Corporate Strategy: Buyer Categorization in Value Quadrant Analysis

Businesses operate on models designed for value creation that are in alignment with their competencies, capabilities and stated value propositions for each class of product and service they offer. While the value proposition helps communicate the marketing and sales message, the business model must deliver the value promised by correlating strategy with market expectations. This article provides guidance on the critical step of classifying customers into value quadrants by first understanding why they buy the product or services offered by a firm. The article further explores the correlation of customer segmentation with profitability analysis by quadrant and provides examples of the output created by Value Quadrant Analysis (VQA) for use in strategic planning.

Businesses operate on models designed for value creation that are in alignment with their competencies, capabilities and stated value propositions for each class of product and service they offer. While the value proposition helps communicate the marketing and sales message, the business model must deliver the value promised by correlating strategy with market expectations. This article provides guidance on the critical step of classifying customers into value quadrants by first understanding why they buy the product or services offered by a firm. The article further explores the correlation of customer segmentation with profitability analysis by quadrant and provides examples of the output created by Value Quadrant Analysis (VQA) for use in strategic planning.

The Rational Behind Value Quadrant Analysis

Strategists can employ value quadrant analysis when considering their firm’s strategic investments, competitive positioning and the effectiveness of their business model(s). Method Frameworks focuses on four primary quadrants to classify the business model a company is following. Those quadrants are: 1) Customer Synergy/Intimacy, 2) Operational & Organizational Excellence, 3) Customer Enrichment & Fulfillment and 4) Product/Service Superiority & Innovation.

Each value quadrant represents the focus of a company or business unit and can be thought of as one of the primary strategic thrusters guiding operational action. A dominant value quadrant can also be considered the primary business model generally being followed. Weaker performing quadrants, in some cases, may be a drain on overall business performance by diluting focus on less profitable customers.

A Value Quadrant Analysis (VQA) is an excellent method to truly understand key buyer segments by profitability. Such an understanding allows a business to make informed decisions related to remaining in one or more quadrants or exiting unprofitable segments. In short, VQA drives value proposition messaging, strategy development and ultimately should determine strategic investment decisions.

Evaluating The Business Model and “True” Value

In order to assess customer relationships and categorize them into quadrants for VQA, a business must first examine itself and honestly consider its own organizational model.

Factors to consider in this self-examination include:

– Organizational Behavior

– Direction / Goal

– Support

– Evaluation & Control

– Operational Process

Assessing the attribution of these core areas can help the business objectively understand its own value to its marketplace. Only then can customer relationships be fully understood and the accurate categorization of buyers to quadrants move forward.

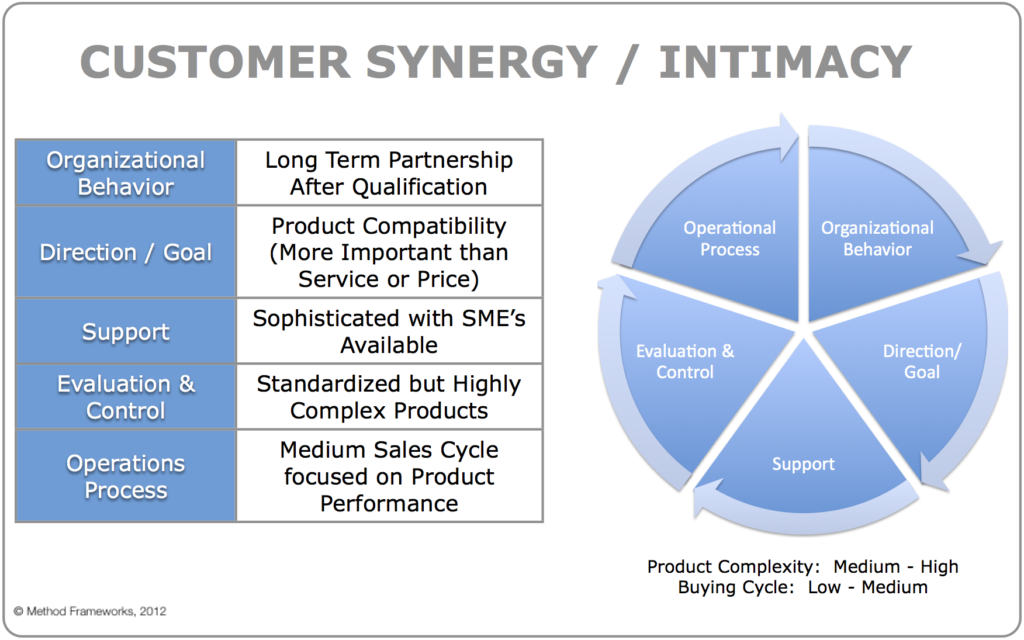

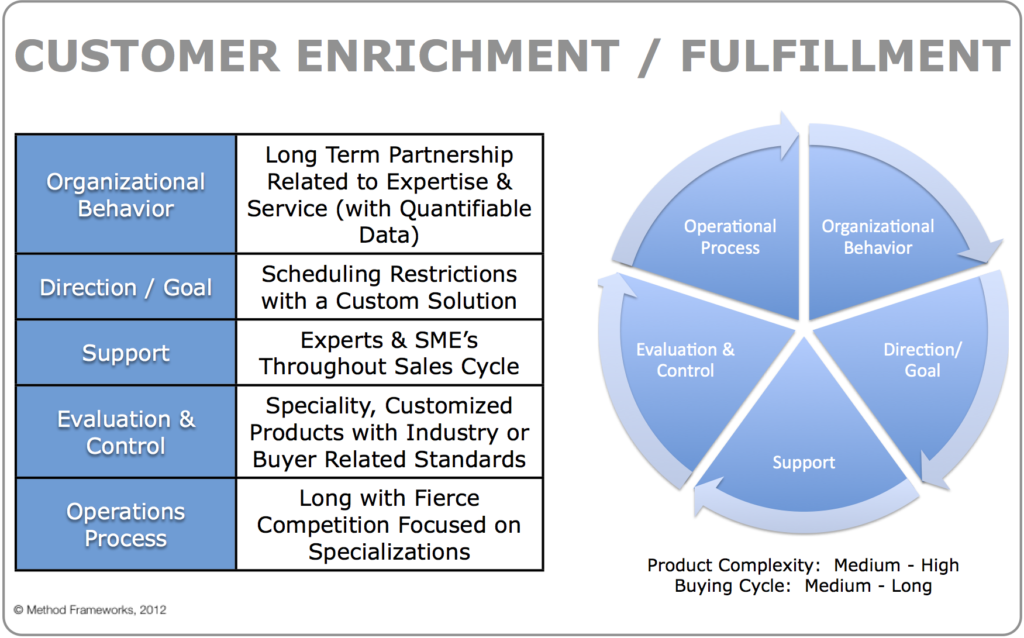

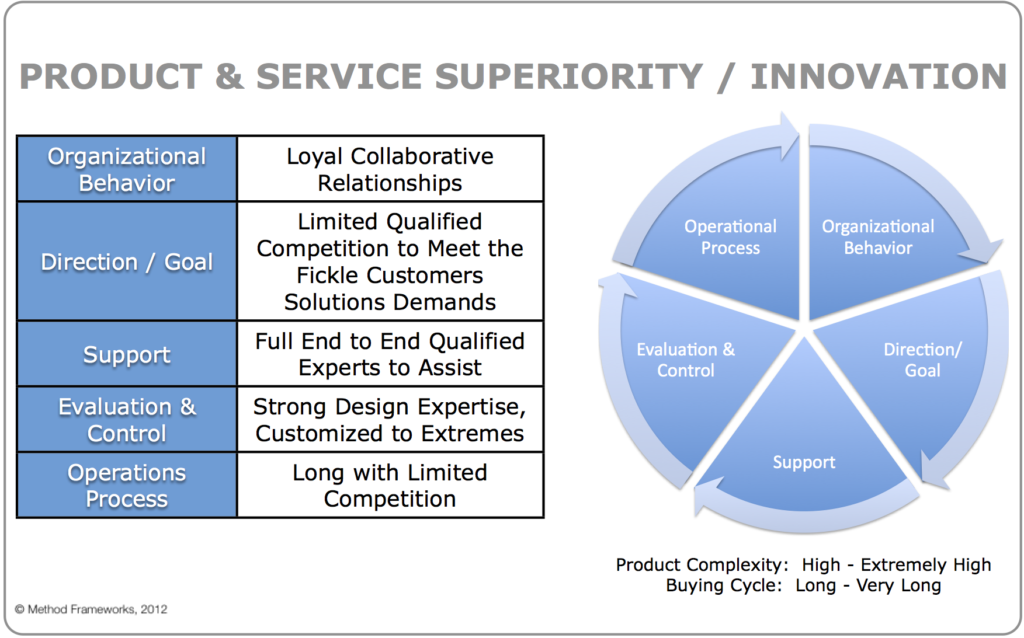

To demonstrate, lets look at each quadrant through the lens of the five core areas shown in the graphic below.

Customer Intimacy & Synergy

Companies operating in the Customer Intimacy & Synergy Quadrant focus on the customization and tailoring of products / services. Their missions are geared toward know their customers well, delivering what specific customers want and “personalizing” the experience.

Customers of businesses in this quadrant have the expectation of a close relationship that is solution-based for their needs. In return, they are willing to accept a higher cost for the goods or services they are purchasing.

Examples:

– USAA

– Nordstrom

– Hilton Homewood

– Johnson Controls

Operational & Organizational Excellence

Companies operating in the Operational & Organizational Excellence Quadrant focus operational efficiencies, supply-chain optimization, maintaining low overhead and accomplishing more with lean structures. Their missions are focused on creating predictability in delivering quality, low price, no-hassle purchase experiences and ease of use.

Customers of businesses in this quadrant have the expectation of low cost and best pricing. In return, they are willing to accept less in the areas of service and relationship intimacy.

Examples:

– McDonald’s

– Toyota

– AT&T

– FedEx

Customer Enrichment & Fulfillment

Companies operating in the Customer Enrichment & Fulfillment Quadrant focus on helping their customers reaching and fulfilling their potential. Their mission themes relate to creating better lives for their customers and the opportunity for self-actualization.

Customers of businesses in this quadrant have the expectation of enjoying an experience and learning through exploration and discovery. In return, they are willing to accept a higher cost for the goods or services they are purchasing.

Examples:

– Whole Foods

– Personal Trainer

– Ikea

– Container Store

Product / Service Superiority & Innovation

Companies operating in the Product / Service Superiority & Innovation Quadrant focus on creating superior or unique “One-of-a-Kind” value-add services or products. Their missions are geared towards innovation and creating the best products and services available in their class.

Customers of businesses in this quadrant have the expectation of receiving high quality and benefiting from innovation in the products or services being purchased. In return, they are willing to accept a higher cost for the goods or services they are purchasing.

Examples:

– Intel

– Nike

– Sony

– HP

– Glaxo

The Output From VQA

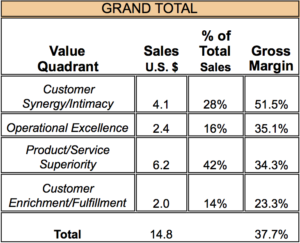

To illustrate the output from a VQA, consider the case of a fictitious small business in the industrial products manufacturing space, Bob’s Chemicals. The fifteen year-old company began seeing erosion of their bottom line two years ago, despite an average of 5% revenue growth over the previous five year period. With total annual revenues of $19.5M, Bob’s Chemicals  offers products in three areas:

offers products in three areas:

- equipment and supplies

- industrial solvents & cleaners

- lubricants and cleaners

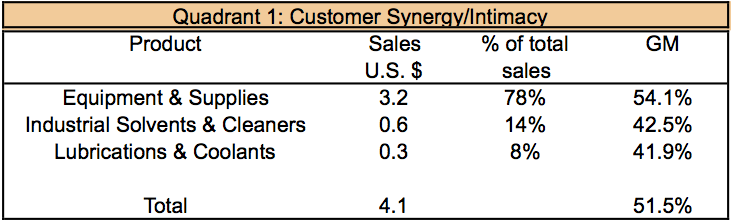

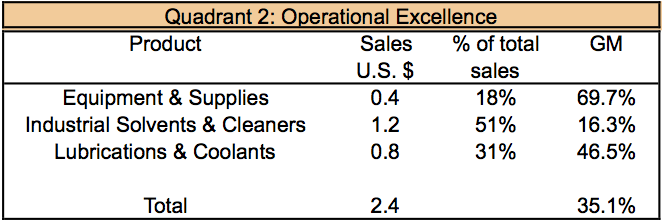

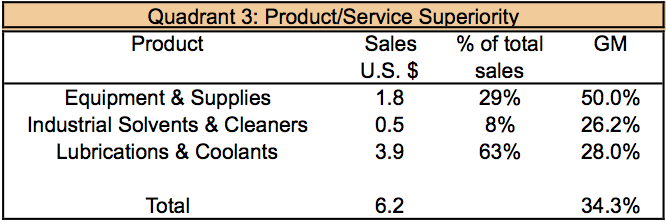

The company focused the VQA on the customers producing the top 75% of revenues and categorized those customers into the appropriate value quadrants based on overall relationship history. The largest grouping in terms of revenue turned out to be in the Product/Service Superiority quadrant, which accounted for $6.2M is revenue and 42% of total sales. Unfortunately that quadrant also was producing the second least profit for the business across the value quadrant segments, coming in with a gross margin of 34.3%. They were surprised to find that the Customer Synergy/Intimacy quadrant enjoyed the healthiest gross margin at 51.5%.

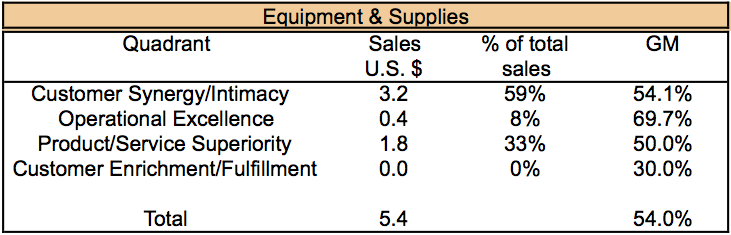

Further VQA showed that across quadrants the Equipment & Supplies line performed much better than the Solvents & Cleaners or Lubrications & Coolants lines, accounting for $5.4M sales and 54% gross margin.

The gross margin for this line was far superior across all value quadrants (see detailed quadrant numbers by product line below).

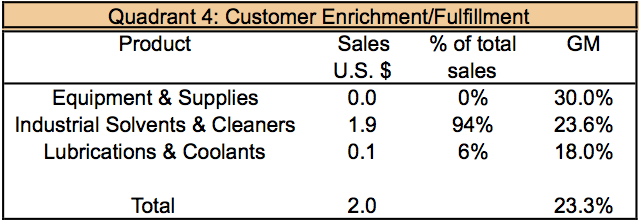

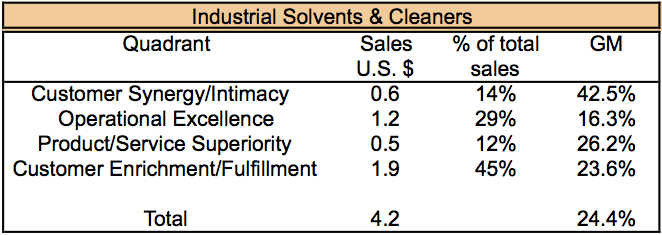

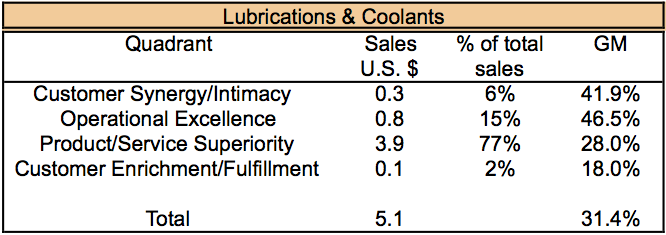

The analysis for Industrial Solvents & Cleaners as well as Lubricants & Coolants demonstrated that the company was struggling to make reasonable margins in the Product/Service Superiority and Customer Enrichment/Fulfillment quadrants. However, Operational Excellence faired better in the Lubricants & Coolants quadrant with a 46.5% gross margin (see data tables below).

Drawing Conclusions From VQA

The VQA performed for Bob’s Chemicals clearly shows a profit heat spot in the Customer Synergy/Intimacy quadrant and indicates that revenues from that segment of customers can produce the highest potential profit contribution to the business if it can be expanded. While some quadrants are lower producing in profits, they are still contributing substantial percentages of overall revenues and exiting such a quadrant is not indicated by the data. However, the VQA does present opportunity areas to capitalize of large revenue streams from customers in the lower margin quadrants if Customer Synergy/Intimacy strategies can be applied there.

With the insight provided by VQA, customer segmentation can then be applied to strategically approach each quadrant with segment sub-strategies. Segment strategy can be applied to invest resources in securing and growing key customer relationships through integration of the company’s operations with those of the key customer’s in a tailored and effective approach. When this approach is followed, the investments can result in lowering key customer’s cost while increasing the profits of the supplier business.

For instance, customer integration within a value quadrant can be a catalyst to eventually transition those buyers into the Synergy/Intimacy quadrant. This could be accomplished by technological integration aimed at tuning customer inventories, smoothing order patterns and even deploying substitute products in carefully-selected situations. The key is to partner with key customers and shift the focus of supply chain efficiency initiatives from optimization solely within the organization’s supply-chain ecosystem to an optimization of the joint vendor-customer supply chain domain. This shift creates enormous new efficiencies for both organizations and helps increase the cost of switching vendors for the customer in the future.

Related Articles

– Business Inflection Points: Knowing When and How To Adjust Strategies

– Does Your Culture Match Your Business Model?

– Concocting The Right Business Strategy: Organizational Value Quadrants

Resources for Taking Action

Free Strategic Planning Article Compilations and PDFs:

1 Free access to the Strategic Planning Monthly: Archive

2 Free Online Strategic Planning Articles Library

3 Free Strategic Planning PDF Downloads

Category : Mergers & Acquisitions

Great article