Ecological trends for 2024 and beyond

Editor’s note: This is the first installment of an annual 4-part series on the trends impacting small and midsize businesses. Here, we study ecological trends for 2024.

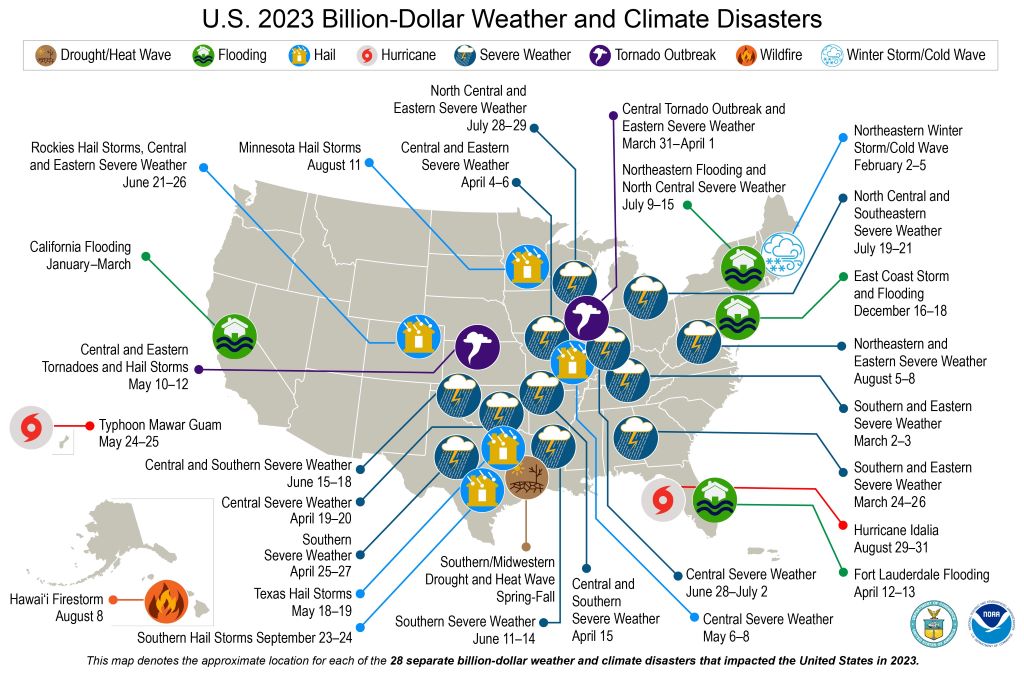

While large-scale weather events are hardly the only measure of climate change, their accelerating frequency and magnitude cannot be ignored. In 1980 there were three $1-billion weather catastrophes in the U.S. Last year there were 18, including Hurricane Ian, which cost $114 billion.i Economists point at the lagging cost of disasters including health care and insurance premiums, which don’t factor into these estimates.

This year, from hurricanes reaching land in Los Angeles to the devastating Maui wildfire and thousands killed in Libya, the financial impact and human toll of climate change are evident.

Everchanging weather conditions are only the tip of the iceberg — literally. When discussing sustainability efforts, we most often focus on emissions and pollution. Yet scientists continue to warn against the ill effects of biodiversity loss (including forests and sea beds), nutrient pollution and water insecurity.

More in this series

Part 2: Technology trends for 2024 and beyond

Part 3: Economic trends for 2024 and beyond

Part 4: Social trends for 2024 and beyond

Business trends for 2024 and beyond [Jan 12. webinar]

U.S. government investment

U.S. government investment in climate technology and clean energy is expected to triple in the next 10 years. Three bills — the Infrastructure Investment and Jobs Act, CHIPS and Science Act, and Inflation Reduction Act — appropriate more than $500 billion to clean energy initiatives over the next decade. Only now are we starting to see the rollout of spending from the bipartisan infrastructure bill passed in November 2021. The bill provides subsidies for clean water, EVs and public transportation. To see how your company may be able to tap into funding and where projects are being executed, view the Maps of Progress.

Yet as we pointed out last year, the U.S. and other industrialized nations are falling further and further behind on the commitments made in the Paris Accord on Climate Change. To view emissions progress by country or sector, see the Climate Action Tracker.

Renewables and the future of energy

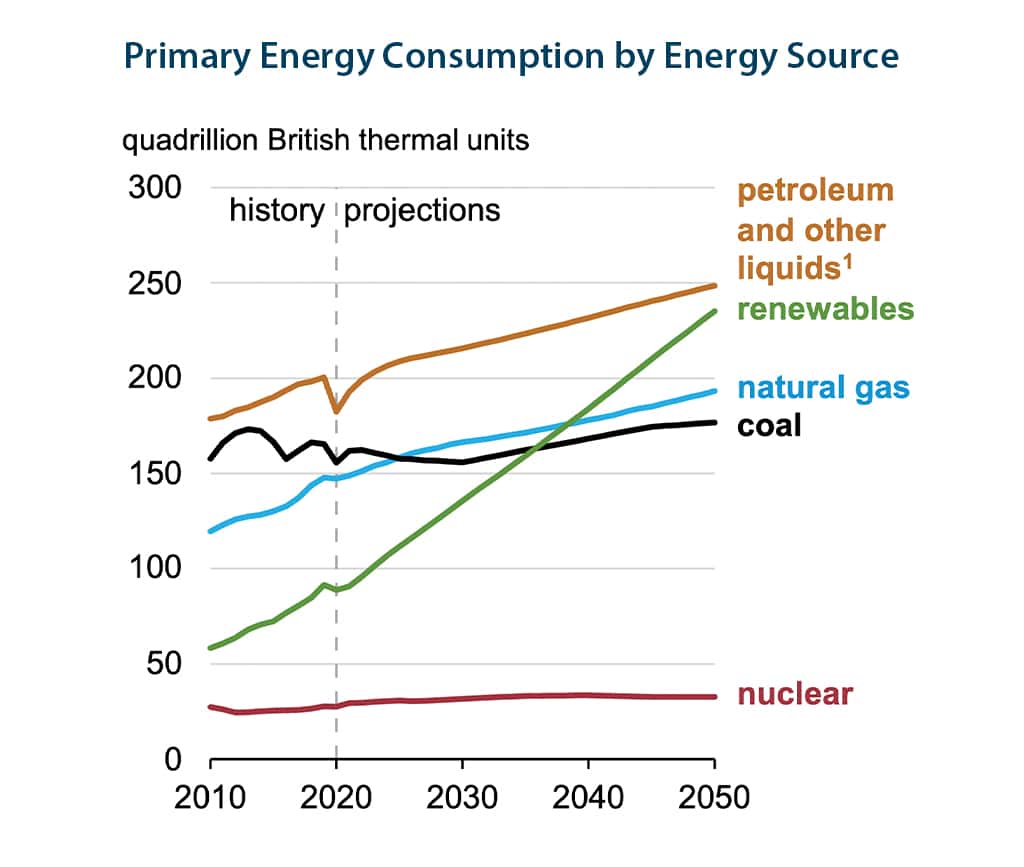

While there are calls to accelerate the adoption of cleaner energy, it won’t be until after 2050 that renewables will outpace petroleum as the primary energy source in the U.S.ii

Source: US Energy Information Administration, Internal Energy

Clean energy sources are evolving, becoming much more accessible and efficient. In 2023, of the $2.8 trillion in global investment, $1.7 trillion will be in solar, hydropower, geothermal and nuclear. Notably, natural gas will continue to drive a growing proportion of U.S. energy production.

Innovation is spanning new technologies such as “green hydrogen” — hydrogen fuel that is synthesized with low-carbon sources like wind and solar. These unique combinations lower costs, and green energy is expected to grow at a 40% clip to $60 billion by 2030.iii

ESG and corporate sustainability goals

Public companies such as BP, Salesforce, Unilever and Microsoft are raising the bar by setting zero emissions goals in adherence with the Net Zero Emissions by 2050 Scenario (NZE Scenario). As we’ve learned, goals set by public companies often filter down into the private companies who serve them. Achieving these standards will require a multipronged approach to energy conservation, utilization of renewables and reduction of emissions.

As ESG (environmental, social and governance) practices are taking form, many companies feel a greater sense of responsibility and a need to satisfy the expectations of their stakeholders, who expect them to deploy, track and report environmental impacts. Some are naming internal ESG champions.

See how to create an ESG roadmap.

Growth of electric vehicles

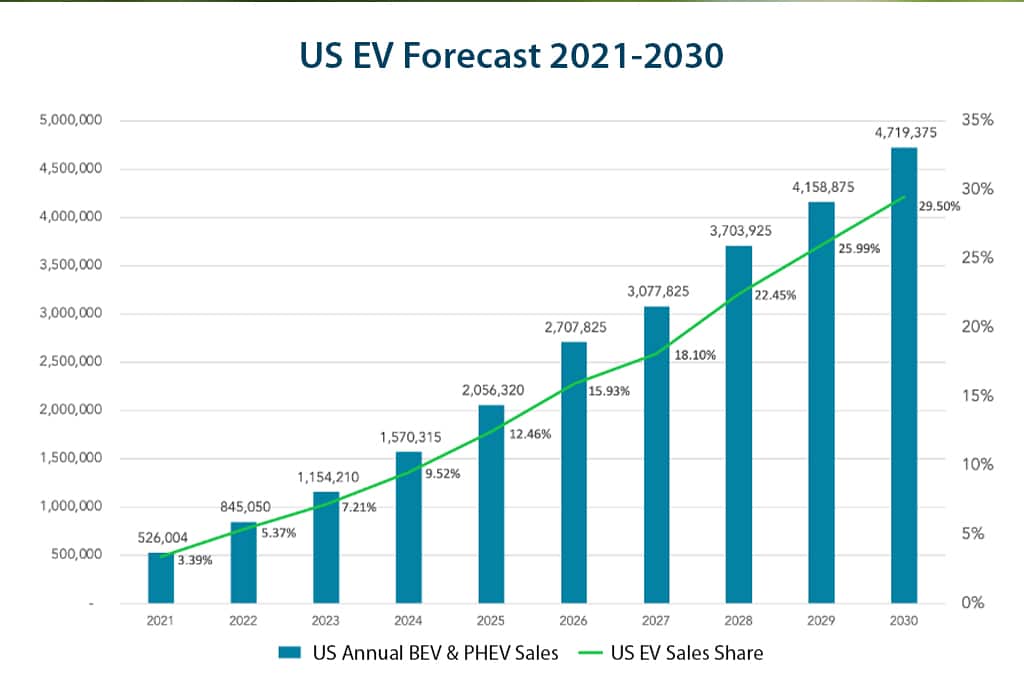

Western governments have banned the sale of gas-consumption engines by 2035, a critical component of the net zero objective, with projections suggesting EVs will need to be about 60% of new car sales by 2030. Adoption of EVs will hinge on battery manufacturing, storage, and access to critical mineral supplies, some of which could result in a bottleneck that could choke the supply chain.iv

Broader EV adoption will also require the installation of chargers in residential and commercial buildings, often subsidized by governments and automakers. While there is deployment of charging infrastructure in many urban areas, charging stations across much of the country remain sparse. The battery storage industry is expected to grow 150% in the next four years. Lithium-ion batteries are the energy source for EVs because of their low heating rate, but they require nickel, manganese and cobalt. Battery technologies are quickly improving in terms of cost, safety, durability and energy density.

A glut of new EVs is hitting the market, with the 2024 entry of a new Honda, and Volkswagen offering a rival product to Tesla’s Model 3.

Source: GoodCarBadCar, InsideEVs, Auto Manufacturers Alliance, Advanced Technology Sales Dashboard

Here are other trends impacting sustainability efforts:

Precision agriculture: Agriculture is undergoing a rapid shift towards robots, autonomous tractors, and vertical farming.v Technologies such as satellites, drones, IoT and AI-powered analytics will drive decisions on irrigation, fertilization and pest management. Such tools can analyze soil conditions, plant health and weather to maximize production. Vertical farming has the potential to accelerate the cultivation of highly nutritious food within communities with limited access.

Carbon capture utilization: There is an investment in CCUs including government grants, VC investment, corporate funding and startups. The International Energy Agency (IEA) estimates that DAC technologies remove 90 million tons of CO2 a year in 2030, and grow 10x by 2050.

Carbon accounting software: the global carbon accounting software market is expected to grow from $15.31 billion in 2023 to $64.39 billion by 2030. Such systems provide accurate tracking and monitoring of emissions and other impacts.

Climate fintech: European startups outpaced North American counterparts last year in climate fintech spending, surpassing $1 Billion.vi Fintech is leveraging technologies such as blockchain and AI to improve transparency, streamline investments and consolidate sustainable finance.

Construction methods: It is estimated that construction contributes 39% to the world’s carbon emissions. The industry is shifting towards using new materials such as bamboo and recyclables.

Greener packaging: As consumer preferences shifted as a result of e-commerce and the pandemic, consumption of wasteful packaging exploded. Packing contributes 30% to total waste and 65% of household waste. There is a shift towards biomaterials and biodegradables.

How you can make a difference

As part of a company’s ESG initiative, consider creating a sustainability checklist.

Critics point to “greenwashing,” the practice by which some companies overstate their sustainability efforts, in an effort to win favor with stakeholders. So if you plan on taking action, it’s important to be genuine — your customers, employees and shareholders are watching.

References

i The Rising Toll of Billion-Dollar Disasters, Bloomberg Businessweek

ii Energy Information Administration – Energy Explained, US Energy Facts

iii Reuters: China plans to raise minimum renewable power purchase to 40% by 2030

iv Global EV Outlook, 2022 IEA

v USDA National Institute of Food and Agriculture

vi FINTECH: Europe dominates in Climate Fintech funding despite overall funding slump in 2022

Category : Economic / Future Trends

Tags: sustainability