Small business confidence reverses as recession nears [WSJ/Vistage March 2023]

In snowboarding, riders need to have “Jedi Legs” when they move through unforeseen terrain. This means keeping their knees bent and flexible to absorb the hidden bumps and turns.

It’s a technique small businesses have also adopted to deal with recent economic “bumps and turns” — and one they’ll have to get used to as we forecast a recession coming later this year.

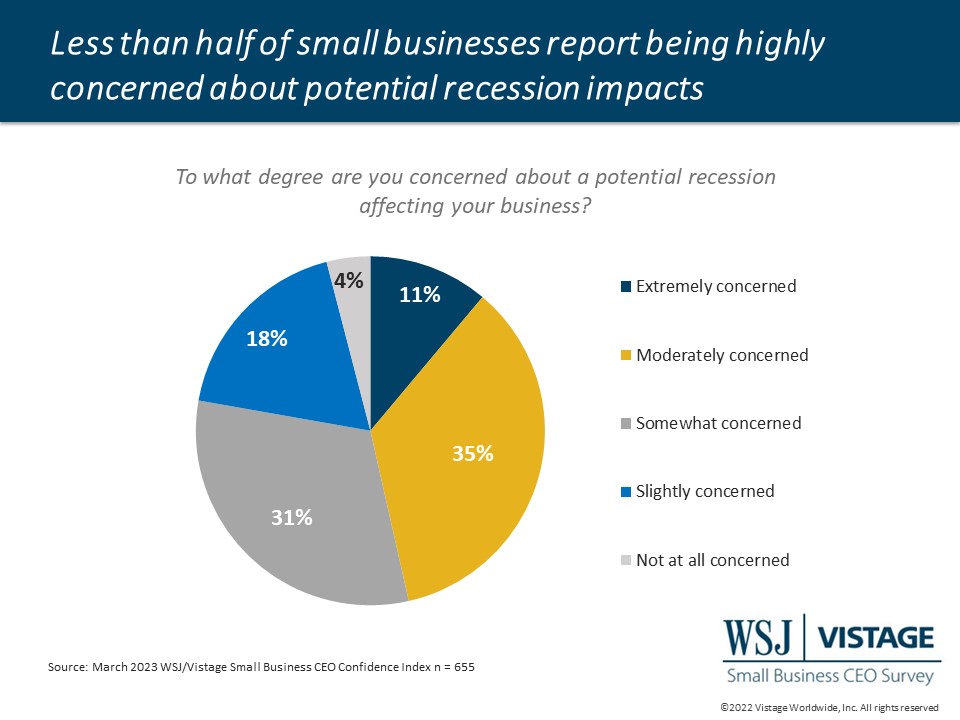

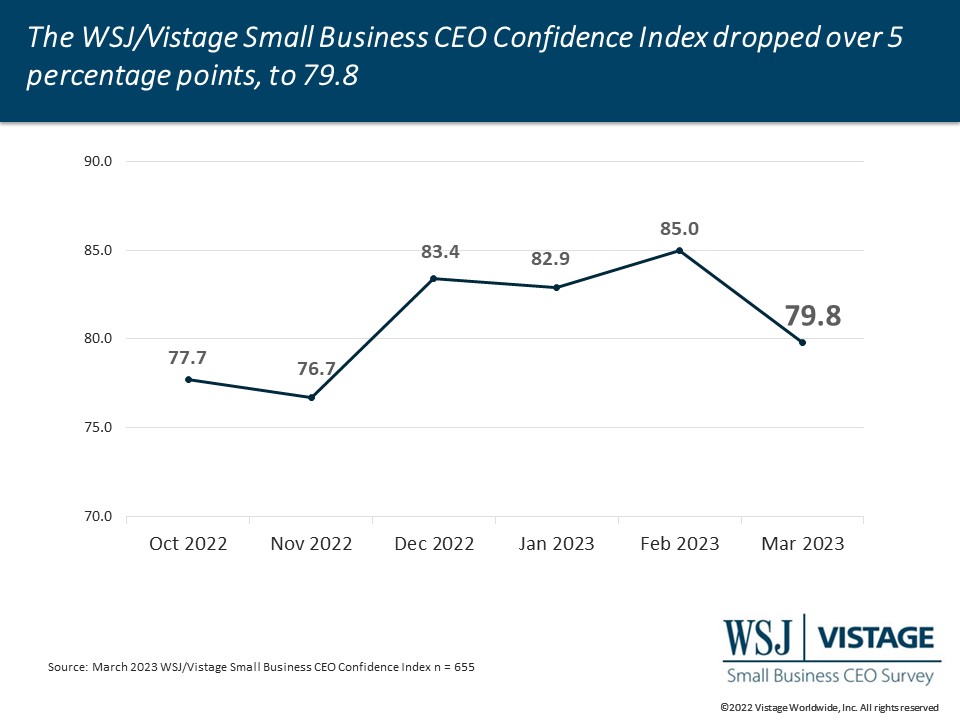

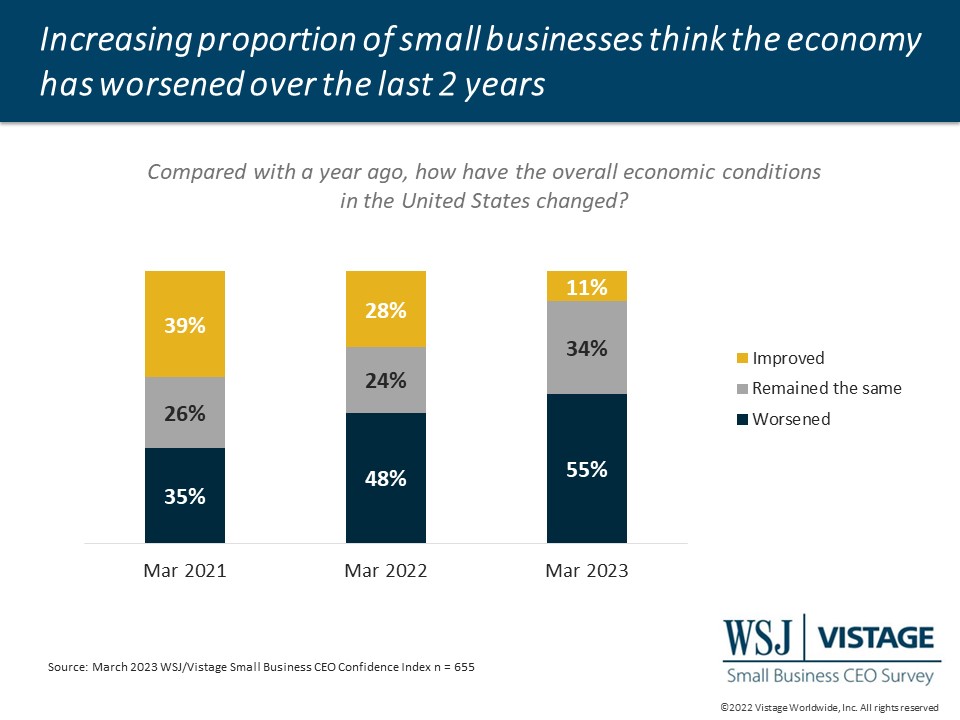

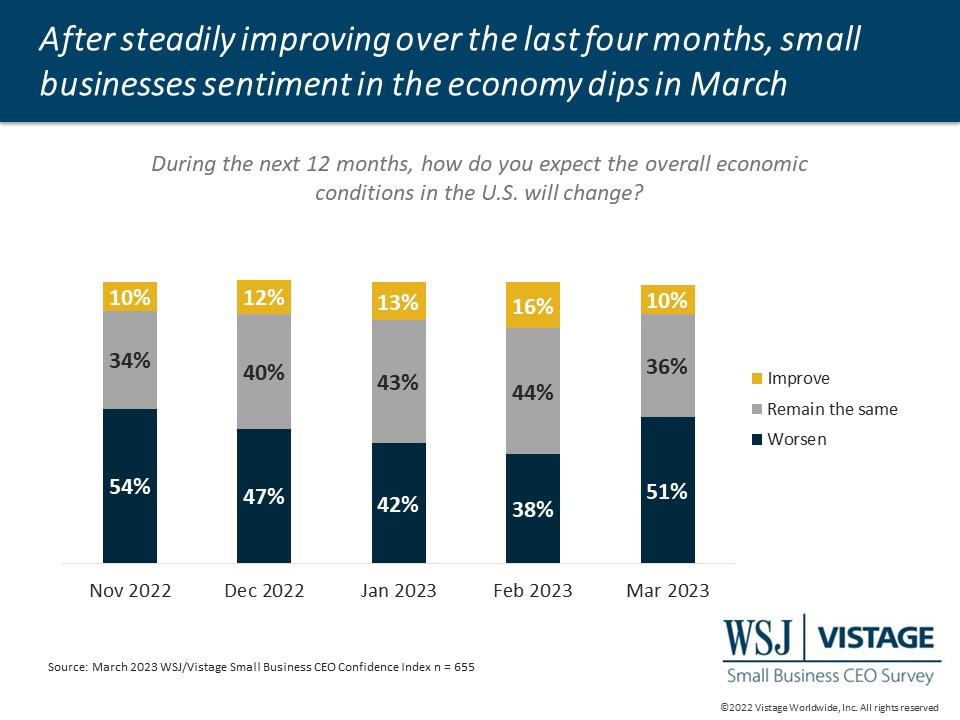

Recently, ITR Economics Senior Forecaster Connor Lokar confirmed they are projecting a recession in late 2023 and into 2024. And small businesses are echoing that sentiment, reporting they are moderately or extremely concerned about a recession. This concern reversed recent gains as the March WSJ/Small Business CEO Confidence Index fell to 79.8, below both last month’s and last year’s marks.

But often, the factors within the Index are at odds with each other, much like the indicators measured in today’s economy.

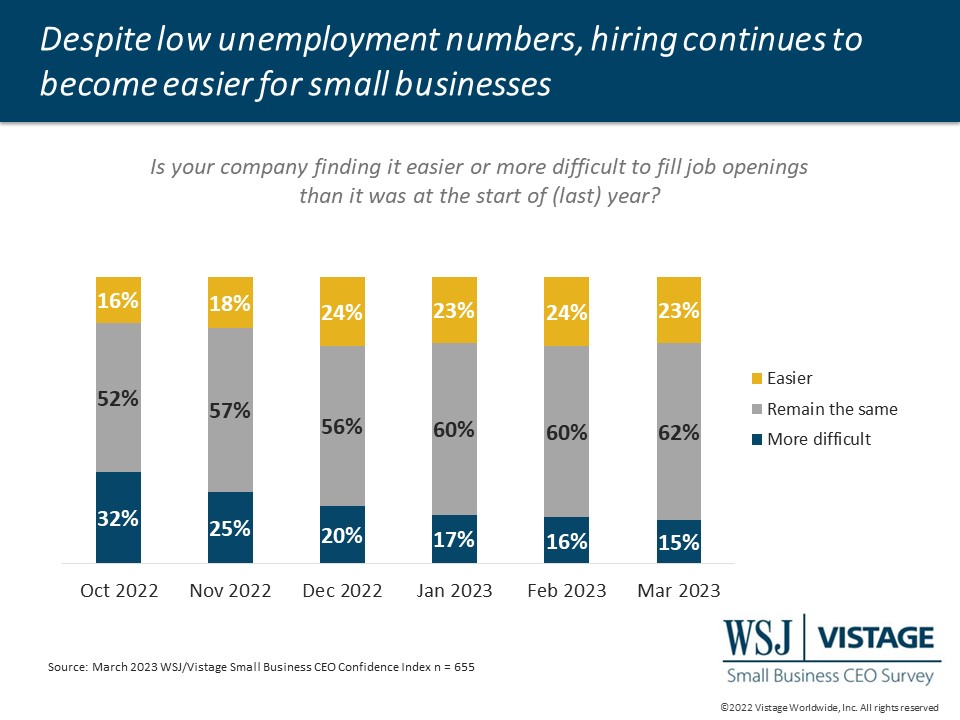

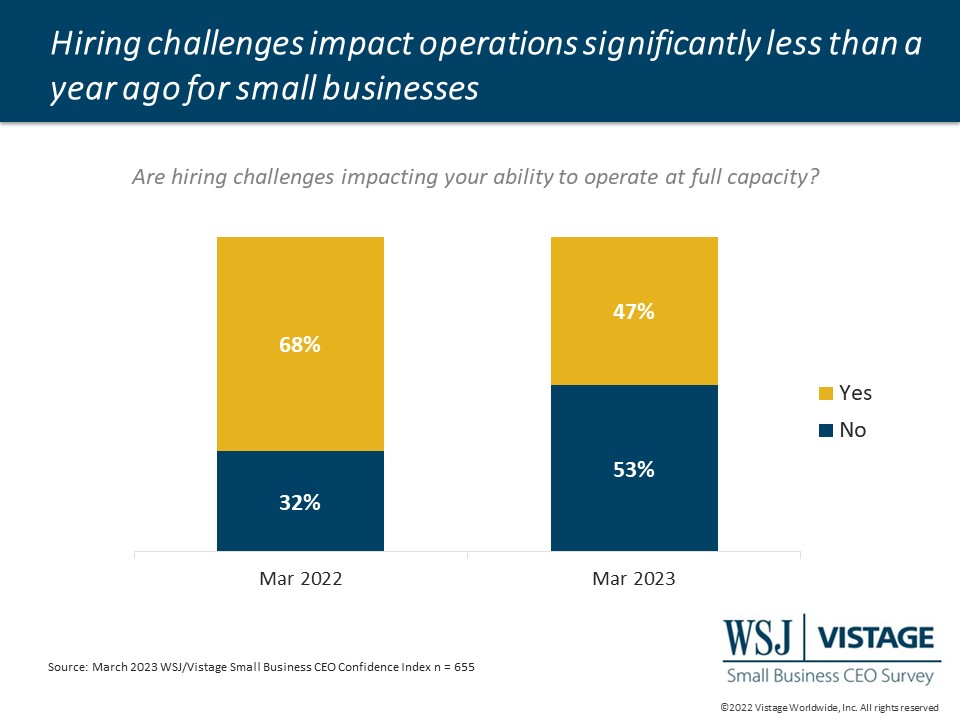

Employment remains a bright spot in the economy, much to the chagrin of the Federal Reserve whose efforts to slow demand should theoretically be driving unemployment up. But unemployment remains at 3.6% and jobs are still being added at a healthy rate.

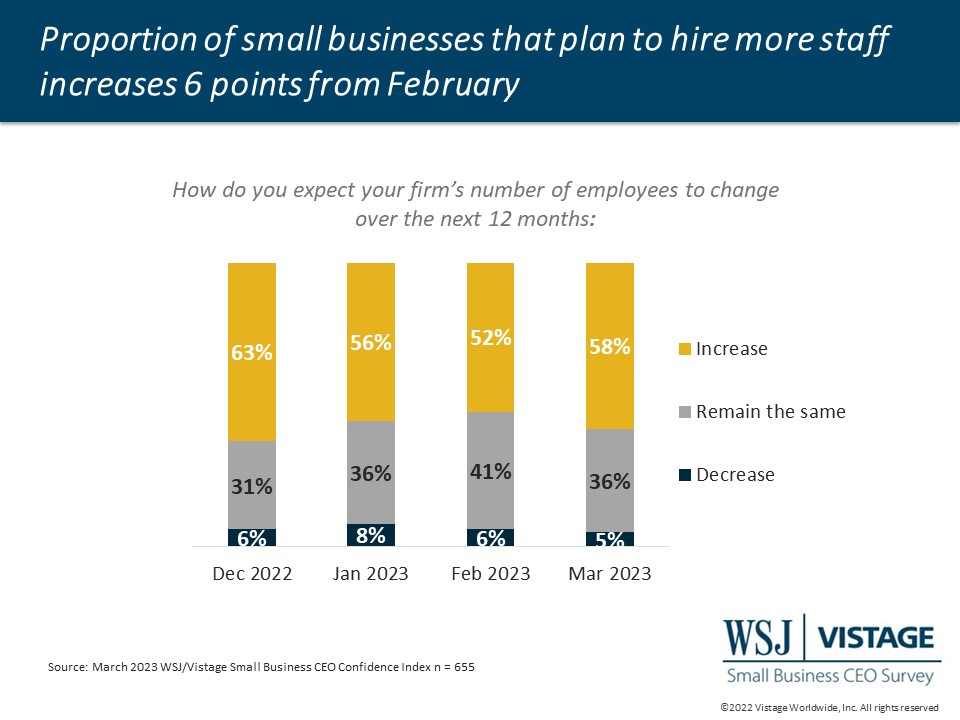

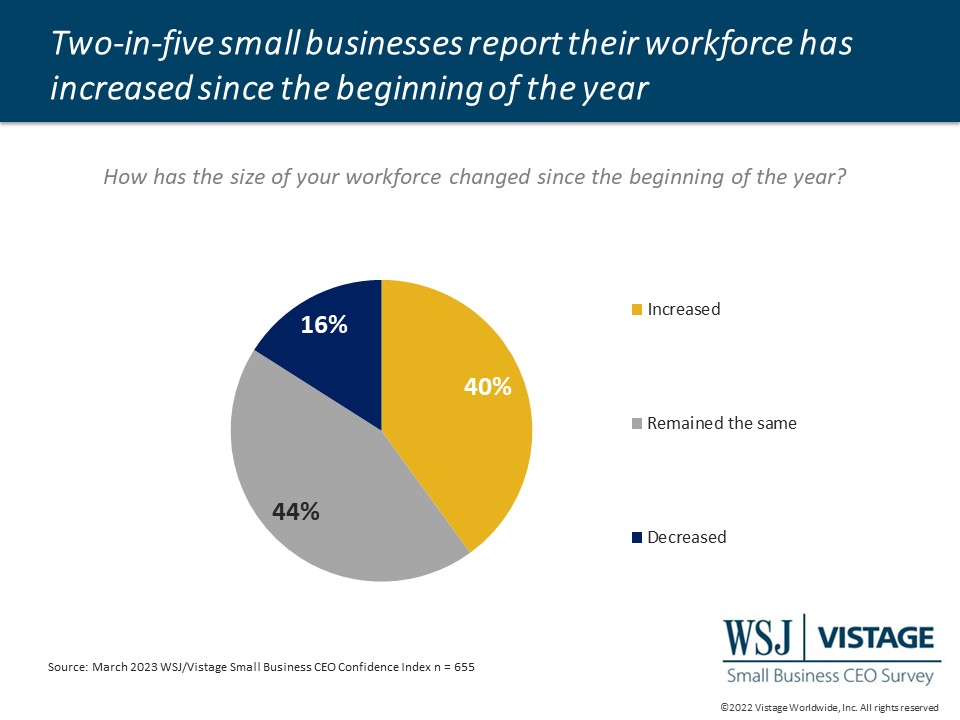

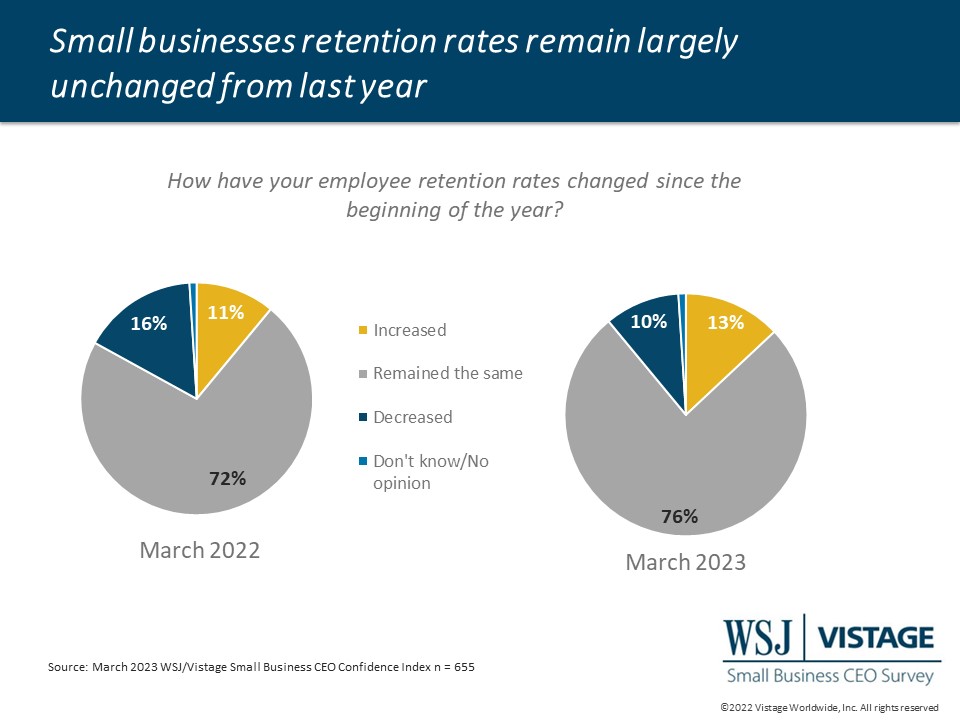

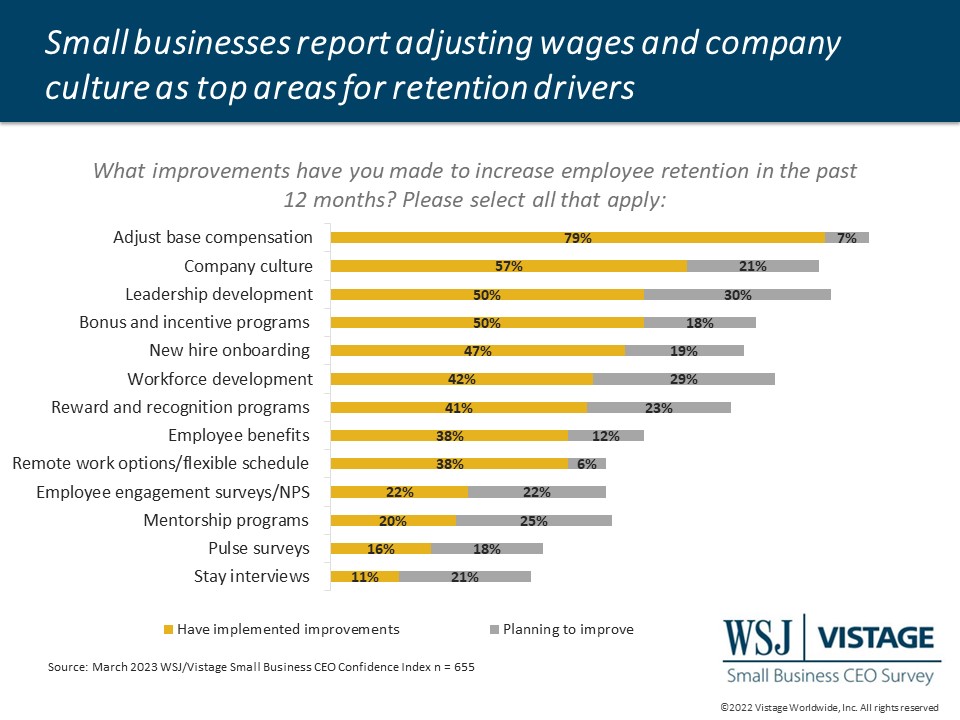

Small businesses have a lot of influence on the strength of the job market. Our data shows that 58% of the small businesses surveyed in March report plans to expand their workforce in the next 12 months. That’s on top of the 40% that have increased the size of their workforce since the beginning of the year. Hiring continues to get easier, and while small businesses might delay filling roles, the proportion who plan to reduce their workforce remains unchanged. Certainly, big company layoffs have presented opportunities for small businesses to fill critical positions.

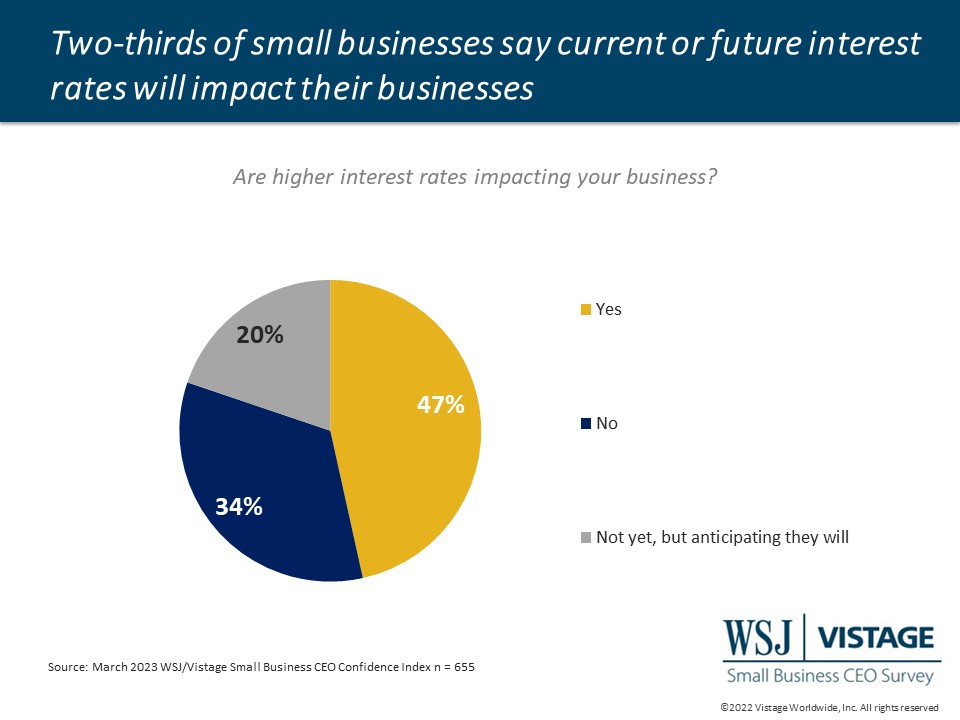

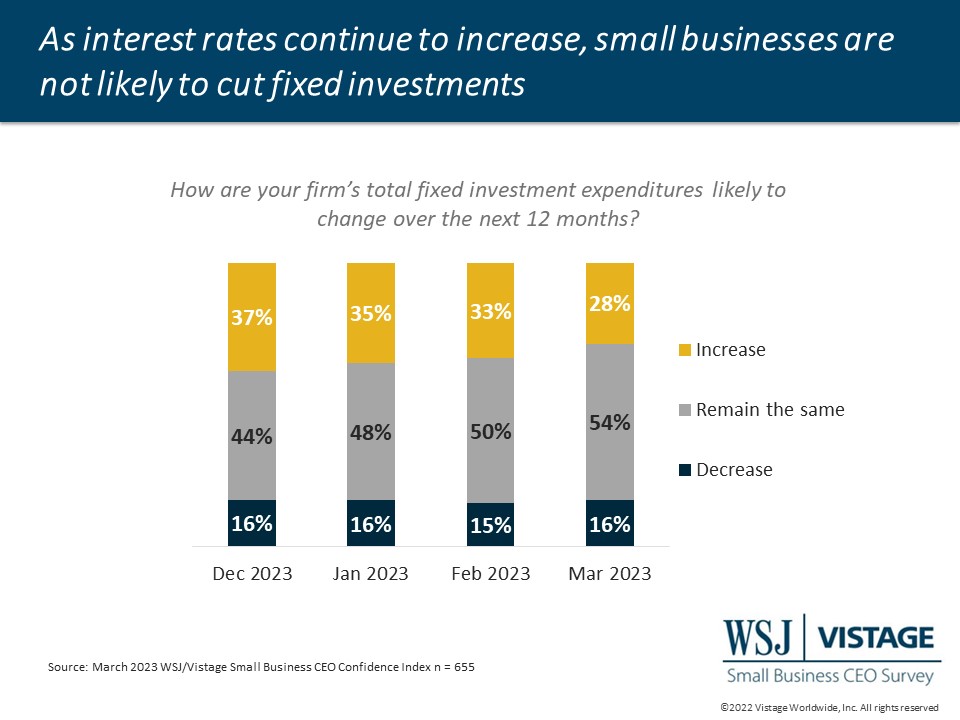

On the other end of the spectrum, small businesses are tightening their belt in terms of spending. Plans for increasing fixed investments over the next 12 months have fallen to a near-record low. This is in part due to rising interest rates; over two-thirds of small businesses report that interest rates have or will impact their business. So while inflation may be slowing, the cost of money is increasing for those with loans.

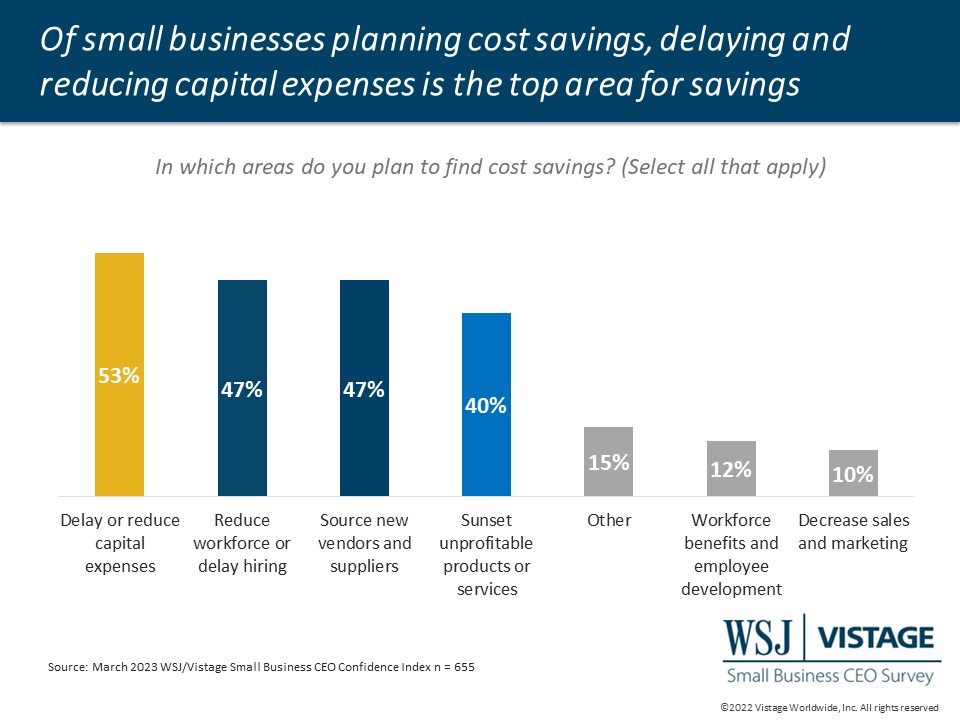

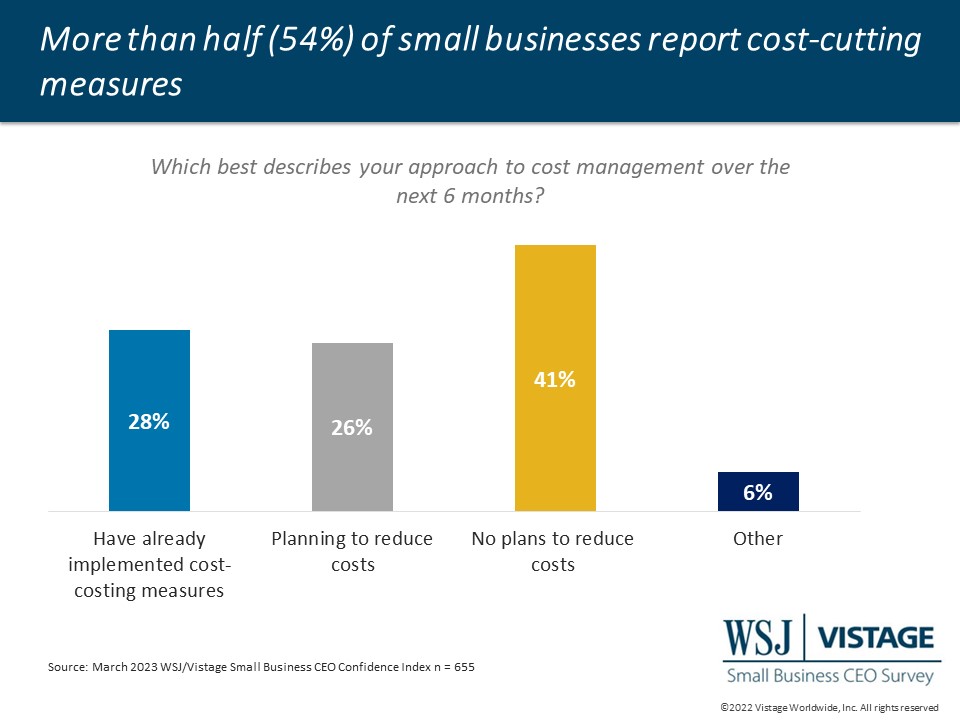

Of the 54% of small businesses reporting cost reductions over the next 6 months, the top areas of focus are delaying hires (47%) and delaying or reducing capital expenses (54%). Other small businesses turn to their P&L and look at profitability to determine cuts as evidenced by the 40% who report plans to sunset unprofitable products and services and 47% who are sourcing new (read: cheaper) vendors and suppliers.

Small businesses must be strategic in managing costs and watching the leading indicators that can tell them how quickly growth is slowing. While they can enjoy disinflation and — in some cases — deflation, those savings are quickly eaten up by increased wages and higher interest rates. As the recession more clearly comes into view, small businesses will need to balance the opportunity to maintain and grow their workforce.

March Highlights:

Download the March report for complete data and analysis

For the complete dataset and analysis of the March WSJ/Vistage Small Business CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about the economy worsens.

- Investments plans have been curtailed while workforce expansion plans remain strong.

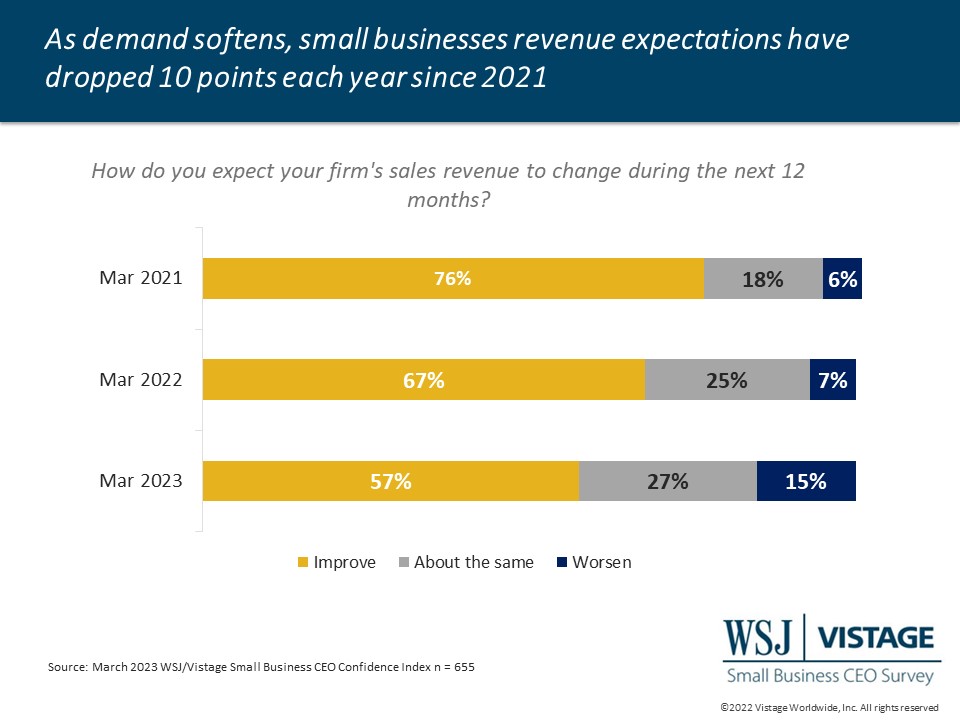

- Revenue expectations grow while profit expectations continue to moderate.

DOWNLOAD THE March 2023 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE March 2023 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The Q1 Vistage CEO Confidence Index survey was conducted March 6-13, 2023, and gathered 1,405 responses from CEOs and leaders of small businesses. The March WSJ/Vistage Small Business report was created from a subset of data from this survey that included 655 respondents reporting revenues between $1 million and $20 million. Our April survey will be in the field April 3-10, 2023.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey