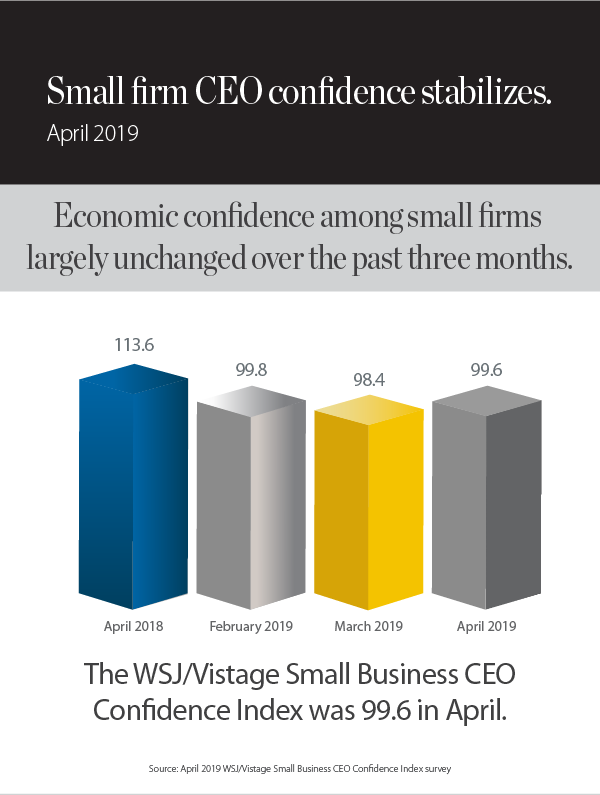

Confidence in the economy has stabilized, according to the April WSJ/Vistage Small Business CEO survey

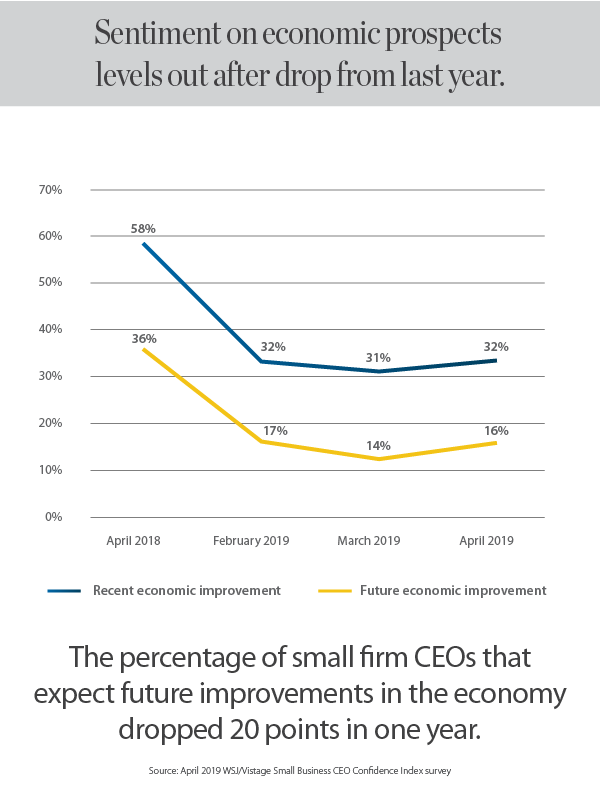

Economic confidence among small-firm CEOs has stabilized over the past three months, according to a survey conducted by Vistage and the Wall Street Journal in April. This suggests that the year-long decline in economic confidence has finally come to a halt. The WSJ/Vistage Small Business CEO Confidence Index for April was 99.8, a slight improvement from 98.4 last month and more significant drop from 113.6 last April.

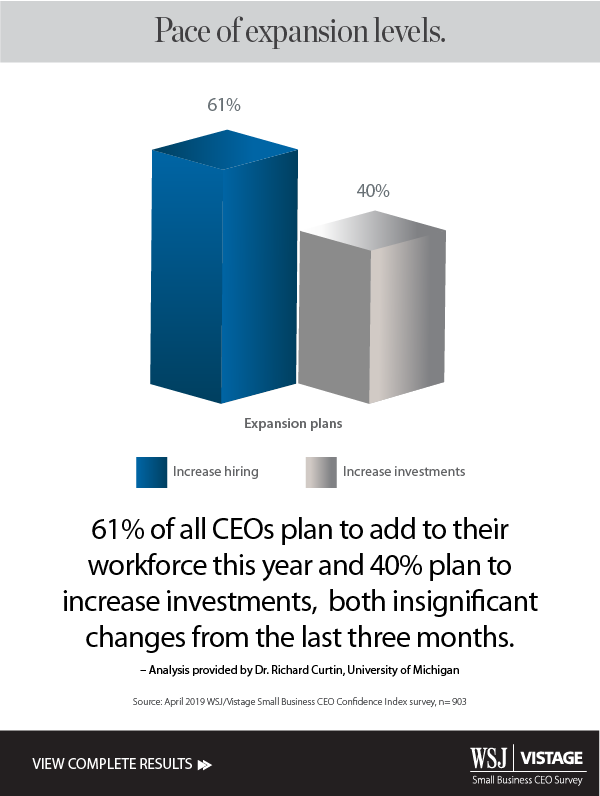

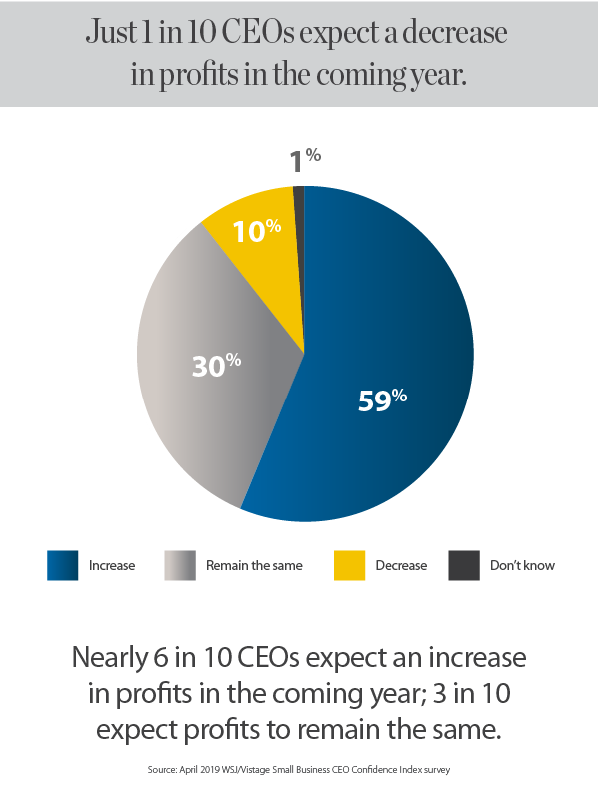

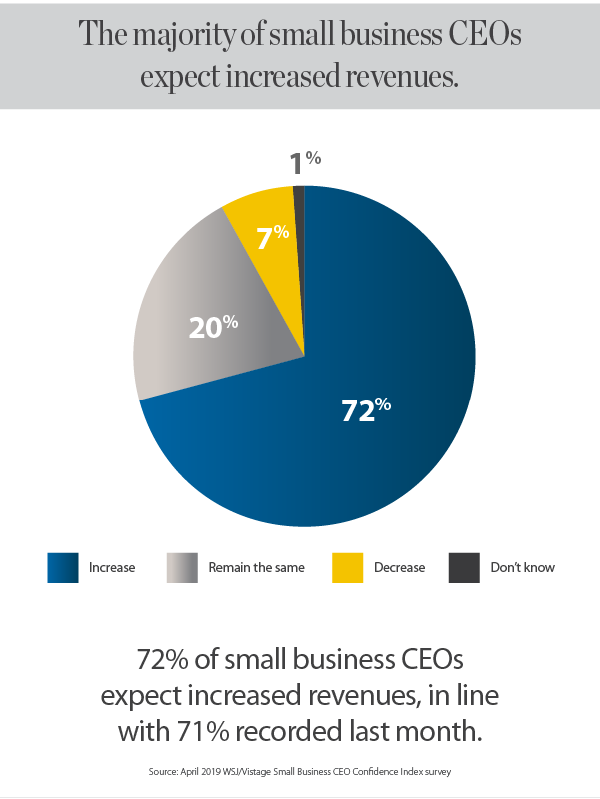

The stabilization was recorded in all factors that comprise the Index: economic sentiment, hiring and investment plans, anticipated revenue and anticipated profit growth. The survey, conducted April 8-15, captured input from 903 CEOs and other leaders of small businesses across the United States.

The analysis — completed by Dr. Richard Curtin, an economist from the University of Michigan — revealed that small firms hold a slightly less favorable outlook for revenues and profits than last April, and correspondingly expect to slightly decrease planned investments and hiring.

“These shifts are unsurprising, given that the 2018 surge in growth was due to expansive fiscal and tax policies, and firms have now adjusted their forward planning to accommodate more modest growth prospects,” Curtin explains.

“In addition, firms have shared the consensus view — and accompanying apprehensions — that all expansion ultimately ends,” Curtin states. “Given that the current expansion will become the longest-ever recorded in a few months, eclipsing the 10-year, all-time record this summer, the attention of firms has been drawn toward mitigating risks if and when a downturn occurs.”

The key takeaway: The recent stabilization suggests that CEOs anticipate this expansion will persist for another year or more.

Download the April report for more perspectives from small-firm CEOs, including:

- Economic sentiment on recent and future performance of the U.S. economy

- Revenue and profitability expectations

- Expansion plans for hiring and investments

Download the full infographic

About the WSJ/Vistage Small Business CEO Survey

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey