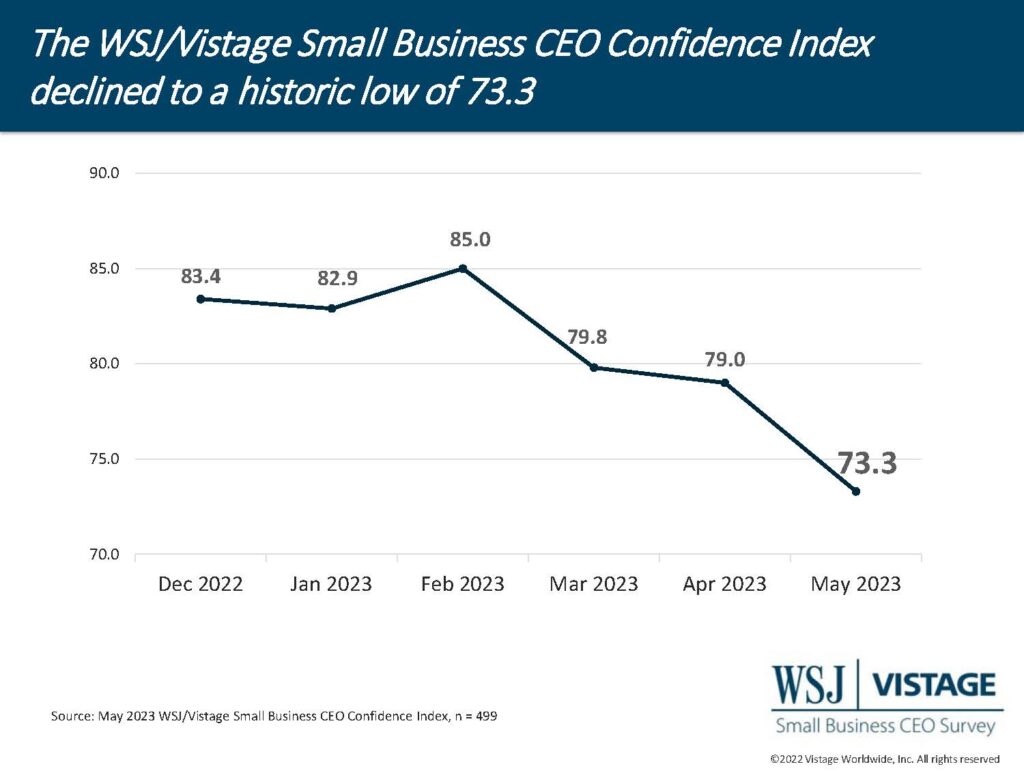

Small business confidence erodes as economic sentiment hits record lows [WSJ/Vistage May 2023]

Only twice in the nearly 11-year history of the WSJ/Vistage Small Business CEO Confidence Index has sentiment about the future of the U.S. economy been worse. The Index dropped to 73.3, falling 7% compared to last month, making it the lowest reading since the COVID-19 pandemic shutdown in June 2020. Small business confidence about the future of the U.S. economy fell nearly 24% in the same time period; just 8% of small businesses believe the economy will get better, while a staggering 57% believe it will worsen.

Please note this data was captured prior to President Biden’s expected signing of the Fiscal Responsibility Act of 2023, which suspends the debt ceiling through January 1, 2025, and newly released data from the U.S. Bureau of Labor Statistics. These sentiments will be captured in the June survey, which will be in the field June 5-12, 2023.

Highlights of the data — informed by 499 leaders of small businesses that responded to the May WSJ/Vistage Small Business CEO Confidence Index survey in the field May 1-8, 2023 — include:

- Current Economy: Just 11% of small businesses believe the economy has improved over the last year, while 54% report it has worsened.

- Future Economy: Just 8% of small businesses believe the economy will get better over the next 12 months, while 57% think it will worsen, a steep month-over-month decline and record low.

- Revenue projections: The proportion of small businesses (48%) expecting increased revenues declined 7 points since last month. Meanwhile, 16% expect decreased revenues in the year ahead. This figure has held steady since late last year.

- Profitability projections: Another key driver of the decline in the Index, the proportion of small businesses expecting increased profits (36%) dropped 8 percentage points from last month, falling back to levels recorded last November.

- Fixed investment plans: Small businesses are focused on cost control with 2-in-10 reporting their fixed investments will decrease over the next 12 months and 49% not making any changes to their plans.

- Workforce expansion plans: Workforce velocity slows; BLS data shows that quit rates are on the decline, and the May survey revealed that the proportion of small businesses expanding their workforce declined 8 points.

In addition to the six components that comprise the Index, the survey captured small business sentiment on how they are addressing hiring and cost management, which are top areas of focus for small businesses:

- Higher interest rates are impacting more than half (53%) of small businesses surveyed.

- Nearly half of small businesses moderately to strongly agree that their cash flow is significantly impacted by accounts receivable.

- Capital investment plans remain intact, with 60% of small businesses reporting no changes to their plans.

Editor’s Note: We bid thanks and farewell to Dr. Richard Curtin from the University of Michigan. Dr. Curtin has analyzed both the Vistage CEO Confidence Index and the WSJ/Vistage Small Business CEO Confidence Index for 20 years. His analysis has helped inform many decisions for the Vistage community. We wish him well on the next chapter of his journey.

Editor’s Note: We bid thanks and farewell to Dr. Richard Curtin from the University of Michigan. Dr. Curtin has analyzed both the Vistage CEO Confidence Index and the WSJ/Vistage Small Business CEO Confidence Index for 20 years. His analysis has helped inform many decisions for the Vistage community. We wish him well on the next chapter of his journey.

For deeper insights on the May WSJ/Vistage Small Business data:

Category : Economic / Future Trends

Tags: Economic uncertainty, US Economy, WSJ Vistage Small Business CEO Survey