The 10 essentials of scalability

In my travels speaking to Vistage groups, I regularly ask members, “What is your top strategic priority?” Often the answer is scalability.

Imagine that a gourmet chef opens an independent restaurant. His talent enables him to cook every night based on instinct, without the need for recipes or measuring. But opening a second location will require written work standards (recipes) and measuring instruments (cups and spoons) for others to successfully replicate his work.

To succeed at scale requires organizations to promote independent decision-making. Scale requires structure, and process can compensate for hiring people with less talent.

Here are considerations for scaling profitably:

Consider growth rate and life cycle

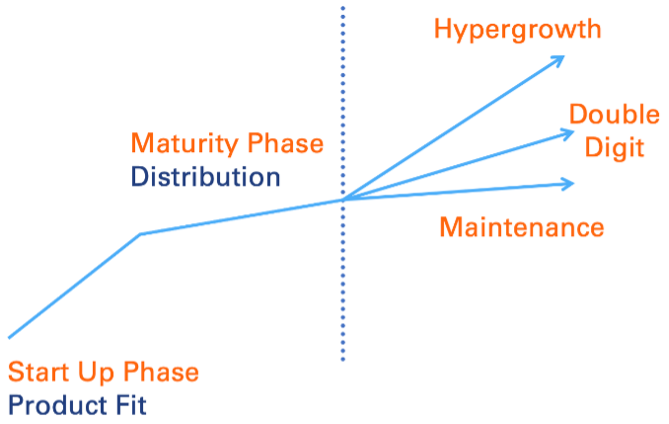

The pace of growth will dictate how you scale. In a business’s startup phase, the focal point is product.i After the product is adopted, focus shifts to gaining distribution. As an organization matures, it must create systems to sustain its growth. But a company growing at 30% has to make very different decisions than one growing at 7%. For example, it may hire people who are “good enough,” whereas a company growing moderately will leverage personal networks and be selective of every hire.

Early-stage companies have a higher cost of capital than mature companies. Mature companies have better access to financing, but interest costs can saddle cash and growth. Companies with a higher return on invested capital have a competitive advantage because they can raise capital more efficiently.

Build out your team

A highly limiting factor can be founders and CEOs who build a business entirely dependent upon them. In our experience working with Vistage members, there is a clear relationship between a company’s ability to grow and hiring qualified C-suite management. A legitimate CFO demands business analytics, secures cheaper financing, and can make the difference in a successful exit. Similar improvements are seen in other functional departments when you up-level senior management.

But perhaps even more important is building a mid-management layer. For example, accessing a new market may require new sales and operational capabilities. To grow aggressively requires building entire systems to establish a strong mid-management tier, such as leadership development programs and sharing information through reporting and analytics.

Of course, then you will need the labor.

Optimize lead to cash

Business owners are often shocked to learn that the faster they grow, the worse their cash position can be. Some industries have terms of upwards of 60-90 days, and clients often don’t pay on time. Having lengthy lead-to-cash cycles is a killer as a company is trying to grow because the need to add resources such as labor outpaces revenue growth. In such an instance, companies need to focus on business model innovation and velocity (turnaround time). Many of today’s leading technology companies, buoyed by subscription models, are getting paid before they even deliver services.

Unit economics

Reid Hoffman of the popular Masters of Scale podcast points out the need to understand unit economics. For a B2C company, that likely means mastering gross profit for products sold. For a service business, that could be knowing the units of measure you operate within. For example, a construction company opening a new branch might have a branch manager, project engineer and crews equipped with superintendents, foremen, and laborers. Understanding direct and indirect labor costs is critical.

Employee productivity

Over time, you should expect employee productivity to improve as tribal knowledge expands and a company leverages its systems. For example, as companies grow, they can hire specialists to measure quality and train at the point of attack. Some of our production clients combine those roles (training and quality) for this purpose. Utilize employee productivity KPIs such as revenue per employee.

Overhead

During the key stages of growth, investment in SG&A (sales, general and administrative expenses) can teeter up and down. Overhead absorption improves as a company grows. However, management often needs to invest in people and technology, and there are periods when SG&A swells. They then realize their return over time as revenue grows, and overhead expenses flatten or decline as a percentage of revenue. This is one reason companies should have a percentage of revenue on every line of the profit and loss statement.

Leverage software and automation

At a time when everyone is attempting to reduce labor, automation projects have been difficult to implement. Companies are reliant on equipment from Eastern Europe (perhaps more susceptible to supply chain shocks) and the need for engineers, which are almost impossible to hire. All our clients with large automation projects are running behind. But software automation efficiencies should be easier to realize. For example, many members have not fully implemented Microsoft Teams. Work threads are a more effective communication tool than email (internal email should be almost entirely eliminated). I spoke to one member who has banned internal email entirely.

Integrate systems

To promote reporting and analytics, companies must have systems that seamlessly integrate data. For mid-market members, this often comes in the form of ERP (enterprise resource planning) systems. Smaller Vistage members do not have the financial or management wherewithal to implement systems of this complexity.

In the past, many relied on grassroots systems built for niche industries by small, independent developers. Since the adoption of the cloud, solutions are much easier to integrate. For example, the Microsoft Suite includes Office, Teams and Power BI — a popular choice given its simple integration. Salesforce ties together CRM, marketing automation, and many other tools including those enabled by artificial intelligence (AI).

SOPs

Standard operating procedures (SOPs) are a quagmire for many businesses. Part of the problem is some business leaders think they need to create an end-to-end manual for every single process. While having an owner and hub for SOPs (such as a software solution) is optimal, it is often better to just chunk down the work and focus on the vital few. At a minimum, have SOPs for the critical and repeatable work processes within your business. An easier mountain to climb is demanding checklists for all repeatable processes.

KPIs

To promote better independent decision-making by mid-management, companies must have a set of key performance indicators (KPIs) that serve to educate and inform their team on the sausage making. Make sure you have predictive indicators in public view (physically or on an intranet). Push key metrics out to decision makers on a regular cadence and review your results in a green/yellow/red format.

As every business is different, you will have to craft your own formula. But a combination of these activities will enable your company to scale.

References

i Masters of Scale with Reid Hoffman

Related Resources

Learn how top-performing executives are scaling new terrain

Category : Business Growth & Strategy

Tags: Business Growth