Why the strategy that got you here won’t get you there

We have an appetite for simplicity. We tend to gravitate toward things that are easy to understand and implement. Cognitively, we are wired to seek out patterns. For this reason, there is also a proclivity for one-size-fits-all solutions. Apply the formula from “Good to Great” or “The Great Game of Business.” It worked for other companies, and it will for us.

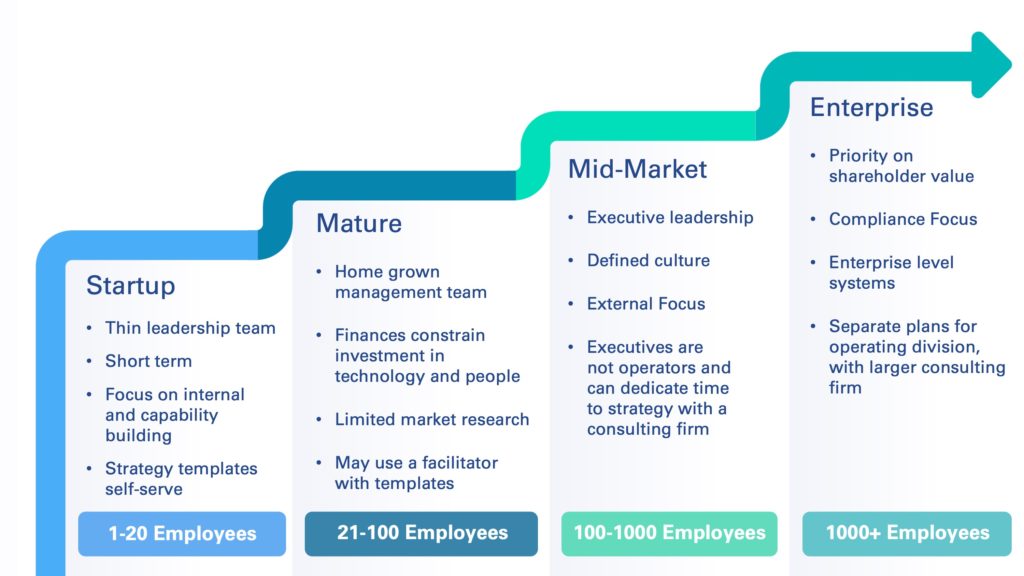

But let’s face it, the underlying needs of a business change as it evolves. In no discipline is this truer than strategy and strategic planning. When calculating how to formulate a strategy, it is critical to consider a company’s life stage (please forgive the generalizations):

Startup Phase

When a company first launches, there is almost a singular focus on product. The offering is limited.

Every manager is a generalist, managing multiple functions and initiatives. There is an agile approach to doing things, where the company tests its thesis and has a collision with reality. The entire company functions like an A/B market test, just trying to figure out what works.

At best, startups operate quarter to quarter, just trying to generate enough cash to survive or make it to the next round of financing.

Because managers of startup companies don’t have much time for planning, they gravitate toward easy-to-use templates and downloadable forms for strategy.

Maturity Phase

Once a company becomes established ($5-$10 million in revenue), its systems start to mature. As its initial product achieves market adoption, the focus shifts to distribution.

There are limited expansions into product extensions. As these companies tend to be resource-constrained, they cannot support a C-suite or VP-level department head for human resources, information technology and operations. Instead of having a Chief Financial Officer, the company is more likely to have a controller or bookkeeper.

Such companies are still likely to use templates for strategy. They may use a facilitator, but their version of strategy is often limited to a set of goals and objectives for the following year.

Their attempt at a growth plan is aspirational but void of analysis that proves or disproves the company’s ability to sustain growth. Many of these companies have a strategic plan but no strategy, or a strategy and no strategic plan.

Mid-Market Phase

When companies become more sizable (more than $25 million) they gain the wherewithal to hire professional management. Often, these managers come from larger companies with more sophisticated systems. Such managers demand a strategy.

They expect their strategic plan to include four critical components — where you will win, how you will win, capabilities to win, and system to win. Let’s consider where you will win as an example.

To properly articulate a target market requires a study of addressable market and its subsets of serviceable market and obtainable market.

If you cannot quantify the size of the market you are addressing, the strategist cannot make data-driven decisions on where and how to grow. This is the level of analysis required, and it is not easily provided by templated “operating systems.”

But perhaps more important than the level of analysis is that professional managers are not operators. VP-level executives don’t run the day-to-day of a business; they oversee a function and have the bandwidth for planning. That is, not only do they have a greater aptitude for it, but they also have time for it. Professional managers feel less threatened by strategic consulting firms and are more likely to bring them in for help.

Such companies spend months collecting inputs such as employee engagement studies, net promoter scores, market analysis and competitor analysis. It is at this time in a company’s life cycle when strategic planning can be the most impactful.

Enterprise Phase

Once a company grows larger, it tends to go public to secure cheaper capital (and often to provide a payday to its founders). Public companies have dedicated strategic planning teams that can create analyses, plan business and budgets, and execute acquisitions.

Yet strategic planning within public companies is also difficult because of the shuffling of executives and the pressure created by reporting. Ironically, these companies go full circle and revert to managing things quarter-to-quarter. It’s the companies that fight through this tendency that sustain growth.

So, where do you want your planning to be?

Make data-informed decisions

As described, mid-market companies invest in a more robust level of analysis. While more junior managers will dismiss analysis as too time-consuming, it’s a trap to execute well with the wrong strategy. Require that your team zero in on target customers, value proposition and building out capabilities.

Remain agile

Larger companies can also take a page from startups. While such companies may not be managing for survival, they remain nimble and iterate based on their collision with reality.

Create a cycle

While larger companies may need more rigor around budgeting and the like, companies of all sizes should find a system, cadence, and repeatable cycle. While the level of time and investment may change, having a repeatable system is critical to a company’s success.

Related Resources

4 ways to prepare your company for ongoing change

5 ways CEOs can remain effective in an evolving business landscape

Category : Strategic Planning

Tags: Business Growth