to data from the U.S. Census Bureau, 15 million Americans are not confident they can make their next rental payment.5 Even couples making $200k can’t be evicted according to some rules.

The National Association of Architects projects 2021 nonresidential building to decline 5% in 2021 after an 8% contraction in 2020. Subsectors such as hotel (20%) and amusement parks (13%) took the biggest hit, with public safety up 16%. Expect Biden to shepherd a job-building infrastructure bill early in his presidency. Such legislation could also fund over $1 trillion in improvements.

Retail and ecommerce

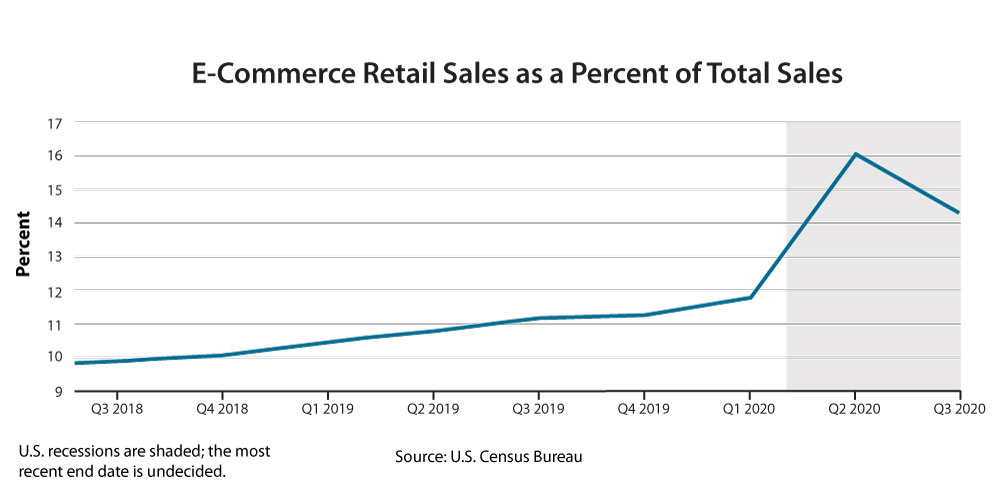

The pace of digital transformation during the pandemic has been staggering. In Amazon’s quarter that ended in September, revenue sored 37% to $96 billion while its profit tripled.6 Yet Amazon is viewed as the e-retailer of choice for goods that are inexpensive and require quick delivery time.

Walmart’s Q3 results are an indicator of shifts in consumer behavior. In-store traffic dropped 14% while ecommerce sales were up 79%. The average in-store ticket was up 24% as customers visited less often and stocked up on staples.

The National Retail Federation expects holiday sales to be up around 4% this year. Retailers have been projecting a strong holiday season as a result of pent up demand and high savings rates. Many families hunkered down this year and skipped their vacations. Yet consumers are curtailing their spending again. JP Morgan Chase & Co’s tracker of 30 million credit card holders showed a decline of 4% in the week ending on November 13.

Home improvement stores have performed well, while apparel retailers are shuttering locations. Home Depot sales were up 24% in Q3 while Kohl’s was down 13%. After an 18-month period where companies had to redesign their supply chains as a result of tariffs, they had to adjust again as supply and demand were in turmoil.

Prescription drugs seem to be the next big battle ground for ecommerce. Amazon’s entry into the pharmacy business sent shockwaves as valuations for CVS and Walgreens plummeted. Today, national chains and big insurance companies control distribution. In March, online pharmacy sales spiked 21% but only represented 6% of the market.

Healthcare

The gravitational pull of COVID-19 has been the impetus to permanent changes in the U.S. healthcare system. In particular, the healthcare sector adopted technology changes that have altered service delivery.

For example, the rapid adoption of telehealth is bringing much needed care to rural communities. In April, 43% of Medicare visits were through telemedicine.7 Telehealth is expected to be a $185 billion business by 2025.

Robotics are becoming part of the healthcare ecosystem, including automated healthcare assistants and even companion robots (recently introduced in the UK) to help contain an emerging mental health crisis. Today, sensors automatically track vital signs and software updates electronic medical records. Headed into 2021, robotic process automation (RPA) will be utilized for everything from managing claims to inventory of PPE.

AI and machine learning are rapidly altering the healthcare data universe. AI technologies such as those used by BlueDot are actively predicting the spread of COVID-19 and can be used for numerous other mitigation strategies such as tracking insect and animal movements, calculating healthcare capacity and developing vaccines. Thermal screening devices are being installed in offices to track temperatures, and customer apps are being used for contact tracing.

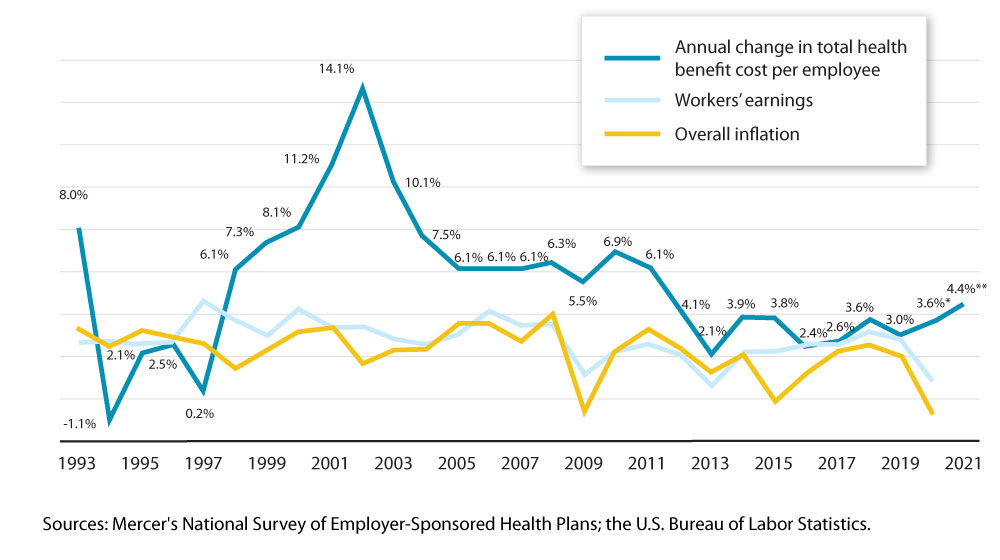

Mercer reports a modest 4.4% average projected increase in health plan costs next year. In a reversal of trends in 2019 and 2020, fewer employers will shift healthcare cost burden to employees.

However, the underlying problems plaguing our healthcare system remain unresolved. Entering 2021, a Supreme Court decision on the constitutionality of the Affordable Care Act’s individual mandate is looming. There is a clear shift in the medical community from reactive care to results-based preventative care.

Automotive

The automotive market is expected to bounce back after a dismal 2020 when new car sales fell by 18%.8 Global automotive sales are expected to rise 15% next year, propelled by EV sales (expected to grow 36%). Consumers are gravitating away from public transportation and back to owning their own vehicles.

Manufacturers are delaying new model releases as a result of sluggish sales. According to Fox Automotive, SUVs and full-sized pickups took share from mid-size and compact cars in September. Nissan’s sales are in steep decline.

Tesla, with its small base, is the only auto manufacturer who grew sales in Q3. Its stock, up over 500% this year, has been the darling of Wall Street (I am smitten with my Tesla, which I don’t get to drive very often.) It will take Volkswagen, BMW, Fiat Chrysler, GM and Ford years to catch up to its autonomous driving technology. There is an expectation that Biden will propel EV technology, perhaps reintroducing EV tax incentives which have expired.

Technology

The pandemic gave rise to new opportunities for the technology sector, during a time of rapid digital transformation. The tech sector is the best performing on Wall Street, up 38% YTD with cloud-based technologies up 42%.9 Large tech stocks are trading with forward PE of over 30.

The recent announcement of Salesforces’ proposed acquisition of Slack is par for the course, as cloud-based providers gobble up applications in an effort to create end-to-end software solutions.

While technology trends have recently focused on cloud infrastructure, 2020 marked a collision of real-world applications and necessity, as companies installed touchless payment systems and retina reading displays. While companies such as Amazon and Microsoft are in a race for supremacy in cloud computing, companies in the shadow industries that support the cloud sector are among the ones growing the fastest and spawning VC investment.

Consumers are gravitating to wearables as real-time health metrics are of heighted importance. Apple even released its new series of smart watches that track blood oxygen levels. Gartner predicts wearable revenue to double in 2021. Don’t even bother trying to find a smart refrigerator.

Blockchain has reemerged during a period where alternative currencies are gaining steam, with its price reaching 18,000. With U.S. carriers rolling out networks, 5G is the great enabler that is unlocking the promise of other technologies.

While the technology sector has never been stronger, it faces new regulatory pressure from both the left and right. Some believe recent Congressional testimony by Facebook’s Mark Zuckerberg and Twitter’s Jack Dorsey only exposed the inherent advantages that large technology companies will create, having to navigate a more complex regulatory environment, and investing billions in AI and machine learning.

Financial services and banking

Perhaps more than any sector, banks had to absorb the shock of a black swan event in 2020 with zero interest rates, and the need to rethink brick and mortar as they consolidate branches and add drive-throughs.

Consumers are migrating away from the big bank model toward Fintech personalized solutions touting convenience and mobility. 66% of banking executives cite new AI, machine learning, blockchain and IoT technologies having a big impact on their businesses though 2025.10 A Harris poll revealed that 60% of consumers used mobile banking apps to manage their money during the pandemic.

At a time where consumers are saving and deposits are swelling, banks have limited opportunities to make money. The Fed has announced their intent to keep interest rates near zero, albeit in an environment where 10 year treasuries have inched higher. The number of mortgages 90 days in arrears has increased 5x during the pandemic, fueling fears of another mortgage bubble.

Global markets

Global GDP is expected to fall 5% in 2020. Europe has been the region with the largest contraction (8.8%). Europe is facing another slowdown in the wake of new lockdowns and a dramatic drop in the service sector, which represents three quarters of GNP.11 The eurozone purchasing managers index fell 10% in November, marketing lower manufacturing activity there.

Eurozone countries already crippled by various austerity measures are unable to generate monetary and fiscal stimulus on par with the United States. Further, countries such as Italy must pay bond yields in excess of 3% to raise money for stimulus.

East Asian countries with large industrial sectors, such as China and South Korea, have fared better during the pandemic. However, there was already pressure from western countries to move production to other regions. Apple recently announced plans to move much of its iPhone production from China to Vietnam, where industrial production is projected to grow 6% next year.12 China’s economy is expected to grow a somewhat modest 5% in 2021, with industrial production projected to grow 6%.

Countries such as Brazil and Japan had slumped during the pandemic, and deflation is of concern there. Japan’s national debt is the highest in the world (250% of GDP).

Central and South America are struggling amid political uncertainty. Q1 industrial production is expected to decline in Cuba (20%), Venezuela (50%), Argentina (2%), and Colombia (3%). Venezuela inflation is still hovering around 2,000% percent.

The Middle East faces the dual impact of COVID and a slumming oil sector, with the region declining around 5% in 2020. Wealthy Gulf states have been willing to provide stimulus but are taking on heavy debt loads. Those same states will seek to stabilize their economies by releasing oil revenues into their economies.13

References

1The Pandemic’s Alternate Realities – Bloomberg Businessweek, September 28

2The Pragmatist – The Economist, October 3rd

3The Not-So-Mighty Dollar by Cristina Lindblad – Bloomberg Businessweek, November 2

4U.S. Home Sales Rose to 14-Year High in October by Nicole Friedman – WSJ, November 19

5The Kiplinger Letter Vol 97 # 47

6Walmart’s Sales Gains Slow as Pandemic Drags On by Sarah Nassauer – WSJ, November 17

7Technology Trends in Healthcare in 2021 – ModDev

8The global automotive sector to see double digit growth in 2021 – The Economist, October 2020

9CSI Market

10Digital Banking and Financial Services Trends for 2021 and Beyond – The CMO Survey, Content Stack

11U.S. Economic Activity Picks Up on Postelection Lift By Paul Hannon, November 23

12Trading Economics

13Global Economic Outlook – The Conference Board, November 2021

Also by this author

Category : Economic / Future Trends