Despite optimism, small businesses remain cautious [WSJ/Vistage Feb 2023]

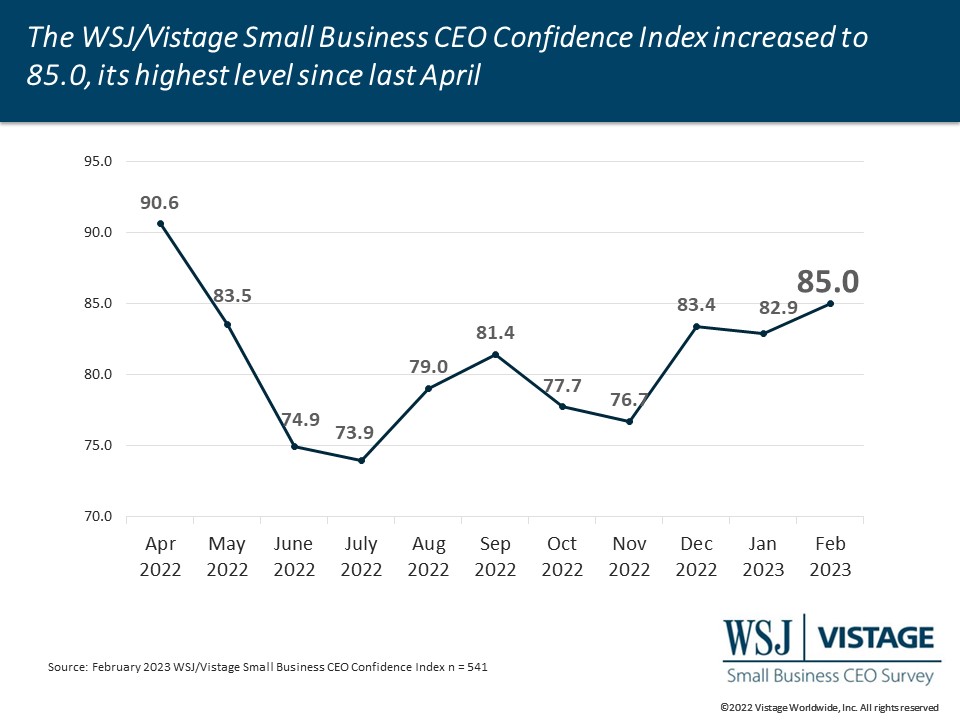

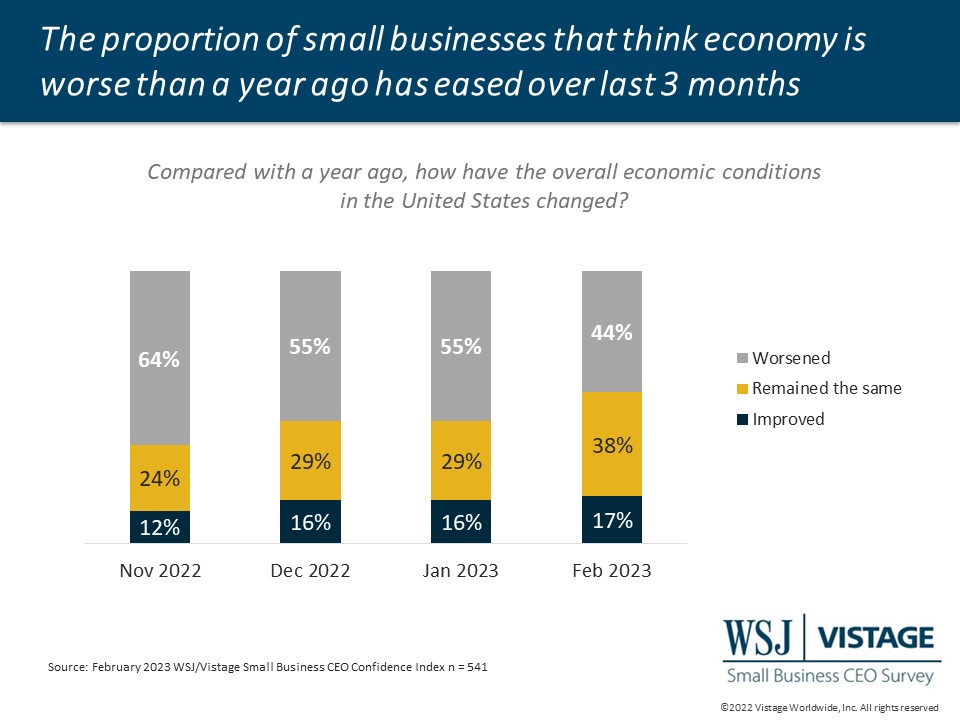

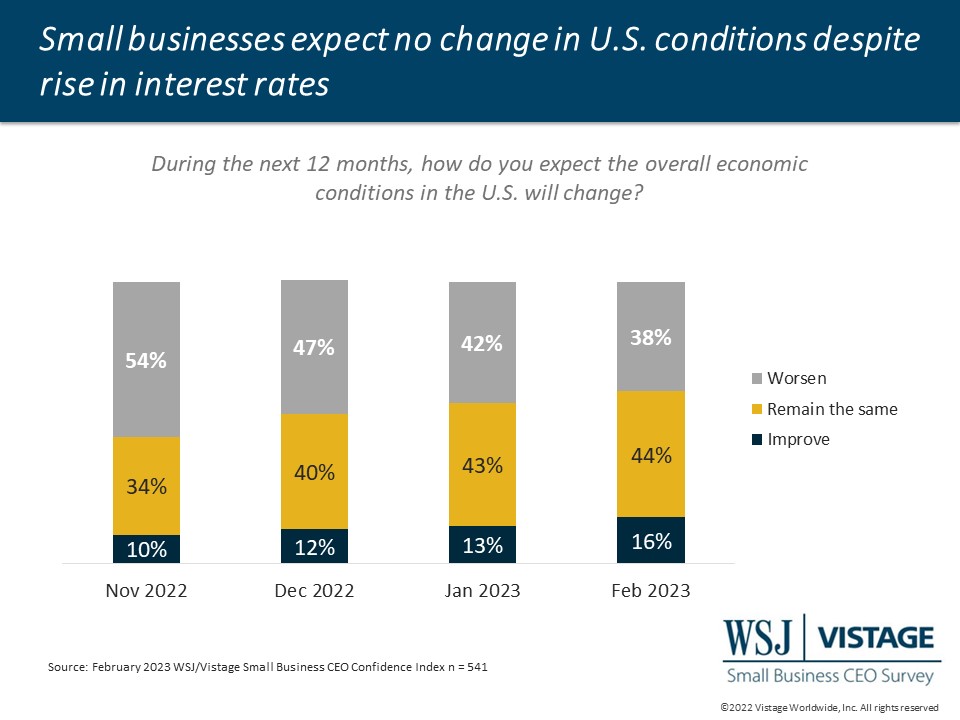

Positive economic news pushed the WSJ/Vistage Small Business CEO Confidence Index to 85.0 in February, the highest recording since last April. However small business confidence remains well below pre-COVID readings, most recently driven by recessionary concerns.

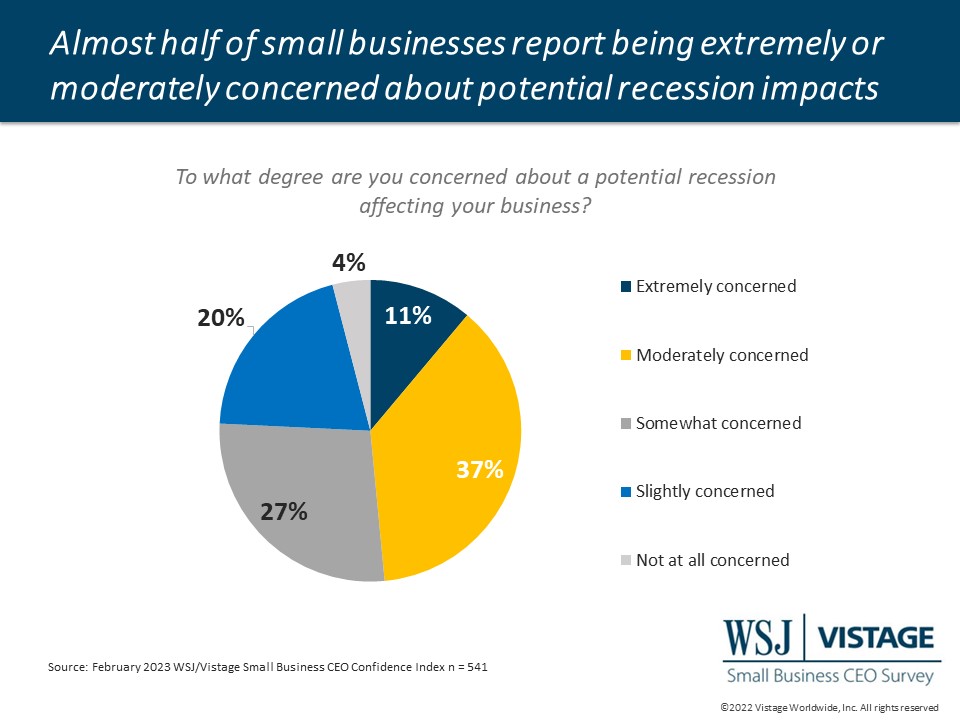

The pending recession forecasts have made small businesses more cautious in terms of their spending. Why? Nearly half of the small businesses surveyed are extremely or moderately concerned about the impacts of a recession on their business.

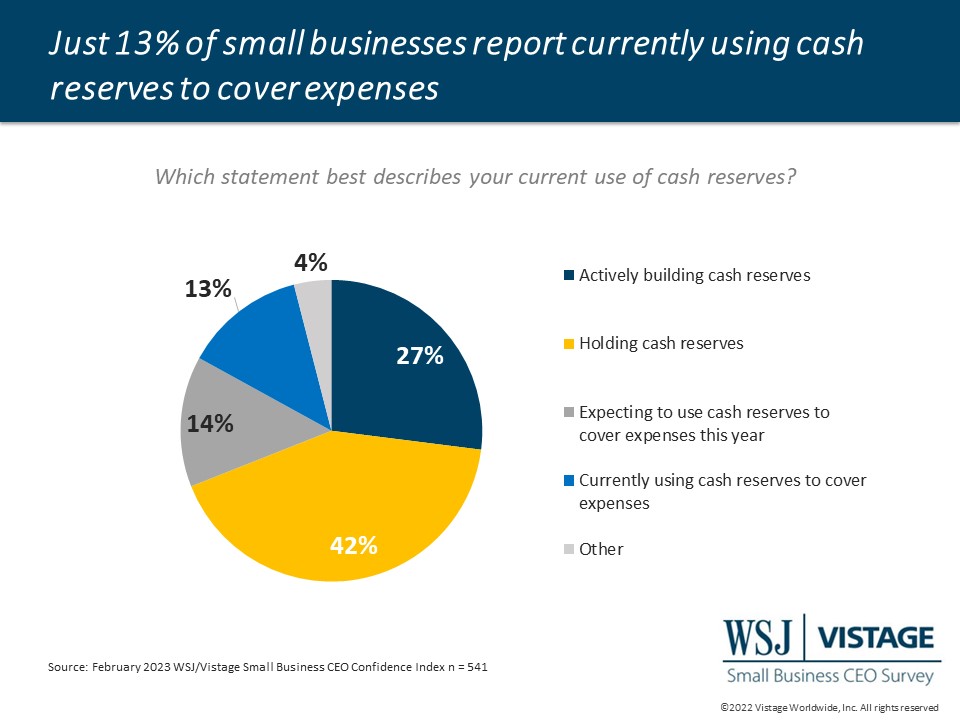

Accordingly, small businesses have become more conservative with how they manage cash flow to prepare for the future. Of small businesses surveyed, 27% are actively building cash reserves while 42% are holding theirs. Currently, just 13% are using cash reserves to cover expenses, and the emphasis is to hold in preparation for slowing growth.

Our data reveals three conditions that are conducive to growing cash reserves.

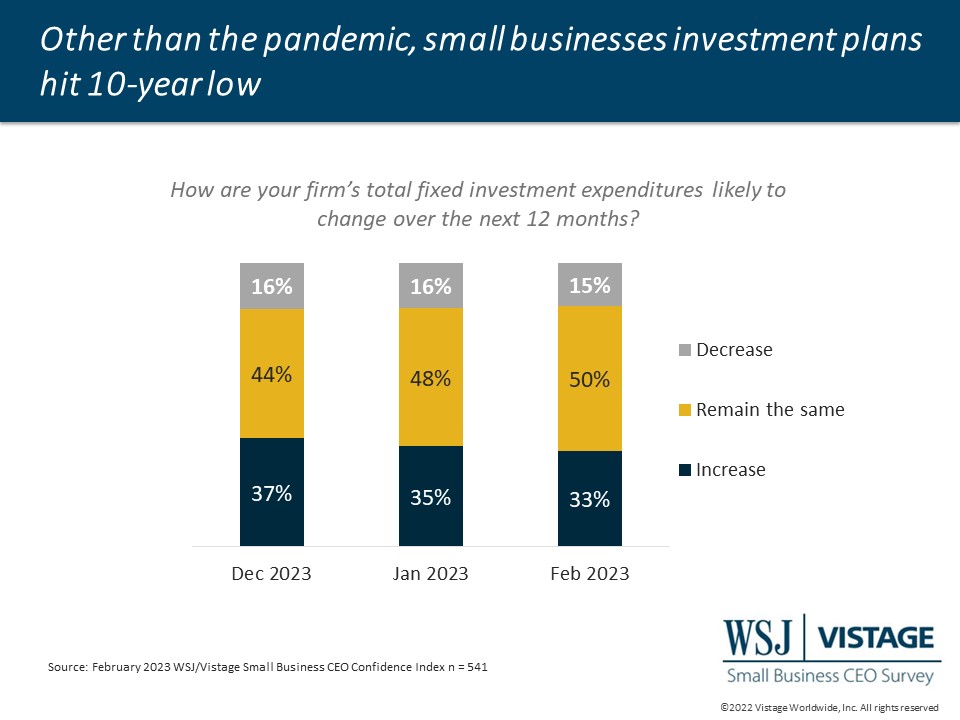

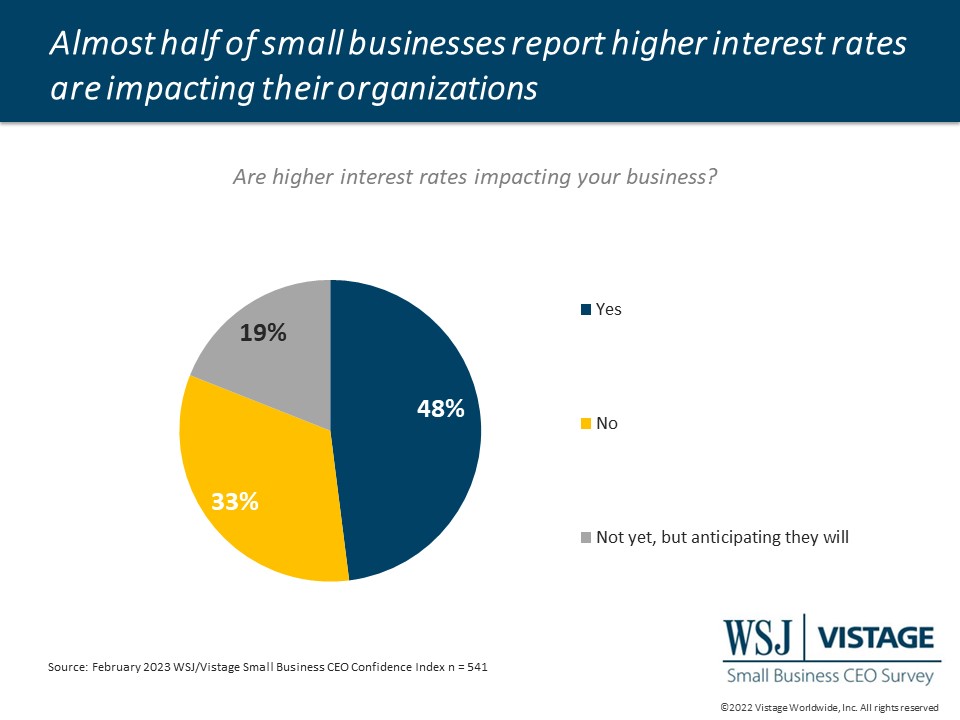

1. Expense management. The proportion of small businesses planning to increase fixed investments fell to 33%, the lowest level since 2013, with several months during the 2020 pandemic as an exception. With the Federal Reserve raising interest rates and continuing economic uncertainty, delaying or cutting investments helps build cash reserves.

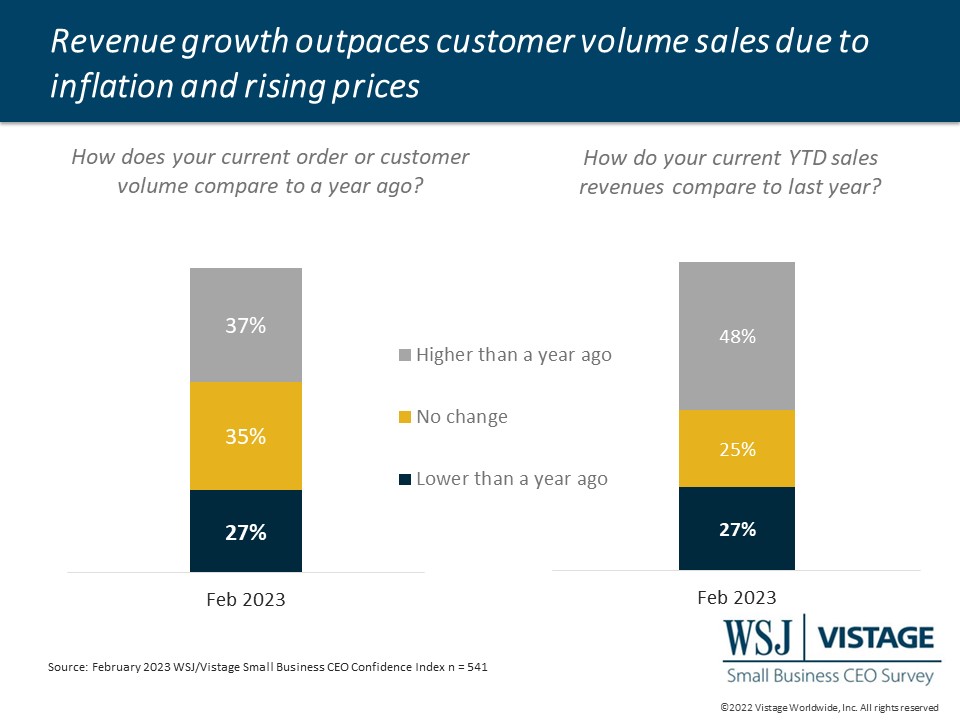

2. Increased revenues. For the past 3 months, the proportion of small businesses that expect increased revenues has held at 60%. When asked about revenues and order volumes compared to last year, the pace of revenue growth is higher than order volume growth. While inflation and increased prices are driving revenues up, customer activity is not growing at the same pace. Small businesses should maintain a strong pricing strategy through this period of slowing growth.

3. Profitability improvements. As previous surveys revealed, small businesses report that costs are not increasing as rapidly, and the proportion of small businesses expecting increased profits is also growing. As profitability is restored, small businesses can use that opportunity to build cash reserves as well.

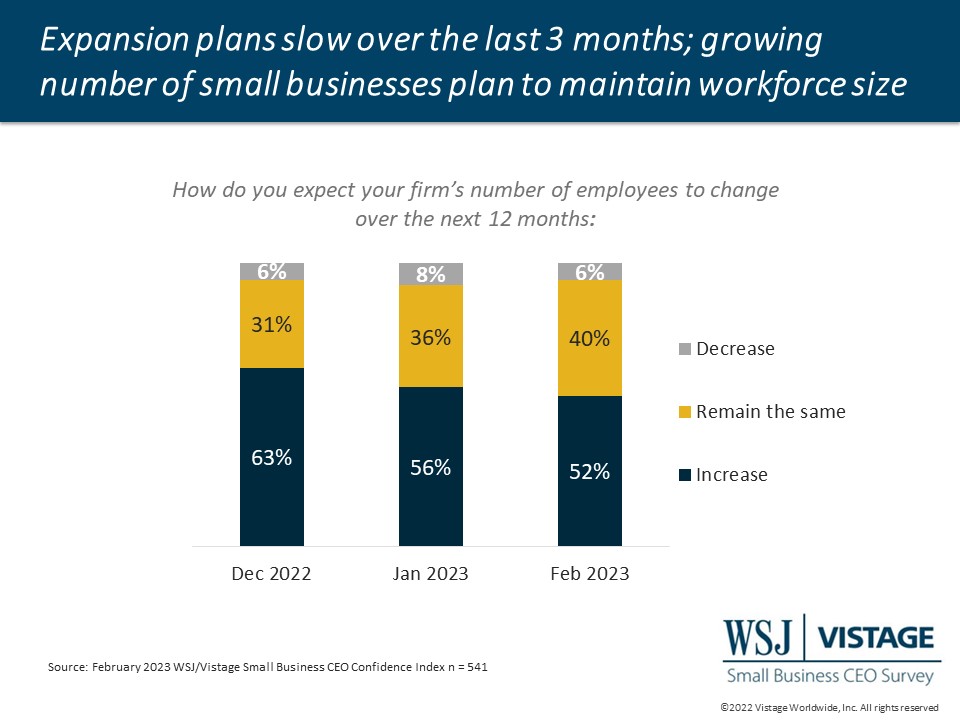

While economists are increasingly calling for a recession, consumer demand and the labor market continue to defy predictions, making it challenging for small businesses to forecast. As a result, they continue to manage demand while becoming more fiscally conservative with their hiring and investment decisions. Just over half (52%) of small businesses indicate plans to expand their workforce, down from 63% in December. The shirking proportion is likely the result of hiring that occurred at the start of the year.

February Highlights:

- The WSJ/Vistage Small Business CEO Confidence Index increased to 85.0 in February as pessimism about the economy continues to decrease.

- The proportion of small businesses expecting increased revenues in the next 12 months has held at 60% for the last 3 months, indicating demand remains strong.

- Compared to last year, revenues are accelerating faster than customer order volumes with 48% of small businesses reporting higher revenues and 37% reporting higher customer order volumes.

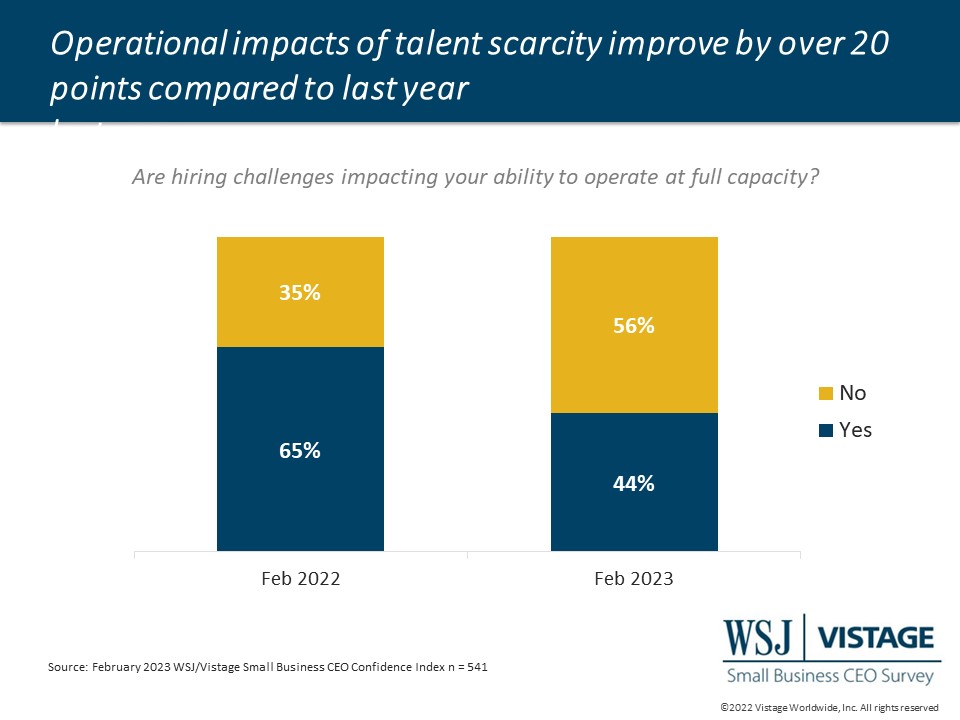

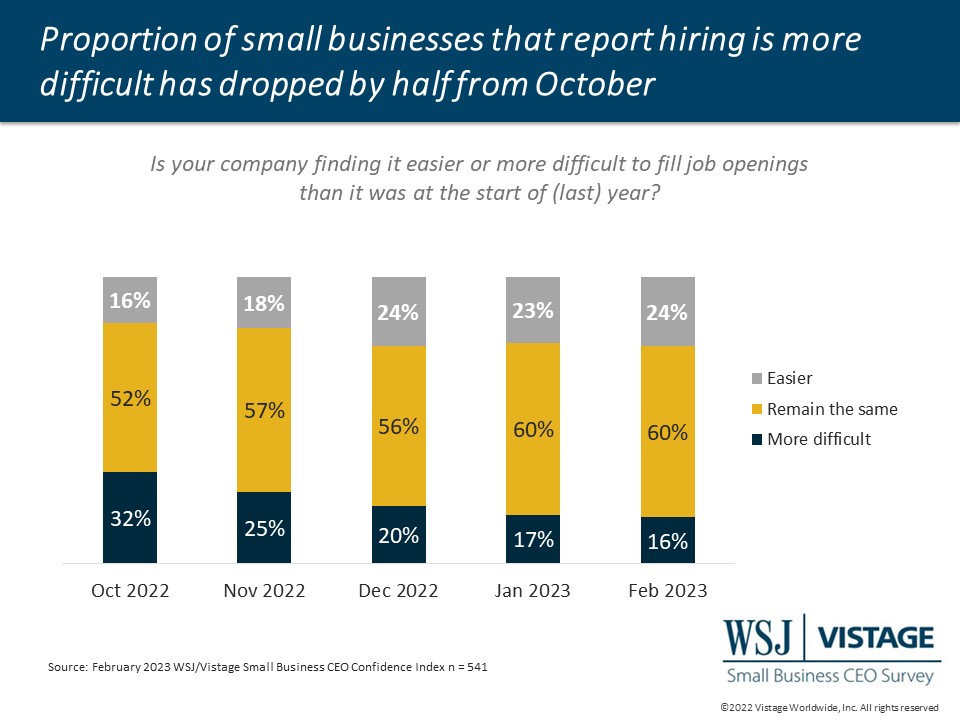

- Just 43% of small businesses report challenges operating at full capacity due to talent scarcity, and 24% report that hiring has recently become easier.

- Since December, the proportion of small businesses expanding their workforce has declined 11 percentage points.

- The proportion of small businesses planning to increase fixed investments fell to 33%, the lowest level since 2013, with several months during the 2020 pandemic as an exception.

Download the February report for complete data and analysis

For a complete dataset and analysis of the February WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD FEBRUARY 2023 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD FEBRUARY 2023 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The February WSJ/Vistage Small Business CEO survey was conducted February 6-13, 2023, and gathered 541 responses from CEOs and leaders of small businesses. Our next survey will be in the field March 6-13, 2023.

Category : Economic / Future Trends

Tags: Hiring, investment, Recession, WSJ Vistage Small Business CEO Survey