Small business confidence improves for second consecutive month [WSJ/Vistage July 2023]

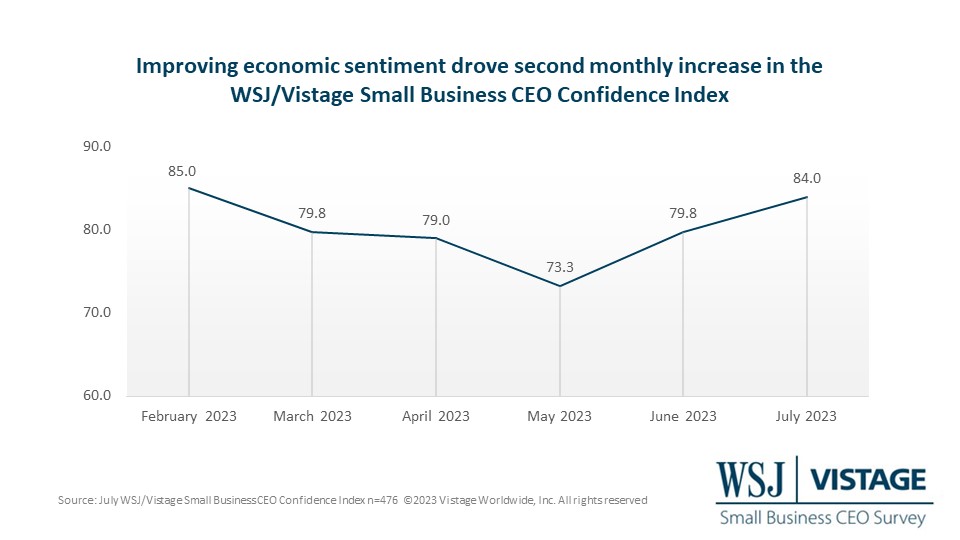

While small business confidence remains at lower than average levels, the WSJ/Vistage Small Business CEO Confidence Index posted a second month-over-month increase, driven by decreasing pessimism about the U.S. economy.

Five of the six components that comprise the WSJ/Vistage Small Business Index increased from last month. Again, it is worth noting the lessening pessimism about the future of the U.S. economy. After a 13-point decline from May to June, the proportion of small businesses that believe the economy will worsen in the next 12 months declined another 7 points from last month to reach 37%. This view of a worsening economy by small businesses is the lowest since February 2022.

Highlights of the data — informed by 476 leaders of small businesses that responded to the July WSJ/Vistage Small Business CEO Confidence Index survey that was in the field July 10-17, 2023 — include:

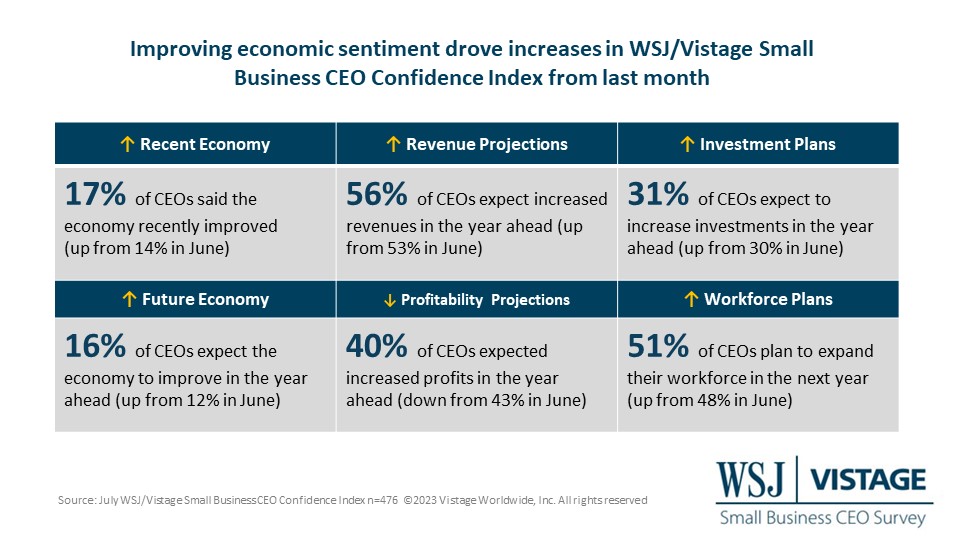

- Current economy: 17% of small businesses said the U.S. economy has improved from last year, up from 14% last month. While 38% said the economy worsened, this is down from 69% last July.

- Future economy: 16% of small businesses expect the economy to improve in the next year, while 37% expect it to worsen — a 7-point drop from last month’s 44%.

- Revenue projections: 56% of small businesses expect to see increased revenues over the next year, rising from 48% in May of 2023 and increasing for the second consecutive month.

- Profitability projections: 40% of small businesses expect increased profitability in the next year, a slight decline from 43% last month but an improvement over last July’s 34%.

- Fixed investment plans: Small businesses remain focused on managing costs, with 51% keeping their plans the same. However, nearly twice as many respondents (31%) plan to increase their costs versus those who plan to decrease fixed investments (17%).

- Workforce expansion plans: Over the last three months, the percentage of small businesses planning to expand their workforce has grown, with 51% planning to increase their headcount in the next year, up from 48% in June and 45% in May of 2023.

In addition to the six components that comprise the WSJ/Vistage Small Business Index, the survey captured small business sentiment on how they are addressing hiring and cost management, which are top areas of focus for small businesses:

Hiring

- Operational capacity continues to be impacted by hiring challenges for 44% of small businesses.

- Just 15% of small businesses report that hiring is more difficult than at the beginning of the year; more than twice as many (32%) say it is easier, while the majority (54%) report no changes.

- Two-thirds of small businesses have not changed their hiring plans for 2023; 18% are hiring more than planned, while 16% are hiring less than planned.

Finances

- Higher interest rates impact more than half (52%) of small businesses surveyed, a marginal decline from last month’s 52%.

- While just 27% report that their banks have tightened lending standards, 32% of small businesses say their plans have changed due to the current lending or funding environment.

For deeper insights on the July 2023 WSJ/Vistage Small Business data, visit our data center or download the infographic.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey