Small business confidence dips over interest rate increases, recession concerns [WSJ/Vistage Oct 2022]

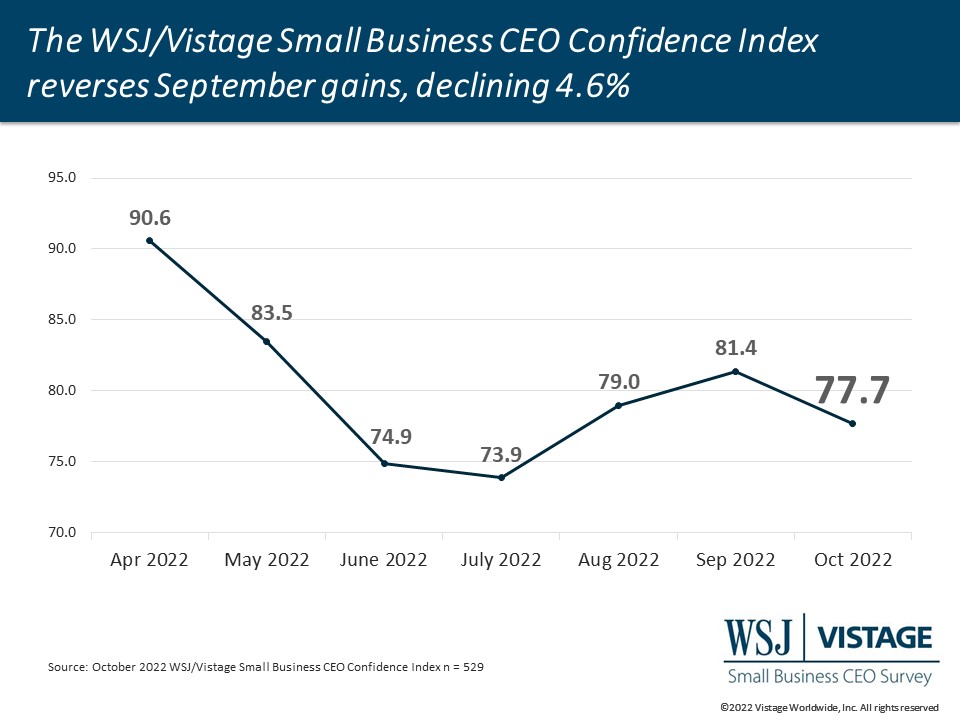

After rising for two months, the WSJ/Vistage Small Business CEO Confidence Index declined in October to reach 77.7 While triple 7s are lucky when playing slot machines, this figure is hardly fortuitous in the context of a nearly 5% decline, reversing last month’s gains.

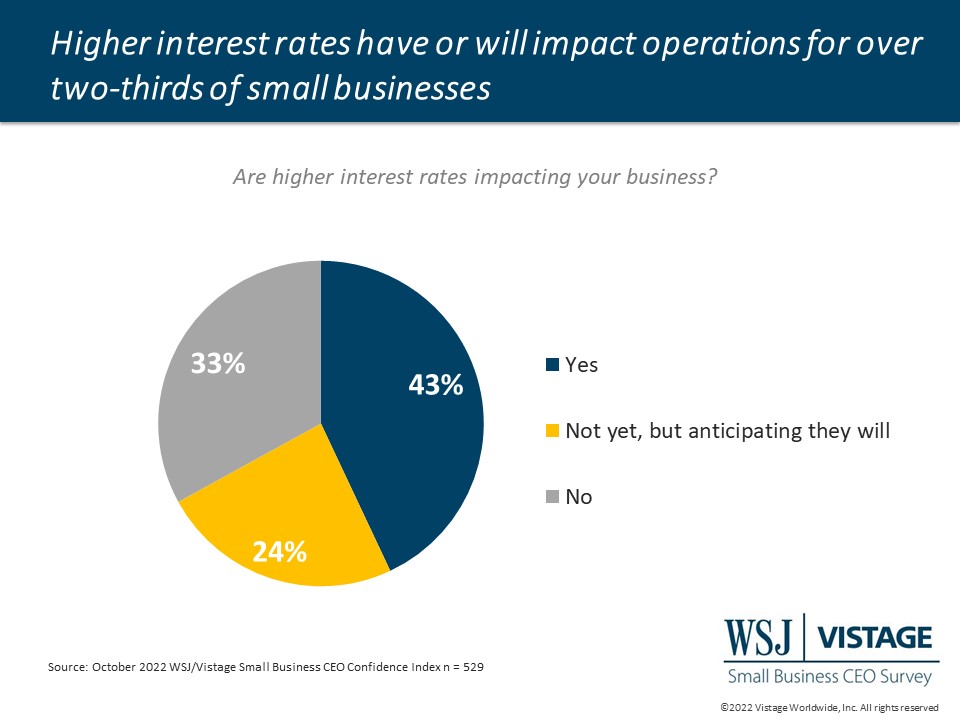

Following the Federal Reserve’s decision to raise interest rates again in late September, small business confidence about the economy also retreated after rising over the last two months. Higher interest rates are presenting challenges to small businesses; 43% report their businesses have been impacted and an additional 24% anticipate impacts in the future. Just one-third of respondents report no impacts of rising interest rates. Rising interest rates have introduced new waves of caution.

Buyers cautious about spending

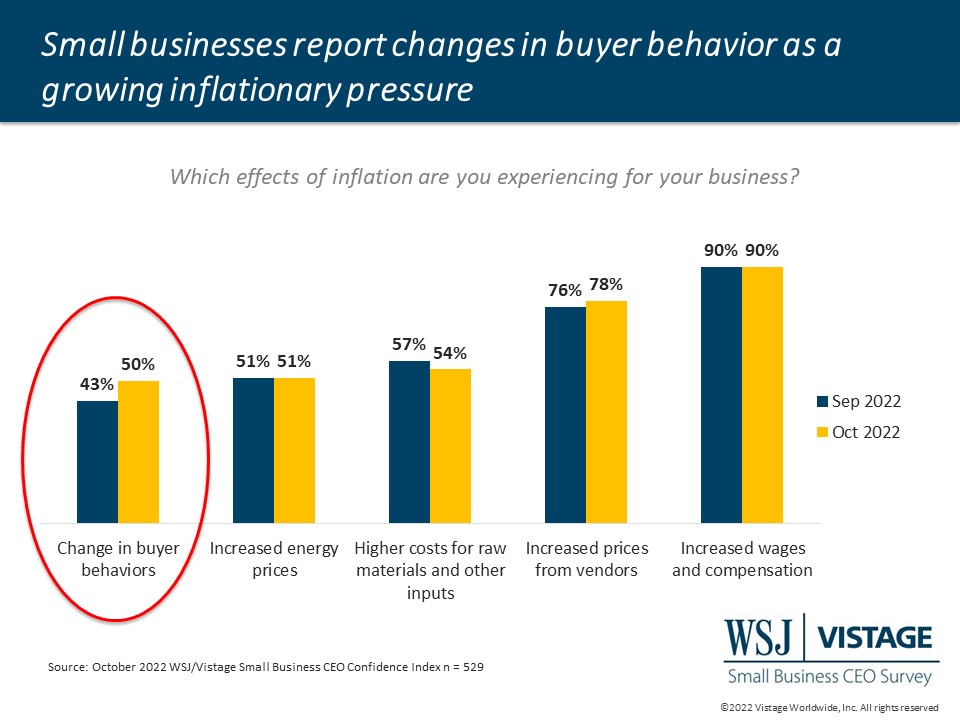

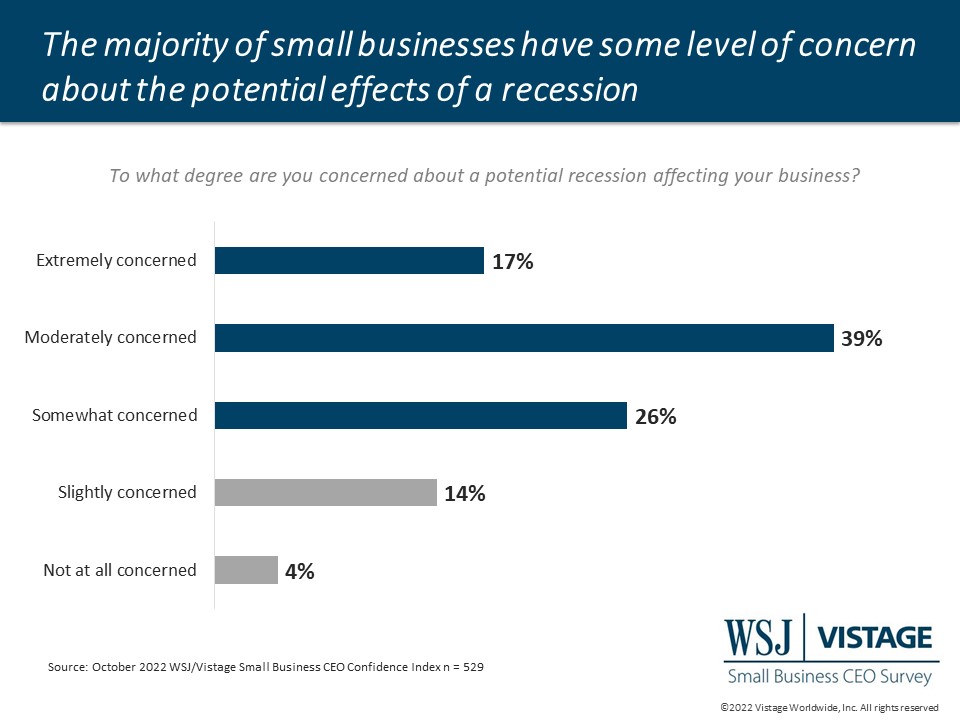

While interest rate hikes are intended to lessen the impact of inflation, inflationary pressures such as increased wages, prices from vendors, and costs for both energy and raw materials remain strong. Add buyer behavior to that list of growing pressures. Of those small businesses surveyed, 50% report changes in buyer behavior as an impact of inflation, up from 43% in September. Specifically, small businesses report that caution among buyers is resulting in delays, smaller budgets, longer sales cycles, fewer new customers and less spending. The slowdown in demand also brings up the concern of recession. When asked about their concern about a recession, 56% of small businesses were moderately or extremely concerned, 26% were somewhat concerned and 14% were slightly or moderately concerned.

Concerns about the economy loom, but supply chain continues to heal

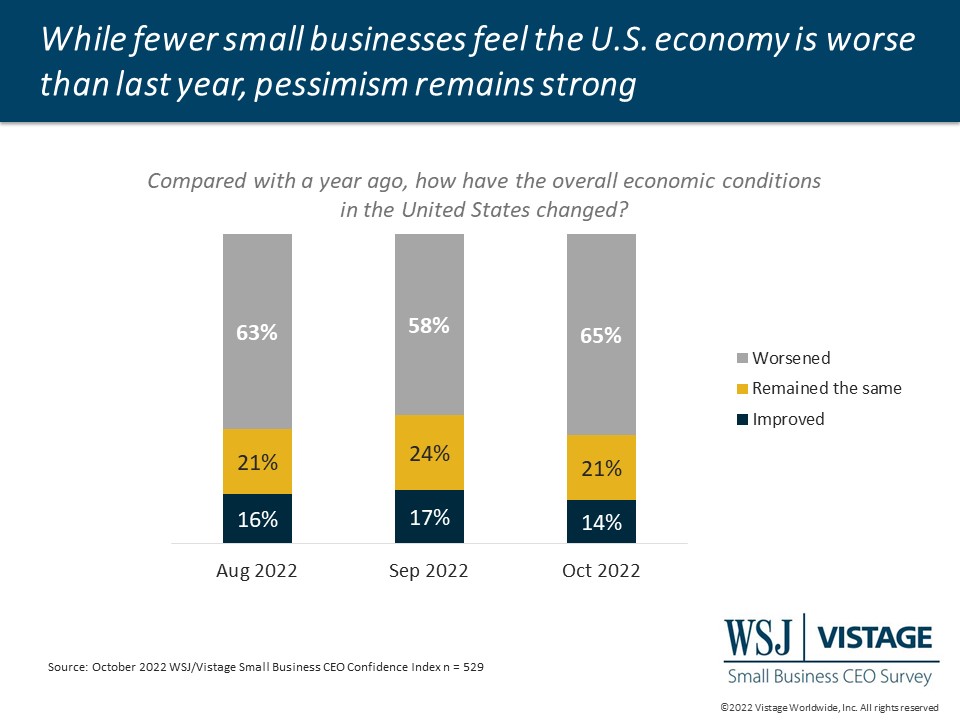

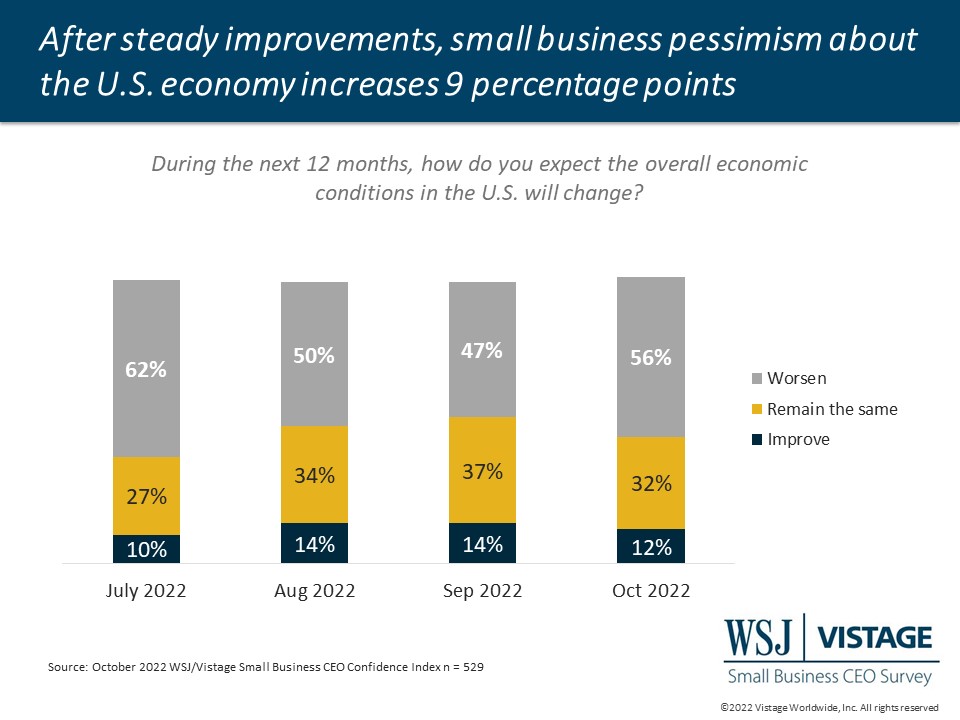

Once again, economic sentiment is the biggest driver of the decline in small business confidence. While the proportion of small businesses that felt the U.S. economy was worse than last year lessened by 7 percentage points, pessimism remains strong and they are not optimistic for the future. In fact, after steady improvements since July, small business pessimism about the U.S. economy increased nine percentage points in October, with 56% reporting they expect the economy to worsen in the year ahead.

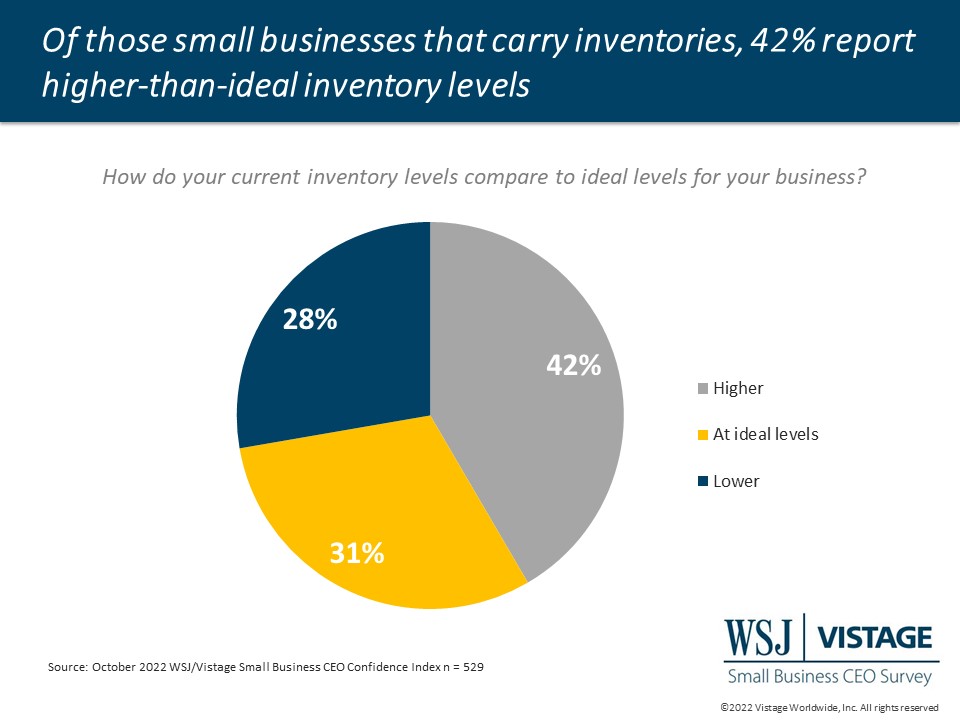

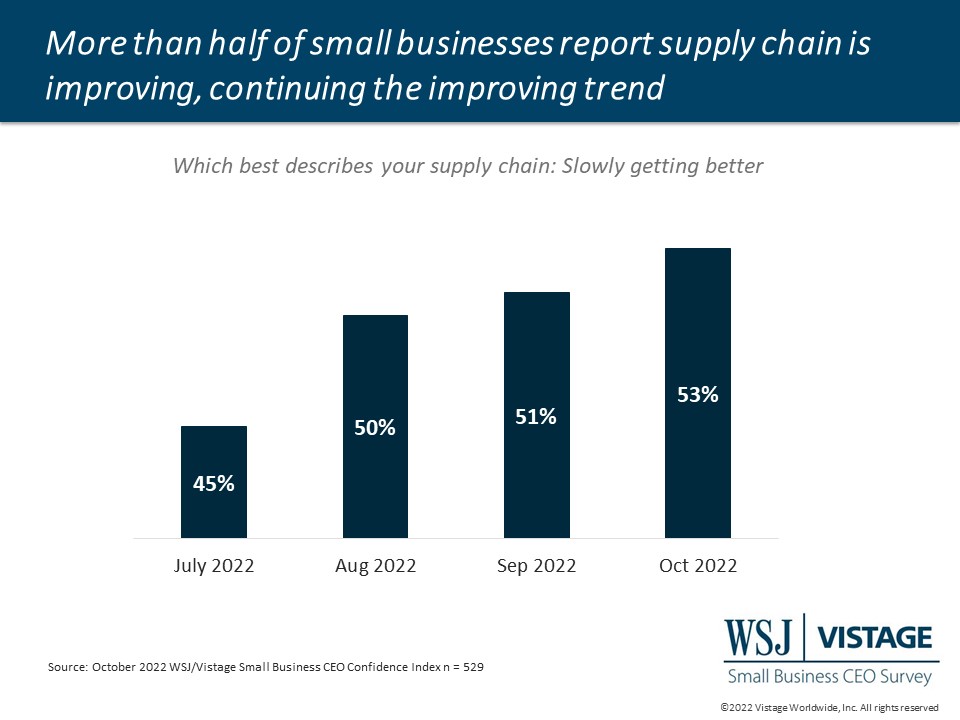

If there is a silver lining, it can be found in the slowly-healing supply chain. Of those small businesses dependent on the supply chain, 65% report that their supply chain is slowly getting better and 16% report that it is no problem. However, the supply chain challenges of the past may have resulted in today’s inventory challenges. Of those small businesses surveyed that carry inventory, 42% report higher-than-ideal inventory levels, while 28% report lower-than-ideal levels.

October Highlights:

- After rising 2 months, the WSJ/Vistage Small Business CEO Confidence Index declined to 77.7 in October.

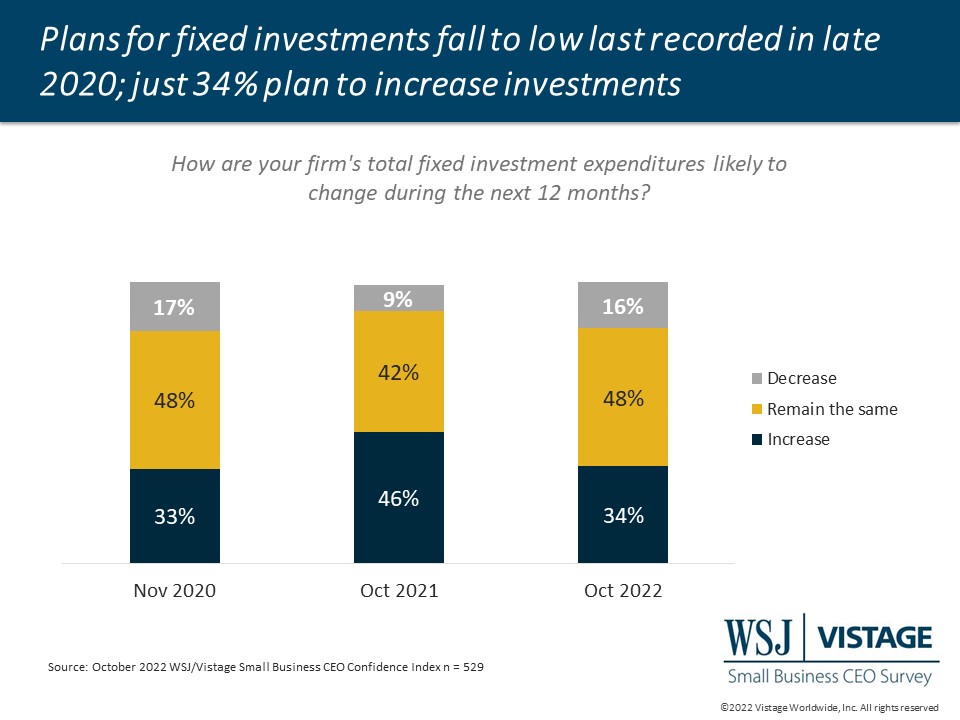

- Plans for fixed investments fall to a nearly 2-year low with just 34% planning to increase investments in the year ahead.

- Recession concerns impact decision-making as 56% are moderately to extremely concerned about a recession.

- 43% of small businesses have been impacted by rising interest rates, while an additional 24% anticipate that rising interest rates will impact them in the future.

- 50% of small businesses report changes in buyer behavior as a result of inflation.

Download the October report for complete data and analysis

For a complete dataset and analysis of the October WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD OCTOBER 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD OCTOBER 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The October WSJ/Vistage Small Business CEO survey was conducted October 3-10, 2022, and gathered 529 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field November 7-14, 2022.

Category : Economic / Future Trends

Tags: Economic uncertainty, inflation, Recession, WSJ Vistage Small Business CEO Survey