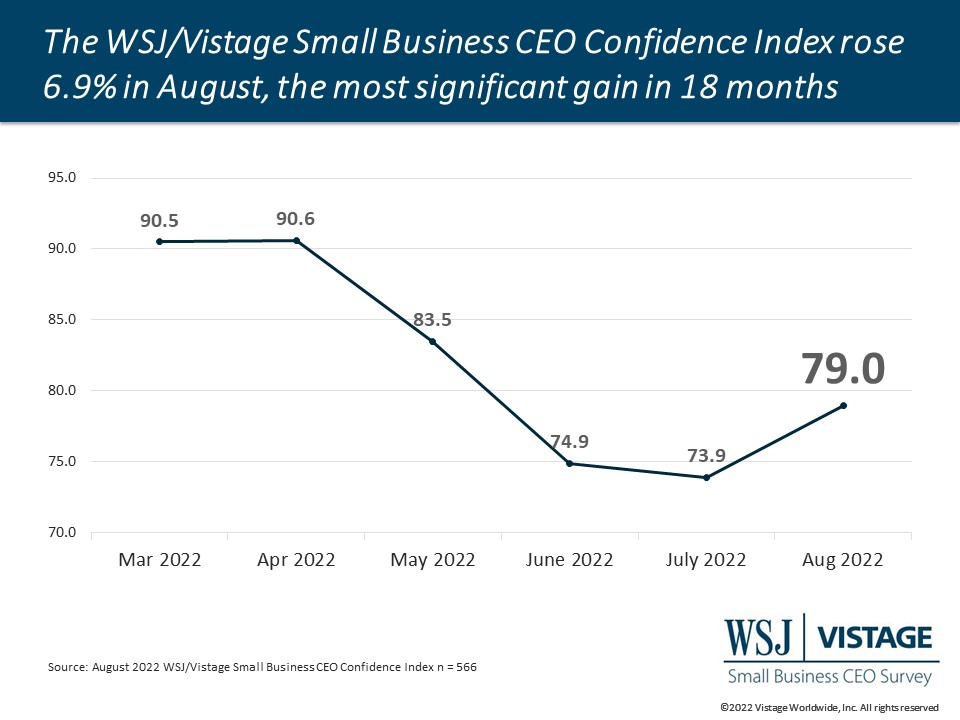

Small business confidence posts largest gain in 18 months [WSJ/Vistage Aug 2022]

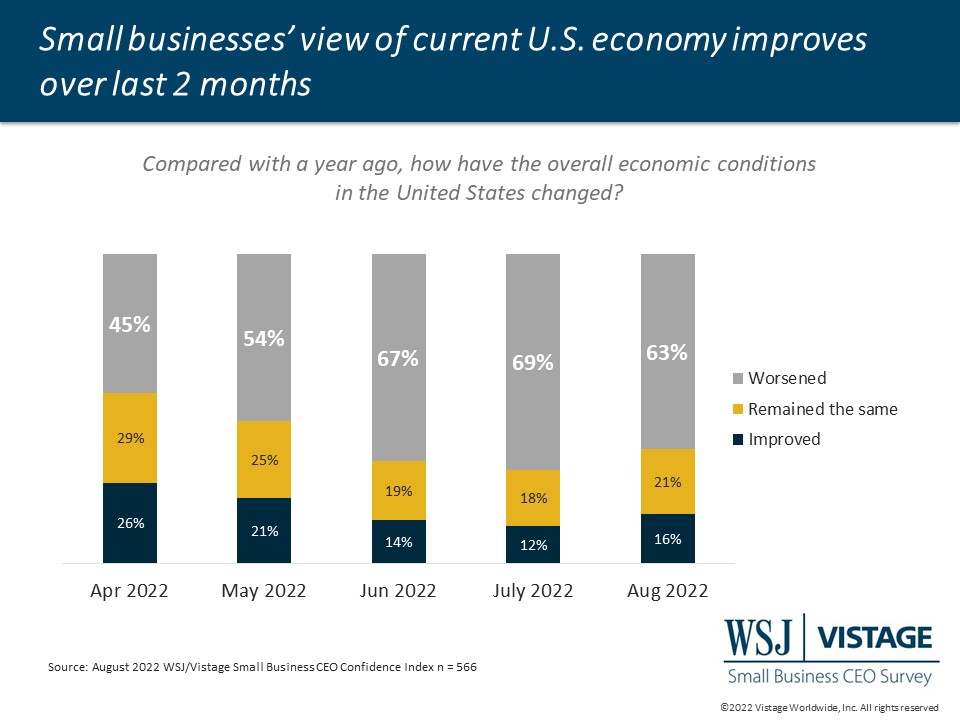

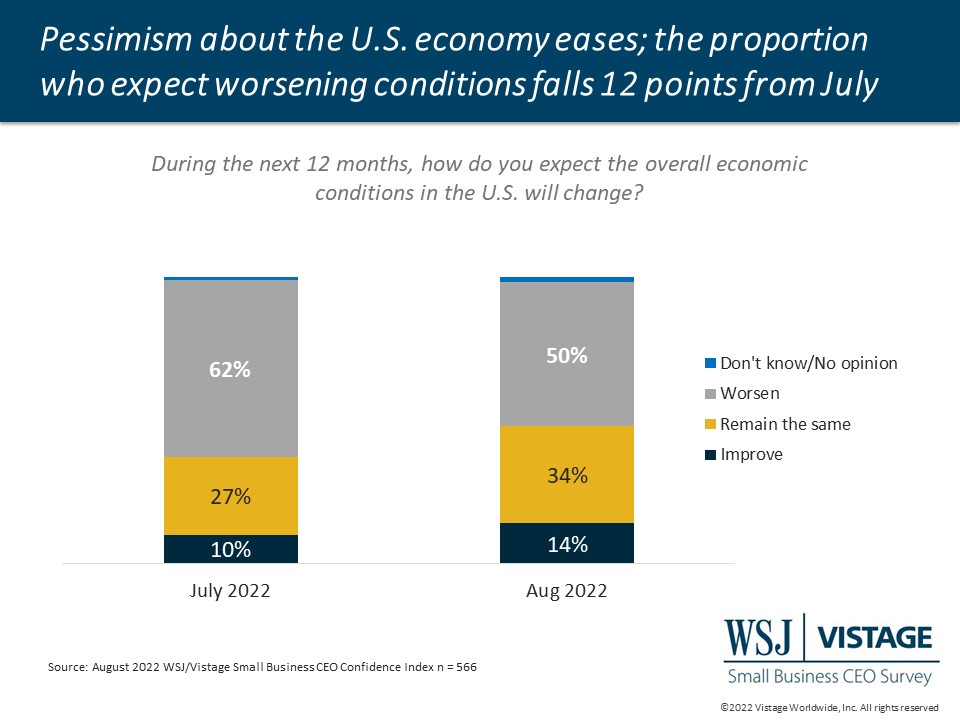

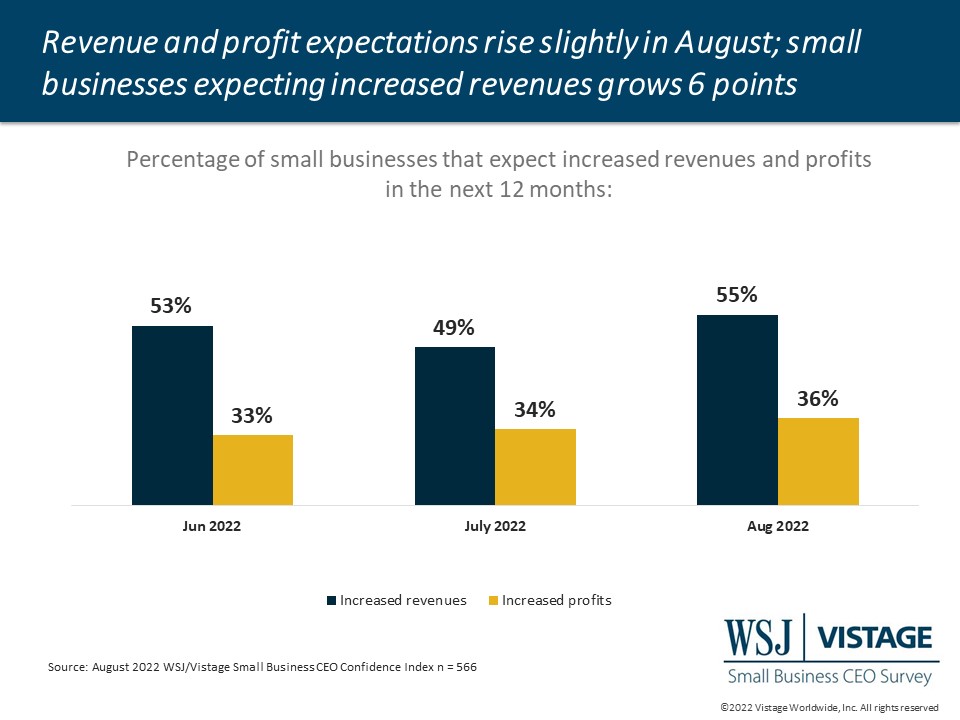

While inflationary pressures persist, small businesses report that the supply chain is improving, and their hiring plans remain stable. All of these things lead to a more favorable view of the economy, which was evidenced by the improvement in small business confidence in August. In fact, the 6.9% increase in WSJ/Vistage Small Business CEO Confidence Index was the largest gain in 18 months. The most significant driver in the increase of the Index was improving sentiment about the future of the U.S. economy among small businesses, which improved 33% from last month despite persistent inflationary pressures.

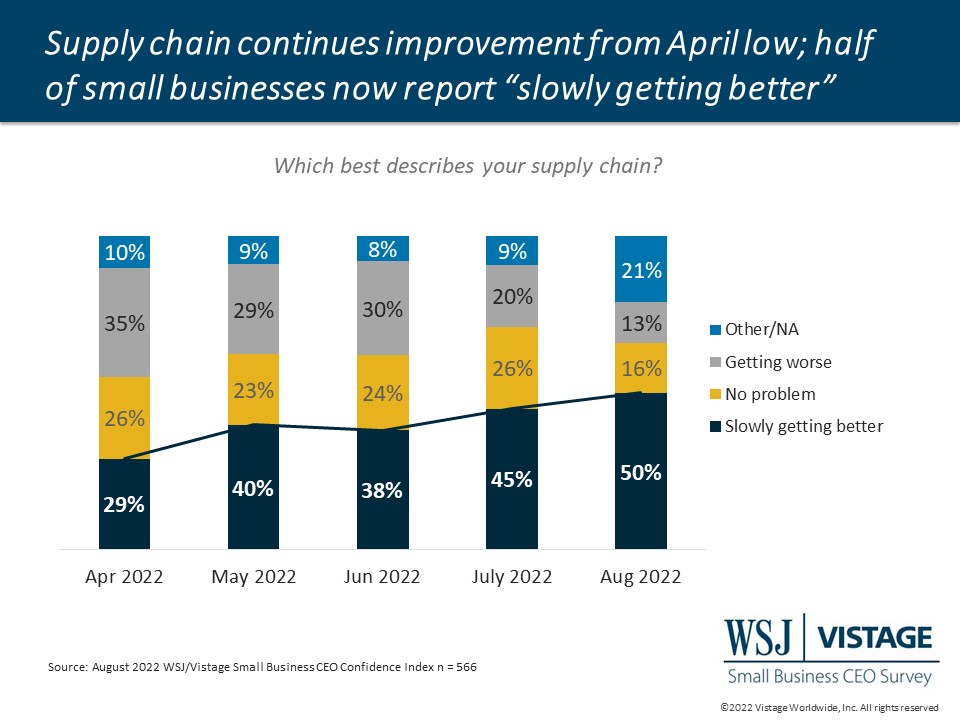

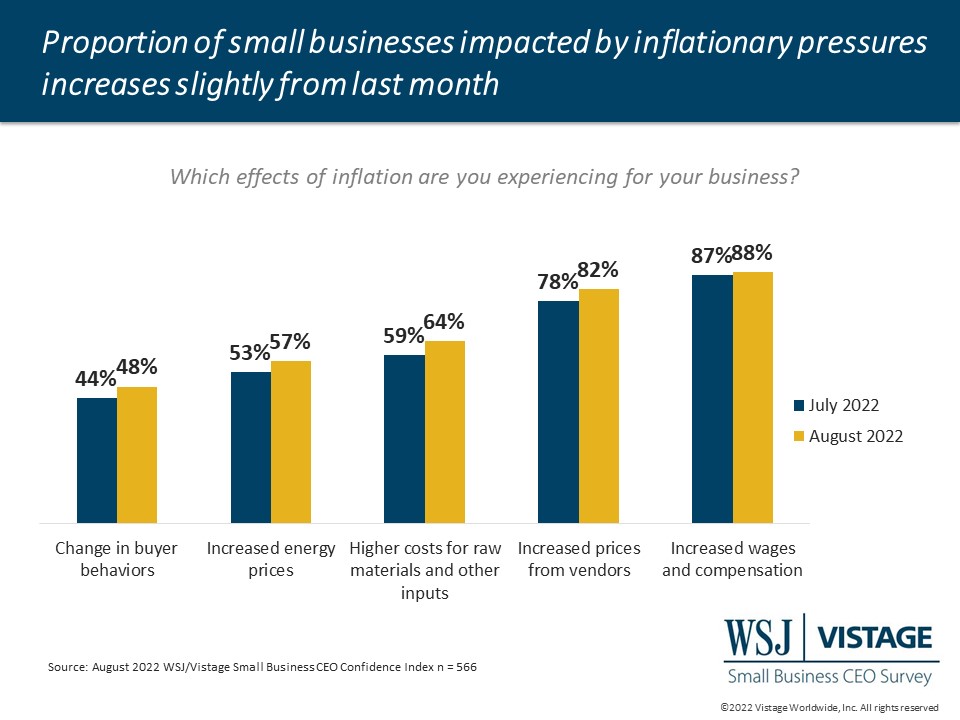

Inflation persists while the supply chain continues to ease

Inflationary pressures are not easing. In fact, the numbers rose incrementally from last month with wages and compensation continuing to be the top impact small businesses are facing. The easing of the supply chain may be a key driver as the improving trend continues from last month with 50% of small businesses reporting that the supply chain is slowly getting better, a 5-point increase from July. More significant is the proportion of small businesses reporting that their supply chain is worsening, which posted a 7-point decline, dropping to just 13%.

Hiring remains critical for operations

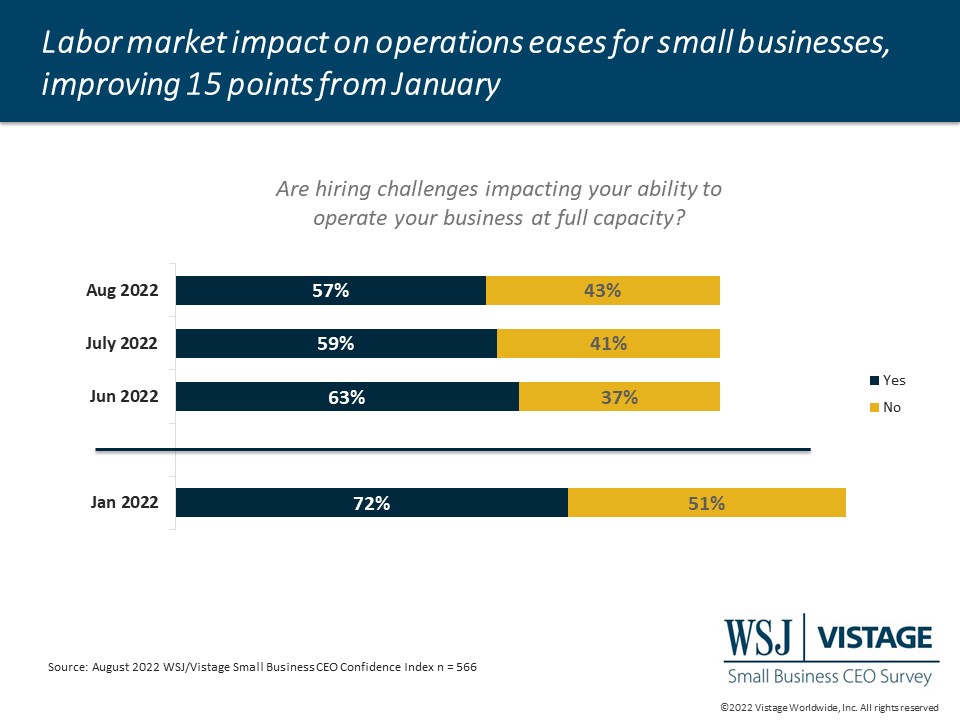

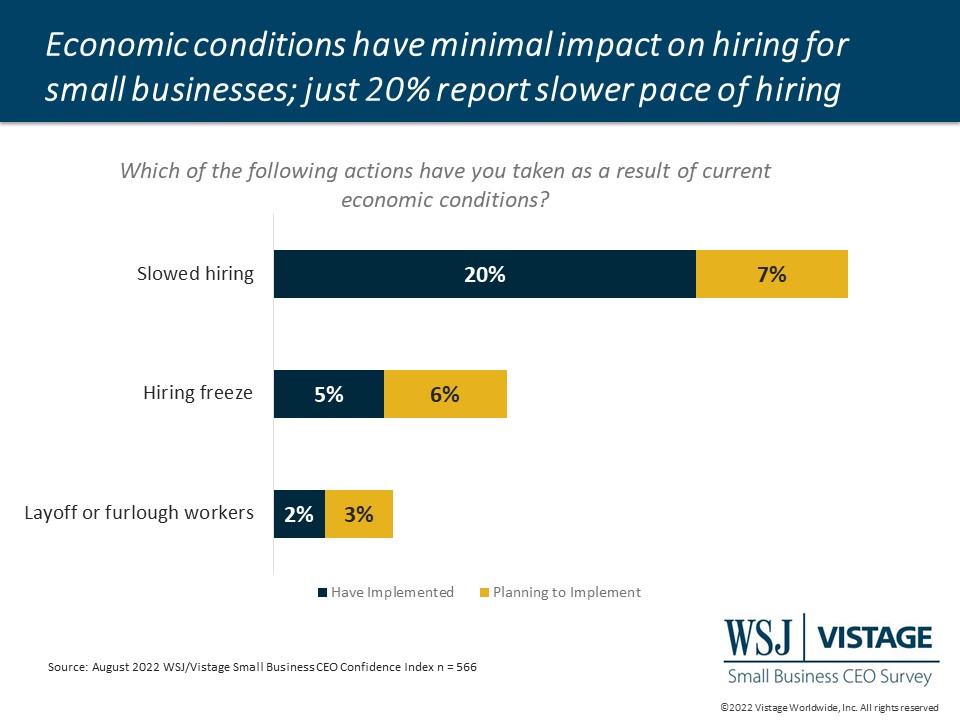

As all eyes are on hiring based on the importance of the labor market to keep the U.S. out of a recession, small businesses continue to show optimism. With 315,000 jobs added in August, small businesses were among those adding to that figure with more than half (52%) planning to increase their workforce in the next 12 months, the same percentage as last month. The economy has impacted hiring plans for very few, with the majority of small businesses hiring the same number as planned at the beginning of the year (70%) and some hiring more than originally planned (13%). Just 17% of small businesses are hiring less than planned, and only 7% are planning to decrease the size of their workforce in the next 12 months.

Filling job openings still presents a challenge for small businesses. Currently, 57% of small businesses report operational challenges as a result of a talent shortage. While that is an improvement from 72% in January, this is the foundation for why hiring plans remain strong.

When asked about whether it was easier or more difficult to fill openings than at the beginning of the year, 56% report no change. Because hiring was a challenge at the beginning of the year, the “no change” response indicates that it remains challenging. Adding to that, 27% of small businesses report that it is harder to fill job openings than at the beginning of the year. With the latest jobs report indicating a slowdown in jobs created and more people entering the workforce, small businesses may soon find it easier to fill roles.

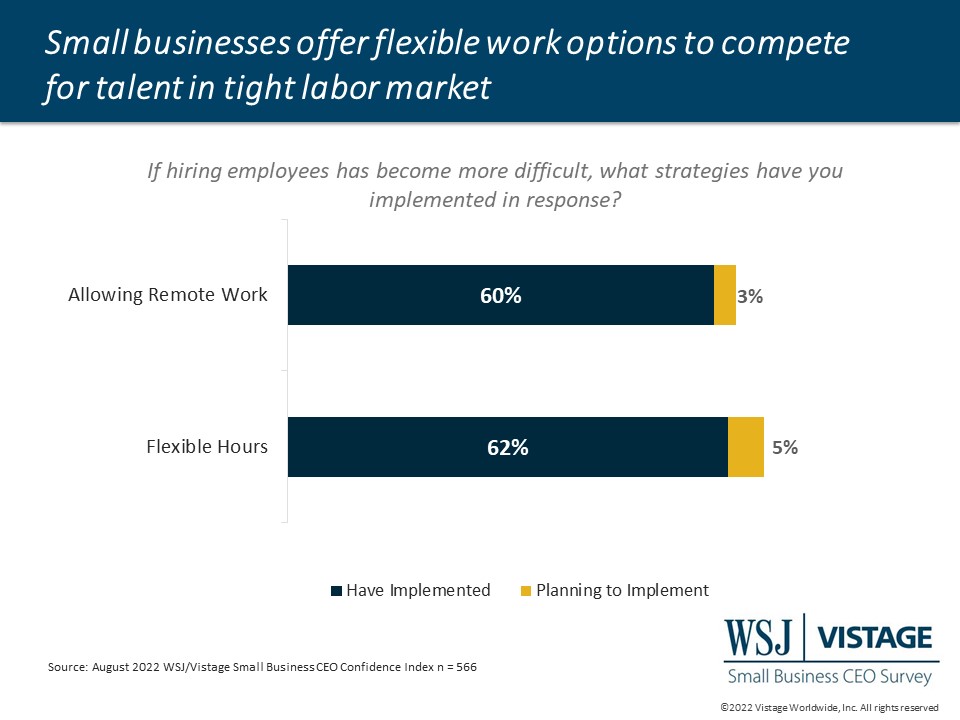

Flexible scheduling options are a key part of hiring strategies

Small businesses continue to innovate how they approach hiring as the workforce revolution has put employees in the driver’s seat. While small businesses continue to boost wages (77%) and add benefits (39%) to remain competitive, small businesses look to other components to differentiate themselves as well. Flexible work options remain a carrot, with 62% offering flexible hours and schedules and 60% offering remote work options. In fact, over the past 3 months, 18% of small businesses have increased flexible scheduling and 16% increased remote working. Other strategies were shared in a recent roundtable where Vistage members shared their hiring best practices.

Overall the increase of optimism among the small businesses surveyed monthly through the WSJ/Vistage Small Business CEO Confidence Index survey is likely an indicator that we can expect to see improving sentiment from the larger population of small and midsize businesses. Opinions collected in Q3 Vistage CEO Confidence Index will reflect a greater scope of how this vital sector of the economy feels and may be a harbinger of improvements ahead.

August Highlights:

- Inflationary pressures persist with incremental gains from last month.

- The WSJ/Vistage Small Business CEO Confidence Index grew 6.9%, the highest increase in 18 months.

- Economic sentiment improves; 23% improvement in the perception of the current economy and 33% improvement in the future economic conditions.

Download the August report for complete data and analysis

For a complete dataset and analysis of the August WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD AUGUST 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD AUGUST 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The August WSJ/Vistage Small Business CEO survey was conducted August 8-15, 2022, and gathered 566 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field September 7-14, 2022.

Related Resources

Category : Economic / Future Trends

Tags: Hiring and Retention, inflation, WSJ Vistage Small Business CEO Survey